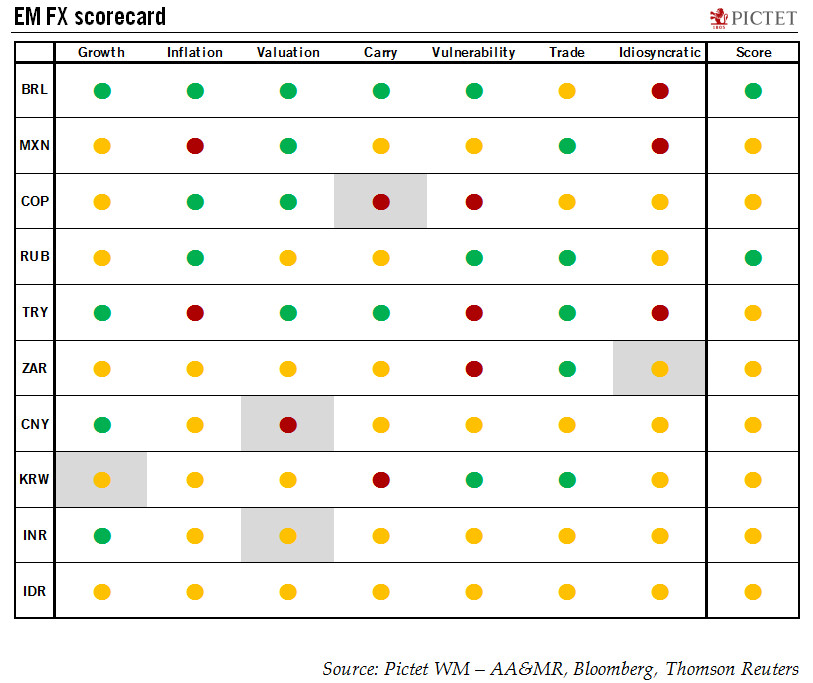

Our EM currencies scoreboard shows valuation factors driving the Chinese renminbi turning negative, while idiosyncratic factors behind the South Africa rand have improved.Our Emerging Market (EM) FX scorecard, designed to assess the attractiveness of a given currency over the coming 12 months, ranks 10 EM currencies according to key criteria such as growth and vulnerability to external shocks.There have been only few changes over the past month. Our EM FX scorecard still shows the Brazilian real and the Russian rouble as the most attractive EM currencies at the moment.Among changes, the valuation of the Chinese renminbi has turned negative. We do not see the currency’s recent appreciation as particularly meaningful, as the People’s Bank of China is likely to continue to favour a broadly

Topics:

Luc Luyet considers the following as important: Brazilian real, Chinese renminbi, Currency drivers, EM currencies, Macroview, Russian rouble, South Africa rand

This could be interesting, too:

Joseph Y. Calhoun writes Weekly Market Pulse: Oil Shock

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Our EM currencies scoreboard shows valuation factors driving the Chinese renminbi turning negative, while idiosyncratic factors behind the South Africa rand have improved.

Our Emerging Market (EM) FX scorecard, designed to assess the attractiveness of a given currency over the coming 12 months, ranks 10 EM currencies according to key criteria such as growth and vulnerability to external shocks.

There have been only few changes over the past month. Our EM FX scorecard still shows the Brazilian real and the Russian rouble as the most attractive EM currencies at the moment.

Among changes, the valuation of the Chinese renminbi has turned negative. We do not see the currency’s recent appreciation as particularly meaningful, as the People’s Bank of China is likely to continue to favour a broadly stable Chinese Foreign Exchange Trade System (CFETS) renminbi index. Consequently, we expect further “two-way volatility” around an equilibrium value. Our best guess for this value is around 95, the average of the CFETS renminbi index for 2006 and 2017.

Meanwhile, idiosyncratic factors driving the South Africa rand have been upgraded to neutral from negative, motivated by the resignation of South Africa’s president Jacob Zuma on 14 February. Although fiscal issues will remain a concern for South Africa in the next quarters, the election of Cyril Ramaphosa lowers the chance of a rating downgrade by Moody’s on 23 March and should support more positive sentiment that could drive capital inflows into the high-yielding rand.

Finally, we consider trade as a driver of a currency’s relative attractiveness. Given their reliance on external trade, the Korean won and the Mexican peso are particularly exposed to potentially bold trade protection measures from the Trump Administration.