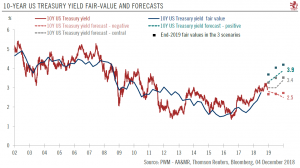

Modest inversion in yield curve, with recession more of an issue for 2020.After an impressive rise in US Treasury yields in 2018, we expect the upward movement in 2019 to be gradual, moderate and driven mainly by further rate hikes by the US Federal Reserve (Fed). We have a year-end target of 3.4% for the 10-year Treasury yield.In light of the limited risk of a sharp rise in the 10-year yield, the relatively high coupon they now pay and the approaching end of the economic cycle, Pictet Wealth Management has recently turned to neutral from underweight on US Treasuries.Given investor fears that US-China trade tensions could start to hamper US economic growth and given US inflationary pressures should remain contained, we see limited upside for the 10-year yield in the coming months.

Read More »Articles by Laureline Chatelain and Jean-Pierre Durante

US 10-year Treasury yield: no return to 4% anytime soon

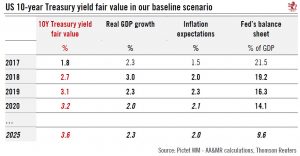

July 30, 2018The 10-year Treasury yield is unlikely to reach pre-crisis levels in the current cycle. Our baseline scenario envisages its fair value being capped at 3.2% in the next two years.The 10-year US Treasury yield is probably the most watched bond yield globally, seeming to encapsulate everything from the noise coming from financial markets and politicians to the health of the world economy, not to mention monetary policy. Trying to forecast the likely behaviour of such a global indicator is challenging, which is why econometric models can help.Our estimate of fair value for the 10-year Treasury yield is determined using a model that takes into account a stable long-term relationship between the 10-year bond yield, the neutral rate, inflation expectations and movements in the size of the Fed’s

Read More »