But signs already point to divergence in interpretation.A temporary trade truce was agreed between US President Donald Trump and China’s President Xi Jinping at a dinner during the G20 meeting this weekend. As part of this truce, the tariff rate on USD200 billion of Chinese imports will stay unchanged at 10% up to 1 March, instead of increasing to 25%, as planned, in January.Deferring the hike in tariffs is a way for the Trump administration to keep pressure on China to discuss wide-ranging...

Read More »Weekly View – Two to tango

The CIO office’s view of the week ahead.As expected, the US and Chinese presidents Donald Trump and Xi Jinping met to discuss trade alongside the G20 summit in Buenos Aires. For now, a tentative truce has been agreed, with Trump calling off further tariff rises in January. On its side, China will purchase an unspecified amount of goods from the US in order to reduce the trade deficit between the two countries. In the coming months however, further rounds of tricky discussions between the two...

Read More »US Federal Reserve hints it might turn off the auto pilot

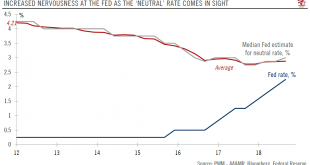

While a December rate hike is on the cards, comments from the central bank are raising questions about when the Fed will pause its rate-hiking cycle.The Federal Reserve (Fed) has been sending dovish signals in recent days: The previous exuberantly optimistic tone about the US growth has been pared down, as some pockets of data have softened, notably housing.Meanwhile, there is renewed debate about the landing zone of the current monetary tightening. Some Fed members want to change the...

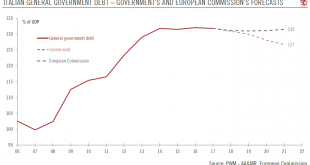

Read More »Growth contraction puts pressure on Italian government

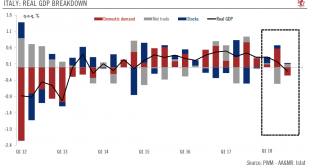

The downward revision to 3Q GDP will make the Italian government’s targets more difficult to achieve and complicate the budget debate with Europe.The Italian statistical office’s (ISTAT) final reading showed that the economy shrank 0.1% q-o-q (-0.5% q-o-q annualised) in Q3, whereas a preliminary reading on October 30 showed that growth was flat. The details were quite negative and confirmed the idiosyncrasy of the Italian economy. Unlikely other euro area economies, net trade contributed...

Read More »Surprise contraction in Swiss Q3 GDP

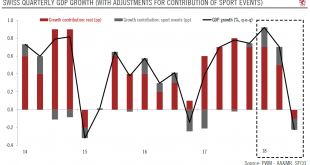

Switzerland’s growth unexpectedly contracted in the third quarter, pushing down our GDP growth forecast. Recent softening in the euro area also casts doubts about the pace of monetary tightening by the SNB.The strong growth enjoyed by the Swiss economy since Q1 2017 came suddenly to an end in Q3 18, when real GDP shrank unexpectedly by 0.2% q-o-q (-0.9% q-o-q annualised). This is much lower than consensus expectations of +0.4% and is down from an average of +0.8% in H1 2018.Details show that...

Read More »Surprise contraction in Swiss Q3 GDP

Switzerland’s growth unexpectedly contracted in the third quarter, pushing down our GDP growth forecast for 2018. Recent softening in the euro area also casts doubts about the pace of monetary tightening by the SNB. The strong growth enjoyed by the Swiss economy since Q1 2017 came suddenly to an end in Q3 18, when real GDP shrank unexpectedly by 0.2% q-o-q (-0.9% q-o-q annualised). This is much lower than consensus...

Read More »Untaxing times for US corporates

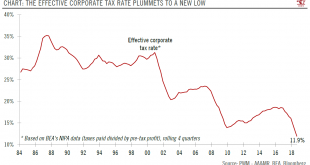

The effective corporate tax rate plummets in the wake of Trump tax cuts.US corporates are delivering strong profits and this robust profit picture is further enhanced by a sharp drop in the corporate tax burden.According to NIPA (national accounts) data, the effective tax rate for the year ending in Q3 2018 reached a new low of 11.9%.President Trump’s December 2017 tax cuts led to a lower federal statutory tax rate of 21% (from 35% prior), but firms still have several options to bring down...

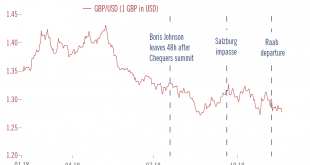

Read More »The long and winding road to Brexit

Uncertainty remains high with outcomes that could have consequences beyond the UK.Having secured formal approval of the divorce deal from EU leaders on 25 November, Prime Minister Theresa May now faces the far bigger challenge of securing UK parliamentary approval by mid-December. Both political and economic uncertainty could remain elevated until the 29 March deadline.The tail risk of a no-deal Brexit on 29 March remains high, although there is still room for alternatives, including an...

Read More »Weekly View – WE HAVE A DEAL!

The CIO office’s view of the week ahead.Brexit and oil kept their centre stage positions in last week’s headlines. Despite initial opposition from France and Spain, all 27 EU members agreed to Theresa May’s Brexit deal by lunchtime at Sunday’s European Council meeting. Could this be an indication of how poor the deal is for the UK? Despite May’s insistence that there is no alternative and this is the only deal available, we think she will have a hard time convincing the UK parliament and...

Read More »Italy and the EU: a debt-based excessive deficit procedure

European Commission deems Italy’s budget noncompliant with EU rules. This week, the European Commission issued its opinion on Italy’s budget plans. Deeming them noncompliant with the EU’s budgetary rules, it recommended that an Excessive Deficit Procedure (EDP) be opened.Of the options available to the EU, a debt-based EDP would be the most difficult for Italy to deal with, as it would last longer and require Italy to...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org