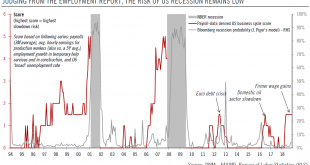

But there is some softness at the microeconomic level.US employment rose by 155,000 in November (+1.7% year on year (y-o-y), decelerating from +237,000 in October. The three-month average dropped as well, but is still a healthy 170,000/month (it was 214,000 up to October 2018). November’s wage growth was unchanged from October’s pace of 3.1% y-o-y.Most cyclical indicators continue to flash green, and there are limited signs of a downturn in the US economy right now; the solid macro picture...

Read More »Some good news despite likely defeat of Theresa May’s Brexit deal in parliament

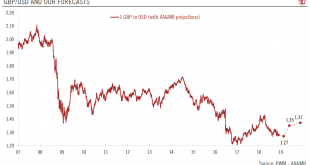

Risks of a “no deal” Brexit appear to be receding.Theresa May’s Brexit plan is likely to be defeated in the 11 December (unless postponed) UK parliament vote. The press is currently suggesting a defeat by a margin of around 100 MPs, but if it is higher, then it would seriously handicap the chances of a ‘yes’ in a second vote. A rejection of May’s deal would open the door to several scenarios, including the possibility of a second vote after possible tweaks to the current deal, although...

Read More »Yellow vest protests cast cloud over Macron’s reform plans

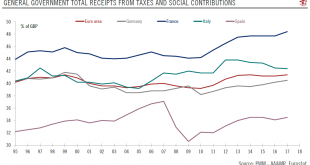

Recent protests could have a negative impact on French growth, tax revenue and president Macron’s reform plans for his country and for Europe.French protests began on November 17 over hikes in fuel taxes, but have progressively broadened out into an expression of general anger with the French government about the cost of living and high taxes.To calm the situation, the government has dropped the planned fuel tax hike from next year’s budget.Whether or not this will be enough to satisfy the...

Read More »Yellow vest protests cast cloud over Macron’s reform plans

Recent protests could have a negative impact on French growth, tax revenue and president Macron’s reform plans for his country and for Europe. French protests began on November 17 over hikes in fuel taxes, but have progressively broadened out into an expression of general anger with the French government about the cost of living and high taxes. To calm the situation, the government has dropped the planned fuel tax hike...

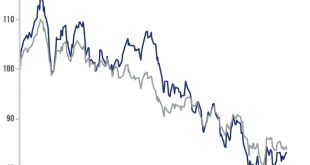

Read More »Gradual, moderate rise in the 10-year US Treasury yield next year

Modest inversion in yield curve, with recession more of an issue for 2020.After an impressive rise in US Treasury yields in 2018, we expect the upward movement in 2019 to be gradual, moderate and driven mainly by further rate hikes by the US Federal Reserve (Fed). We have a year-end target of 3.4% for the 10-year Treasury yield.In light of the limited risk of a sharp rise in the 10-year yield, the relatively high coupon they now pay and the approaching end of the economic cycle, Pictet...

Read More »House View, December 2018

Pictet Wealth Management’s latest positioning across asset classes and investment themes. Asset Allocation We remain neutral on global equities overall, seeing relatively limited potential for developed market stocks in particular as earnings growth declines. We favour companies with pricing power as well as measurable growth drivers and low leverage. We have moved from underweight to neutral in US Treasuries, as the...

Read More »Growing Fed doubts as neutral rate comes into sight

Next year is likely to mark the end of the tightening cycle as the Fed fund rates moves closer to the Fed’s estimate of the nominal neutral rate.The Federal Reserve estimated the theoretical, inflation-adjusted (‘real’) neutral rate at 0.8% in Q3 18, slightly down from 0.9% in Q2, but in line with the average since 2016.Adding core PCE inflation of 1.8% year-on-year in October (down from 1.9% in September), this means a ‘spot’ nominal neutral rate of 2.6%.The Fed’s strategy has been to...

Read More »Indian Q3 growth numbers disappoint

But leading indicators point to Q4 rebound.Indian GDP in Q3 2018 rose 7.1% year-over-year (y-o-y) in real terms, down from 8.2% in Q2 and significantly below the consensus and our own forecasts of 7.5%. As a result, we have revise down our fiscal year (FY) 2018-2019 GDP forecast for India to 7.2% from 7.6% previously. Our forecast for FY 2019-2020 remains the same, however.In our view, external headwinds, specially surging oil prices, were the main reasons for the downturn in Q3, but...

Read More »House View, December 2018

Pictet Wealth Management's latest positioning across asset classes and investment themes.Asset AllocationWe remain neutral on global equities overall, seeing relatively limited potential for developed market stocks in particular as earnings growth declines. We favour companies with pricing power as well as measurable growth drivers and low leverage.We have moved from underweight to neutral in US Treasuries, as the rise in yields slows. But we have shifted from a neutral to underweight...

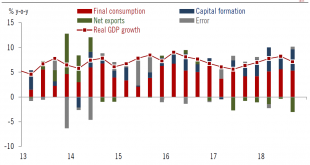

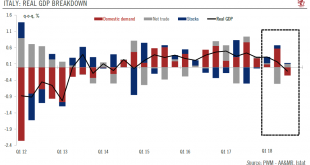

Read More »Growth Contraction puts pressure on Italian Government

The downward revision to 3Q GDP will make the Italian government’s targets more difficult to achieve and complicate the budget debate with Europe. The Italian statistical office’s (ISTAT) final reading showed that the economy shrank 0.1% q-o-q (-0.5% q-o-q annualised) in Q3, whereas a preliminary reading on October 30 showed that growth was flat. The details were quite negative and confirmed the idiosyncrasy of the...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org