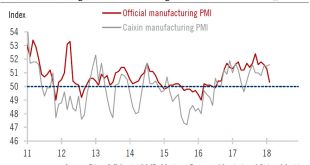

China’s official manufacturing Purchasing Manager Index (PMI) for February, compiled by the National Bureau of Statistics of China and the China Federation of Logistics and Purchasing, came in at 50.3, down from 51.3 in January and 51.6 in December 2017. This is the lowest reading of this gauge since October 2016. The Markit PMI (also known as the Caixin PMI), however, edged up slightly to 51.6 in February from 51.5 in...

Read More »Europe – ECB preview

Market participants have enjoyed a protracted period of very low volatility, but it may well have come to an end in 2018. Central banks are often said to be responsible for the disappearance of volatility, for example through their large-scale asset purchases, which have compressed the term premium. But, now that the same central banks are heading for the exit from unconventional policies, they, too, need to relearn how...

Read More »ECB policy is boosting the Bundesbank’s profits

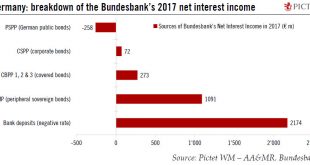

This week the German Bundesbank published its 2017 annual report, which includes a number of interesting figures that are relevant to the broader (monetary) policy debate in the euro area. In particular, the Bundesbank provided details of the amount of securities held on its balance sheet for policy purposes, including QE, at the end of 2017, and the corresponding flows of income stemming from its asset purchases....

Read More »Europe – ECB preview

We expect only small changes to the ECB staff projections, with GDP growth likely to be revised slightly higher again.The ECB remains on a cautious exit path. At the 8 March meeting, we expect the ECB to drop its commitment to increase QE in terms of its size and/or duration, if needed – a change that is long overdue, in our view, against a very favourable economic background and given that constraints linked to bond scarcity make it all but impossible to increase QE anyway. Ideally, this...

Read More »ECB policy is boosting the Bundesbank’s profits

The Bundesbank made a net profit from ECB QE last year, while the combination of all unconventional measures boosted the central bank’s net profit by EUR 3.4bn.This week the German Bundesbank published its 2017 annual report, which includes a number of interesting figures that are relevant to the broader (monetary) policy debate in the euro area. In particular, the Bundesbank provided details of the amount of securities held on its balance sheet for policy purposes, including QE, at the end...

Read More »Who will tackle Italy’s root problems?

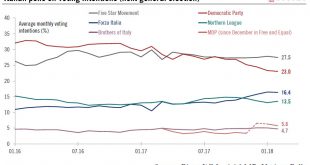

Just ahead of Sunday’s general election, there is little sign of appetite among the leading parties to tackle the significant challenges that Italy faces. The Italian general election campaign is in its final stretch before voting on 4 March. The election will take place under the new electoral law (Rosatellum bis), which allocates 37% of parliamentary seats via the principle of “first-past-the-post” and 61% via...

Read More »Switzerland: So far so good

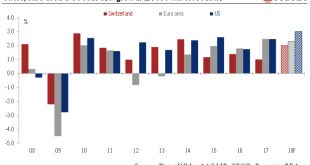

According to the State Secretariat for Economic Affairs (SECO)’s quarterly estimates, Swiss real GDP rose by 0.6% q-o-q in Q4 (2.4% q-o-q annualised; 1.9% y-o-y), above consensus expectations (0.5%). The Swiss economy expanded by 1.0% in 2017 overall, in line with our own forecast. This comes after GDP growth of 1.4% in 2016 and 1.2% in 2015. Two aspects of today’s report are worth mentioning. First, on the expenditure...

Read More »China: February PMIs point to deceleration in industrial activity

Although latest data may reflect impact of temporary environmental measures and seasonal distortions, we expect Chinese growth to moderate in 2018.China’s official manufacturing Purchasing Manager Index (PMI) for February came in at 50.3, down from 51.3 in January and 51.6 in December 2017. The Markit PMI (also known as the Caixin PMI), however, edged up slightly to 51.6 in February from 51.5 in the previous month.Due to the floating date of the Lunar New Year (LNY), Chinese data in January...

Read More »Switzerland: So far so good

The Swiss economy is gaining momentum, with growth becoming more broad based at the end of the year.Switzerland lagged the US and the euro area in terms of annual GDP growth for the third consecutive year in 2017, but today’s data confirm that the Swiss economy is continuing its recovery. Economic prospects for this year look promising. We expect growth in the Swiss economy to accelerate from 1.0% in 2017 to 2.0% in 2018, reducing the gap with other economies.According to the State...

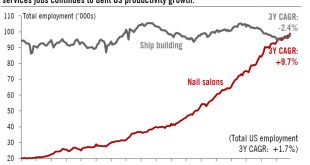

Read More »US chart of the week – Not nailing it

The US economy is creating a lot of low-skilled and low-productivity jobs.Productivity is a crucial missing link in US growth. Q4-2017 productivity data was again disappointing: labour productivity was up just 1.1% year-on-year (y-o-y). It averaged only 1.3% in 2017 as a whole, while the five-year average is a lacklustre 0.8% (versus more than 3% in the early 2000s).Low productivity growth remains a front-and-centre worry of Federal Reserve officials. Before lawmakers on 27 February, the new...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org