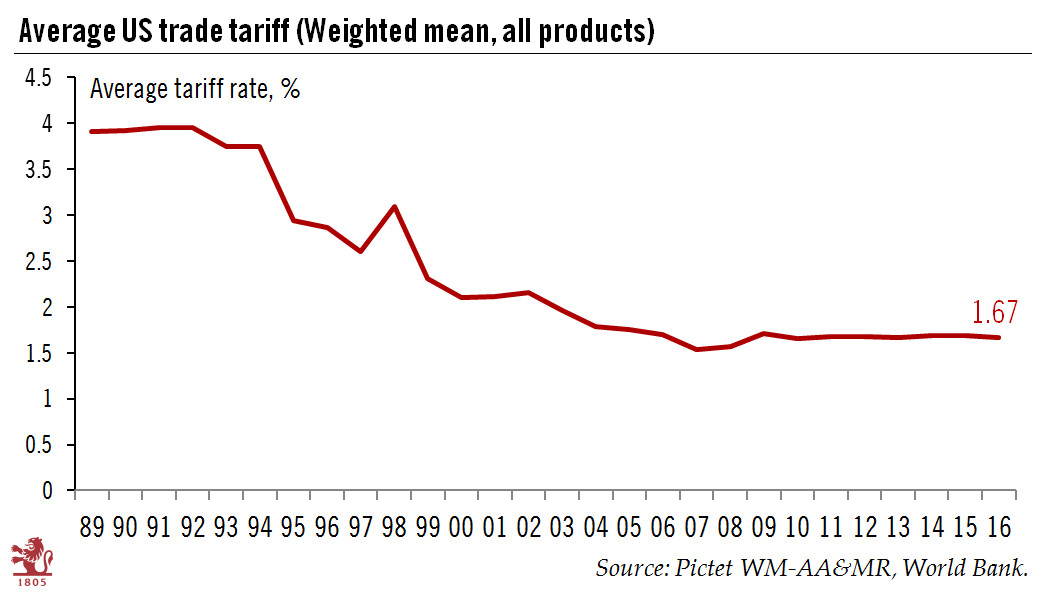

Actions by the Trump administration may well represent a ‘regime shift’ in terms of US tariff rates.Perhaps the main regime shift that has occurred during the Trump presidency is in US trade policy. More than tax policy, this is an area where Trump could mark the clearest break – although economic historians often point out that the US economy’s rise to global dominance in the 19th century owed a lot to protectionism.Still, the trend since World War 2, and even more since the end of the Cold War, has been toward a sharp reduction in import protection. Using World Bank data, the average tariff rate for US imports stands at a very low 1.7% currently; it was around 4% in the early 1990s. Mobile phone imports from Asia, for instance, currently carry a zero tariff.The average tariff rate is

Topics:

Thomas Costerg considers the following as important: Macroview, protectionism, tariff war, Trump tariffs, US trade policy

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

Actions by the Trump administration may well represent a ‘regime shift’ in terms of US tariff rates.

Perhaps the main regime shift that has occurred during the Trump presidency is in US trade policy. More than tax policy, this is an area where Trump could mark the clearest break – although economic historians often point out that the US economy’s rise to global dominance in the 19th century owed a lot to protectionism.

Still, the trend since World War 2, and even more since the end of the Cold War, has been toward a sharp reduction in import protection. Using World Bank data, the average tariff rate for US imports stands at a very low 1.7% currently; it was around 4% in the early 1990s. Mobile phone imports from Asia, for instance, currently carry a zero tariff.

The average tariff rate is likely to inch higher given that the Trump administration increased duties on imports of steel and alumium (at 25% and 10%, respectively) on 1 June, and is planning a 25% tariff on USD 34 billion of Chinese imports (out of USD 505 billion total imports from China) for 6 July.

We think the tariffs announced so far are marginal in the greater scheme of US imports, which totalled USD 3.3 trillion in 2017, so the macro impact will likely stay limited for now. We think the US tariffs are mostly about Trump’s domestic political agenda as we move closer to the November mid-term elections. Still, the latest batch of threats, including on European cars (justified on “national security” grounds) makes one wonder what Trump really wants to achieve. Are tariffs, as he has asserted, simply a way of achieving even freer international trade in the future?