…but it could start tightening at the end of this yearAt its latest quarterly monetary policy assessment unveiled today, the Swiss National Bank (SNB) maintained its accommodative monetary policy. The target range for the 3-month Libor was kept between -1.25% and -0.25%, the interest rate on sight deposits with the SNB was maintained at a record low of -0.75%, and the central bank reiterated its willingness to intervene in the foreign exchange market if needed.Importantly, the central bank’s assessment of the Swiss franc also remained unchanged, stating that it continued to see the currency as “highly valued” and the situation on foreign exchange markets as fragile, adding that “monetary conditions may change rapidly”.The SNB also revised down its forecasts for inflation and GDP growth

Topics:

Nadia Gharbi considers the following as important: Macroview, Swiss economy, swiss franc valuation, swiss inflation forecasts, Swiss monetary policy

This could be interesting, too:

Investec writes Swiss economy stalls in second quarter of 2023

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

…but it could start tightening at the end of this year

At its latest quarterly monetary policy assessment unveiled today, the Swiss National Bank (SNB) maintained its accommodative monetary policy. The target range for the 3-month Libor was kept between -1.25% and -0.25%, the interest rate on sight deposits with the SNB was maintained at a record low of -0.75%, and the central bank reiterated its willingness to intervene in the foreign exchange market if needed.

Importantly, the central bank’s assessment of the Swiss franc also remained unchanged, stating that it continued to see the currency as “highly valued” and the situation on foreign exchange markets as fragile, adding that “monetary conditions may change rapidly”.

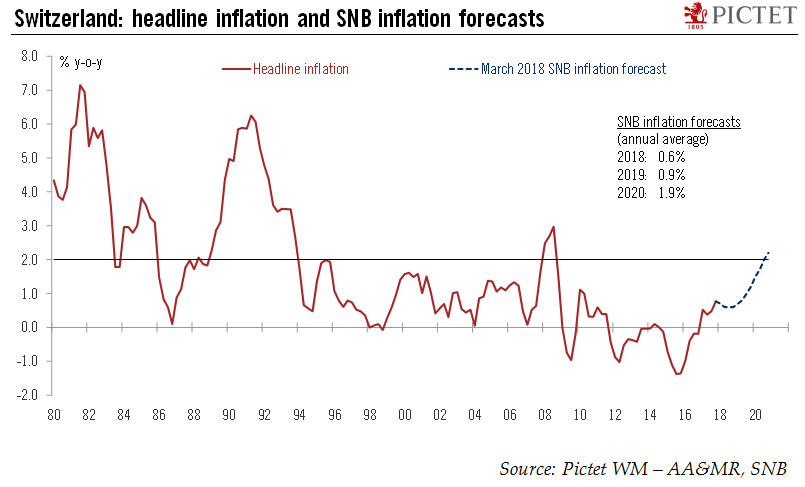

The SNB also revised down its forecasts for inflation and GDP growth to 0.6% in 2018 and 0.9% in 2019. Regarding growth, the SNB expects the Swiss economy to grow by around 2% in 2018, compared to 1.0% in 2017.

On the negative side, the SNB again pointed out financial stability risks, in particular in the residential property.

All in all, our baseline scenario remains unchanged: we expect a change of communication about future monetary policy to come during H2 2018. We expect the SNB to hike its policy rate by 25bp for the first time in December 2018 (assuming that the ECB announces a gradual tapering of QE in June or July).