ECB policymakers can be expected to set aside a fall in the March euro area composite PMI index which was likely amplified by unusual circumstances.Euro area flash PMI indices fell sharply in March, below consensus expectations for the second month in a row. However, details were still largely consistent with a robust, broad-based economic expansion this year, if only at a slightly slower pace than last year. We forecast euro area GDP to expand by 2.3% in 2018.The correction in business...

Read More »March Fed review – Mr. Middle Ground

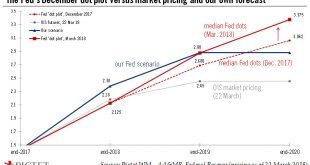

In line with expectations, the Fed raised rates at its last meeting. Chair Powell was keen to underline his “middle ground” approach to normalising monetary policy. We still expect 3 additional rate hikes in 2018.On 21 March, the Federal Reserve hiked rates by one quarter point, as widely expected, nudging the interest rate on excess reserves (IOER) to 1.75%.Chair Jerome Powell’s press conference and the accompanying material – in particular the forecasts for future rate hikes (the ‘dots’) –...

Read More »US trade policy update – Eyeing China

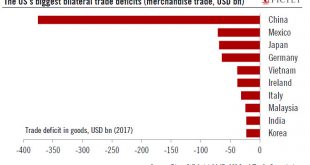

US trade policy's attention is now turning towards China, with a threat of new tariffs. But we see here a lot of political rhetoric.After the tariffs on steel and aluminium, the Trump Administration’s attention now seems to be focused on China as the US’s merchandise trade deficit with China rose to a new high of USD 375bn in 2017. The trade hawks close to Trump – Ross, Lighthizer and Navarro – seem to be having an increasing influence on Trump, and they seem eager to reach a new deal with...

Read More »US Chart of the week – Statistical issues

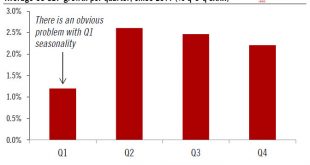

Weak US Q1 GDP growth revives debate about seasonality issues, as solid macroeconomic signals suggest that growth will rebound sharply.Do US statisticians have a problem with seasonal adjustment? The question is likely to arise once again this year as Q1 GDP growth looks set to be on the weak side, despite most other macroeconomic signals – including solid employment growth – flashing green. The Atlanta Fed GDP tracker is now at 1.8%. That would mark a slowdown from 2.5% q-o-q SAAR in...

Read More »Fed preview: all eyes on the ‘dot plot’

This week’s Fed meeting will likely to see a rise in Fed policy makers’ forecasts for 2018 growth and rates.The Federal Reserve meets on 20–21 March and is widely expected to hike rates by a quarter point (moving the interest rate on excess reserves up to 1.75%). This decision is ‘priced in’ at 100% according to Bloomberg data.The focus will be on signals for further tightening in the rest of the year, especially as there will be plenty of materials to consider (including a fresh ‘dot plot’...

Read More »Europe chart of the week – Employment

Euro area employment grew for the 18th consecutive quarter in Q4 2017 (+0.3% q-o-q), and is now 1.5% above its pre-crisis (2008) level. By contrast, hours worked per person employed decreased during the same period, remaining 4% below their pre-crisis level. The two data series have followed divergent trends since the start of the economic recovery. Between Q1 2008 and Q2 2013, the total amount of labour input used by...

Read More »Latest data point to moderate deceleration in Chinese growth

Early 2018 data releases are general upbeat, but some details indicate that growth momentum could slow.The first batch of 2018 Chinese data on investment and industrial production came in stronger than expected. However, details of the data suggest that actual growth momentum may not be as strong as the numbers indicate.Property investment rebounded to 9.9% y-o-y in the first two months of 2018 from 7.0% in 2017, while investment in the manufacturing sector and infrastructure moderated...

Read More »Japan: Land-sale scandal comes back to haunt prime minister

Were Shinzo Abe forced to resign, the impact on monetary and fiscal policy would be limited, in our view, but there is a moderate downside risk for growth and financial markets.A land-sale scandal that first emerged last year involving Japanese Prime Minister Shinzo Abe and his wife is back in the spotlight. Although it is still premature to tell if the scandal will end Abe’s tenure, the probability has risen notably If more evidence emerges in this scandal, it’s not inconceivable that Abe...

Read More »Europe chart of the week – Employment

Average number of hours worked per employee suggests there is still slack in the euro area job market.Euro area employment grew for the 18th consecutive quarter in Q4 2017 (+0.3% q-o-q), and is now 1.5% above its pre-crisis (2008) level. By contrast, hours worked per person employed decreased during the same period, remaining 4% below their pre-crisis level.The two data series have followed divergent trends since the start of the economic recovery. Between Q1 2008 and Q2 2013, the total...

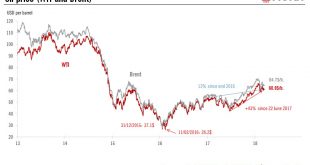

Read More »Limited upside potential for oil

The current spot price is already close to oil’s upwardly revised equilibrium price.Strong global growth, a substantial US fiscal stimulus, signs that reflation is taking hold in the US and a relatively weak US dollar all should represent a favourable environment for commodities, and for oil in particular, for the rest of this year. However, our analysis suggests that oil is now close to its long-term equilibrium price, offering limited upside potential.Now that markets have fully taken on...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org