But there is some softness at the microeconomic level.US employment rose by 155,000 in November (+1.7% year on year (y-o-y), decelerating from +237,000 in October. The three-month average dropped as well, but is still a healthy 170,000/month (it was 214,000 up to October 2018). November’s wage growth was unchanged from October’s pace of 3.1% y-o-y.Most cyclical indicators continue to flash green, and there are limited signs of a downturn in the US economy right now; the solid macro picture is, however, dented by eroding momentum in construction, which echoes the broader deceleration in housing as higher mortgage rates kick in. But to put things in perspective, construction employment still increased a solid 4.0% y-o-y in November. We would really worry only if it slowed below 2.0% y-o-y;

Topics:

Thomas Costerg considers the following as important: Federal Reserve, Macroview, US economy, US employment

This could be interesting, too:

Dirk Niepelt writes Does the US Administration Prohibit the Use of Reserves?

Marc Chandler writes US Dollar is Offered and China’s Politburo Promises more Monetary and Fiscal Support

Marc Chandler writes Busy Wednesday: French Confidence Vote, Fed’s Powell Speaks, ADP Jobs Estimate, and Beige Book

Marc Chandler writes US-China Exchange Export Restrictions, Yuan is Sold to New Lows for the Year, while the Greenback Extends Waller’s Inspired Losses

But there is some softness at the microeconomic level.

US employment rose by 155,000 in November (+1.7% year on year (y-o-y), decelerating from +237,000 in October. The three-month average dropped as well, but is still a healthy 170,000/month (it was 214,000 up to October 2018). November’s wage growth was unchanged from October’s pace of 3.1% y-o-y.

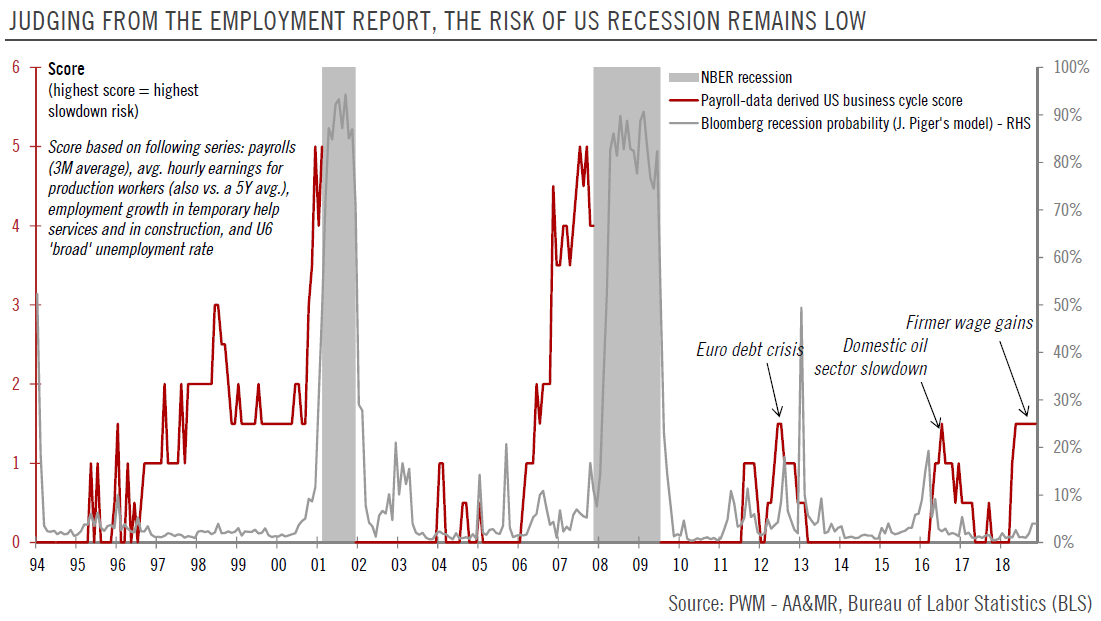

Most cyclical indicators continue to flash green, and there are limited signs of a downturn in the US economy right now; the solid macro picture is, however, dented by eroding momentum in construction, which echoes the broader deceleration in housing as higher mortgage rates kick in. But to put things in perspective, construction employment still increased a solid 4.0% y-o-y in November. We would really worry only if it slowed below 2.0% y-o-y; we are not there yet.

A ‘microeconomic’ story that hurt payrolls in November (and in previous months) is the ongoing softness in government employment, particularly at the state level.

The Federal Reserve looks set to increase rates again at its December meeting, continuing its routine of one quarter-point rate increase per quarter. But the 2019 outlook is getting murkier as financial market jitters continue and Fed officials show rising sensitivity to financial market swings. There is a growing risk of the Fed turning off its rate hike “auto pilot”. The price action in global oil is adding further uncertainty to the Fed outlook for 2019.