Risks of a “no deal” Brexit appear to be receding.Theresa May’s Brexit plan is likely to be defeated in the 11 December (unless postponed) UK parliament vote. The press is currently suggesting a defeat by a margin of around 100 MPs, but if it is higher, then it would seriously handicap the chances of a ‘yes’ in a second vote. A rejection of May’s deal would open the door to several scenarios, including the possibility of a second vote after possible tweaks to the current deal, although squeezing out concessions from the European Union could be tough.How Brexit will unfold remains highly uncertain. We still see a high likelihood of a second vote passing with tweaks made to the current deal, thereby avoiding a no-deal Brexit on 29 March next year. That said, the possibility of an extension

Topics:

Team Asset Allocation and Macro Research considers the following as important: Brexit, Brexit currencies, Macroview

This could be interesting, too:

Claudio Grass writes “Inflation it is not an act of God”

Claudio Grass writes “Inflation it is not an act of God”

Dirk Niepelt writes The Economics of Brexit

Marc Chandler writes High Anxiety: China’s Covid and US Inflation

Risks of a “no deal” Brexit appear to be receding.

Theresa May’s Brexit plan is likely to be defeated in the 11 December (unless postponed) UK parliament vote. The press is currently suggesting a defeat by a margin of around 100 MPs, but if it is higher, then it would seriously handicap the chances of a ‘yes’ in a second vote. A rejection of May’s deal would open the door to several scenarios, including the possibility of a second vote after possible tweaks to the current deal, although squeezing out concessions from the European Union could be tough.

How Brexit will unfold remains highly uncertain. We still see a high likelihood of a second vote passing with tweaks made to the current deal, thereby avoiding a no-deal Brexit on 29 March next year. That said, the possibility of an extension of the 29 March deadline is rising, especially as the idea of a new referendum is gaining steam, but we consider fresh general elections as still more likely than a referendum.

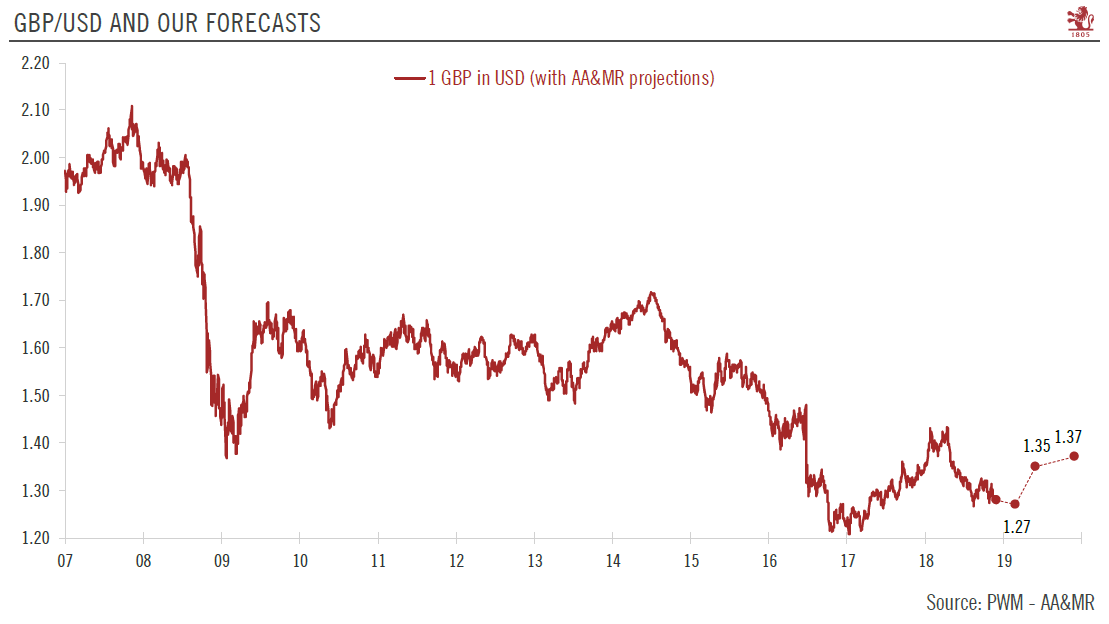

The UK parliament is strongly against a cliff-edge scenario and appears to be affirming its power over the Cabinet. Therefore, we believe that the pound sterling is likely to stay range-bound, with a lower chance of a no-deal Brexit limiting the downside, but also the rising possibility of an extension (prolonging uncertainty) limiting the upside. One possible outcome of parliament failing to ratify the deal would be an extension of the 29 March deadline: this scenario sees sterling underperforming other major currencies and remaining around current levels relative to the US dollar for a longer time period than envisaged by our central scenario. All in all, we think that recent political developments reduce the risk of a no-deal Brexit.