But leading indicators point to Q4 rebound.Indian GDP in Q3 2018 rose 7.1% year-over-year (y-o-y) in real terms, down from 8.2% in Q2 and significantly below the consensus and our own forecasts of 7.5%. As a result, we have revise down our fiscal year (FY) 2018-2019 GDP forecast for India to 7.2% from 7.6% previously. Our forecast for FY 2019-2020 remains the same, however.In our view, external headwinds, specially surging oil prices, were the main reasons for the downturn in Q3, but domestic activity also posted weak results. In more detail, while growth picked up slightly to 12.4% year-on-year in Q3 from 12.7% the previous quarter, it was dwarfed by the surge in imports, which rose by 25.6% in Q3 from 12.5% in Q2. The dramatic increase in imports was largely driven by the significant

Topics:

Dong Chen considers the following as important: India economy, India GDP, Macroview, oil prices

This could be interesting, too:

Jeffrey P. Snider writes I Told You It *Wasn’t* Money Printing; How The Fed Helped Cause, But Can’t Solve, Our Current ‘Inflation’

Joseph Y. Calhoun writes Weekly Market Pulse: Oil Shock

Jeffrey P. Snider writes Houston, We Have An Oil (and inventory) Problem

Cesar Perez Ruiz writes Weekly View – Big Splits

But leading indicators point to Q4 rebound.

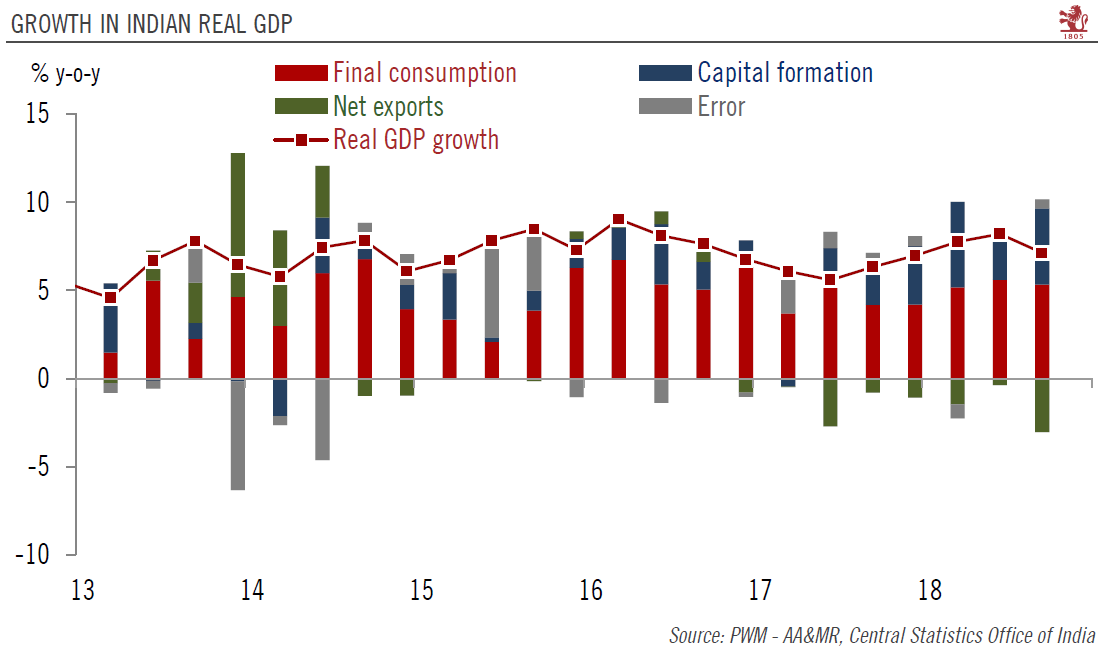

Indian GDP in Q3 2018 rose 7.1% year-over-year (y-o-y) in real terms, down from 8.2% in Q2 and significantly below the consensus and our own forecasts of 7.5%. As a result, we have revise down our fiscal year (FY) 2018-2019 GDP forecast for India to 7.2% from 7.6% previously. Our forecast for FY 2019-2020 remains the same, however.

In our view, external headwinds, specially surging oil prices, were the main reasons for the downturn in Q3, but domestic activity also posted weak results. In more detail, while growth picked up slightly to 12.4% year-on-year in Q3 from 12.7% the previous quarter, it was dwarfed by the surge in imports, which rose by 25.6% in Q3 from 12.5% in Q2. The dramatic increase in imports was largely driven by the significant rise in global oil prices.

However, more recent data indicate that momentum in the Indian economy is picking up again both in manufacturing and services. With the recent slump in crude oil prices, we expect to see a rebound in growth in Q4. November purchase manager indices came in at 54.5 for the manufacturing sector and 53.7 for the services sector, an improvement over the previous month for both sectors.

Export growth has also picked up. In October, exports rose by 33.4% y-o-y, and grew faster than crude oil imports for the first time in five months. The recent fall in global oil prices should bode well for India as well, given the value of India’s crude oil imports (in USD terms) rose by 52.6% y-o-y in Q3. Over the past two months, crude oil prices have dropped by more than 30% from their peak in early October. This could greatly reduce the drag of net exports on Indian growth and improve India’s current account position.

To summarise, India’s Q3 growth numbers are disappointing, with net exports the main drag. Manufacturing also showed some notable weakness, while the services sector was largely stable. Latest PMIs are pointing to a meaningful improvement in activity in Q4. Combined with the sharp decline in crude oil prices, we expect to see a rebound in Indian growth in Q4.