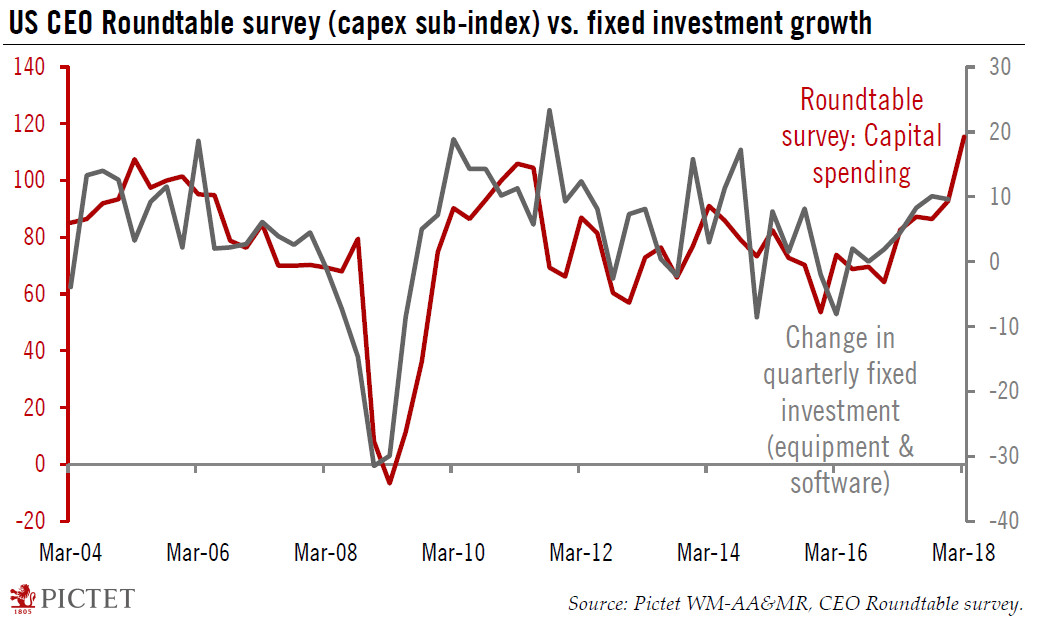

CEO sentiment reaches a record high, but protectionist tendencies could impact confidence down the road.US businesses are feeling good – in fact, they are borderline euphoric. The latest evidence comes from the quarterly Business Roundtable CEO economic outlook index, a survey of 137 CEOs, conducted in February, which rose to its highest level since the survey began 15 years ago. All three sub-indices (capex, employment, sales) rose to fresh highs.Particularly encouraging was the sharp rise in the capex sub-index. This has tracked US investment particularly closely in recent years (see Chart), and so it is a survey worth following. We see the subindex’s rise as supportive of our central scenario of a sharp pick-up in corporate investment this year. We forecast real nonresidential

Topics:

Thomas Costerg considers the following as important: Macroview, US business sentiment, US CEO sentiment survey, US Chart of the week, US protectionism

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

CEO sentiment reaches a record high, but protectionist tendencies could impact confidence down the road.

US businesses are feeling good – in fact, they are borderline euphoric. The latest evidence comes from the quarterly Business Roundtable CEO economic outlook index, a survey of 137 CEOs, conducted in February, which rose to its highest level since the survey began 15 years ago. All three sub-indices (capex, employment, sales) rose to fresh highs.

Particularly encouraging was the sharp rise in the capex sub-index. This has tracked US investment particularly closely in recent years (see Chart), and so it is a survey worth following. We see the subindex’s rise as supportive of our central scenario of a sharp pick-up in corporate investment this year. We forecast real nonresidential investment to grow 7%, making it a key driver for our 3% 2018 GDP growth forecast. At face value, and based on historical correlations, the latest CEO survey actually points to 20% growth in investment—but this is probably not entirely plausible.

Can the euphoria continue? The risk right now lies with President Trump’s recent protectionist turn – especially his latest tariffs on steel and aluminium. The resignation of pro-business and pro-trade economic adviser Gary Cohn is not encouraging. For now, we think the tariffs are mostly political posturing and negotiation tactics, but business sentiment – and potentially investment – could be dented if US policy hardened in the coming weeks, especially towards China.