After a solid February job report, we continue to expect four Fed rate hikes this year (and two in 2019).There are two main conclusions to be drawn from the February US employment report. First, the US economy’s underlying momentum is particularly robust, consistent with our view that GDP growth will pick up to 3.0% this year, from 2.3% in 2017. Second, while the labour market is tight, there is still some slack left; in other words, the US labour market is not (yet) overheating.That momentum remains solid can be seen not only in the solid headline nonfarm payroll reading itself (+313,000, the highest since July 2016) but also the strong three-month average (+242,000). The job gains were led by cyclical sectors like construction and manufacturing. In fact, February saw the biggest monthly

Topics:

Thomas Costerg considers the following as important: Fed dot chart, Macroview, US nonfarm payrolls, US participation rate, US wage growth

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

After a solid February job report, we continue to expect four Fed rate hikes this year (and two in 2019).

There are two main conclusions to be drawn from the February US employment report. First, the US economy’s underlying momentum is particularly robust, consistent with our view that GDP growth will pick up to 3.0% this year, from 2.3% in 2017. Second, while the labour market is tight, there is still some slack left; in other words, the US labour market is not (yet) overheating.

That momentum remains solid can be seen not only in the solid headline nonfarm payroll reading itself (+313,000, the highest since July 2016) but also the strong three-month average (+242,000). The job gains were led by cyclical sectors like construction and manufacturing. In fact, February saw the biggest monthly increase in construction jobs since March 2007.

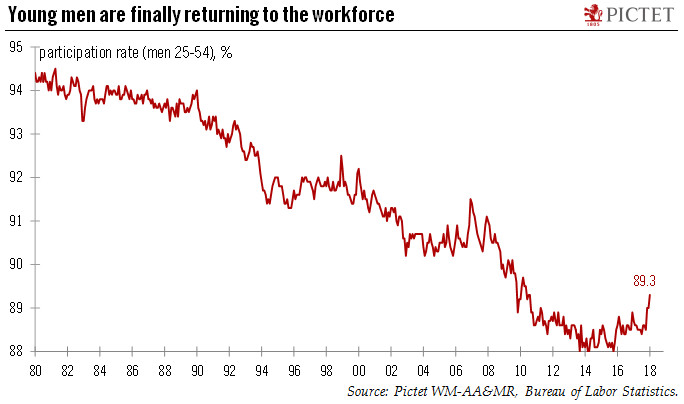

Although it increased in February, the participation rate suggests there is still some slack in the US jobs market. So does the moderate rise in wages (+2.6% y-o-y in February, from 2.8% in January). We believe the unemployment rate (unchanged at 4.1% in February) will drop in the coming months.

From the Federal Reserve’s perspective, this employment report adds little incremental value. It will likely just validate its existing moderately hawkish stance based on a strong economy and the impact of fiscal easing. We still think there is a reasonable chance the Fed raises its 2018 median dot on its ‘dot chart’ from three to four at its next policy meeting on 21 March. We maintain our call for four rate hikes this year, and two next year.