Modest inversion in yield curve, with recession more of an issue for 2020.After an impressive rise in US Treasury yields in 2018, we expect the upward movement in 2019 to be gradual, moderate and driven mainly by further rate hikes by the US Federal Reserve (Fed). We have a year-end target of 3.4% for the 10-year Treasury yield.In light of the limited risk of a sharp rise in the 10-year yield, the relatively high coupon they now pay and the approaching end of the economic cycle, Pictet Wealth Management has recently turned to neutral from underweight on US Treasuries.Given investor fears that US-China trade tensions could start to hamper US economic growth and given US inflationary pressures should remain contained, we see limited upside for the 10-year yield in the coming months.

Topics:

Laureline Chatelain and Jean-Pierre Durante considers the following as important: Macroview, US Fed hikes, US Treasuries, US Treasuries forecast

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

Modest inversion in yield curve, with recession more of an issue for 2020.

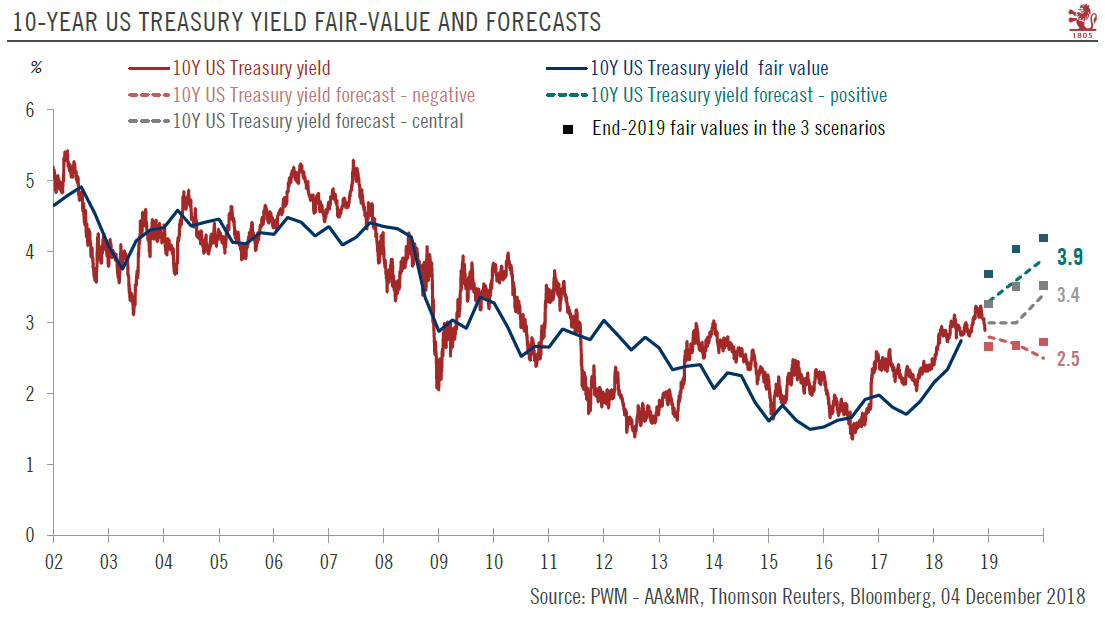

After an impressive rise in US Treasury yields in 2018, we expect the upward movement in 2019 to be gradual, moderate and driven mainly by further rate hikes by the US Federal Reserve (Fed). We have a year-end target of 3.4% for the 10-year Treasury yield.

In light of the limited risk of a sharp rise in the 10-year yield, the relatively high coupon they now pay and the approaching end of the economic cycle, Pictet Wealth Management has recently turned to neutral from underweight on US Treasuries.

Given investor fears that US-China trade tensions could start to hamper US economic growth and given US inflationary pressures should remain contained, we see limited upside for the 10-year yield in the coming months. However, our central scenario is for an acceleration in US core inflation and wage growth, along with a potential pause in the Fed’s rate hikes (which would preserve US economic growth), pushing the 10-year yield up to 3.4% by end-2019. Overall, due to high political uncertainties, 2019, like 2018, should prove to be a volatile year for bonds. Hence, we assign only 55% to our central scenario. An alternative negative scenario (30% probability) sees the 10-year yield falling to 2.5% due to fears of a looming US recession that would force the Fed to cut rates in 2020. Our alternative positive scenario (15% probability) has as its premise a US economy that remains robust, with rising inflation expectations compelling the Fed to continue hiking rates, driving the 10-year yield up sharply to 3.9% by end-2019.

A prominent subject this year has been the flattening of the US Treasury yield curve (with the difference between two-year Treasuries and their 10-year equivalents reaching an 11-year low of 11 basis points on 4 December. In our central scenario, we do expect further yield curve flattening and then inversion, meaning shorter-dated bonds yield more than longer. Historically, an inverted yield curve has been seen as a harbinger of recession. However, the yield curve inversion we expect should be modest next year given our forecast for a rise in the 10-year yield to 3.4% by end-2019. Recession will likely be more of an issue in 2020 than 2019.