The CIO office’s view of the week ahead.As a US-China trade negotiation impasse became evident last week, markets corrected a bit, particularly cyclical sectors. Given the strong US economy, Trump is feeling empowered to pursue his agenda, raising existing tariffs from 10-25% on USD 200bn worth of goods with immediate effect and threatening more. Now we will wait to see how China retaliates. For the time being, we feel assured that the Chinese authorities will not use currency or its US...

Read More »French tax cuts designed to reboot Macron’s presidency

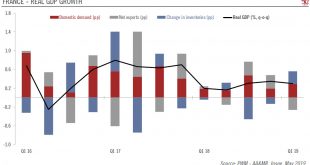

The French government’s respond to the ‘yellow vest’ protests could provide a meaningful boost to consumer spending, mostly next year. Following a series of townhall meetings with French citizens up and down France, President Emmanuel Macron responded to social unrest with two doses of fiscal easing. The December package (worth EUR10bn) was incorporated in the stability plan sent to Brussels before Easter and is...

Read More »French tax cuts designed to reboot Macron’s presidency

The French government’s response to the ‘yellow vest’ protests could provide a meaningful boost to consumer spending, mostly next year.Following a series of townhall meetings with French citizens up and down France, President Emmanuel Macron responded to social unrest with two doses of fiscal easing. The December package (worth EUR10bn) was incorporated in the stability plan sent to Brussels before Easter and is included in the 3.1% public deficit planned for this year. The measures...

Read More »A spanner in the works

While Trump’s weekend tweets have created fresh uncertainties around US trade talks with China, some perspective is needed. At the weekend, US President Trump threatened to increase the tariff rate on Chinese imports as he believes that US-China trade negotiations are going “too slowly”. Importantly, Trump’s threats do not mean bilateral talks are breaking down. Indeed, the Chinese government confirmed today that its...

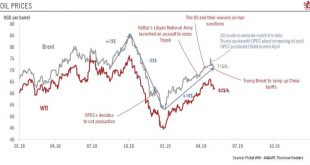

Read More »Oil prices decline despite the end of Iran waivers

We believe prices will remain volatile in the short term, before a possible oil glut becomes an issue toward year’s end.The increase in prices that followed President Trump’s 22 April decision to end waivers on Iranian oil imports did not last, with Brent prices falling from almost USD75 on 24 April to below USD70. Nonetheless, we continue to see heightened risk of oil price spikes above USD80 for Brent in the short-term.Trump’s recent threat to increase US tariffs on Chinese imports could...

Read More »A spanner in the works

While Trump’s weekend tweets have created fresh uncertainties around US trade talks with China, some perspective is needed.At the weekend, US President Trump threatened to increase the tariff rate on Chinese imports as he believes that US-China trade negotiations are going “too slowly”. Importantly, Trump’s threats do not mean bilateral talks are breaking down. Indeed, the Chinese government confirmed today that its trade delegation would still go to Washington DC this week for another round...

Read More »Weekly View – The final countdown

The CIO office’s view of the week ahead.Last week markets were relatively muted, with commodities down, developed markets flat and emerging markets up slightly. That brief period of calm has already ended, with Trump’s Sunday tweets sending Chinese markets sharply down on Monday. With the Chinese scheduled to attend the next round of trade negotiations in the US on Wednesday, the US president is putting extra pressure on China to concede to US demands and seal a deal through threats to...

Read More »House View, May 2019

Pictet Wealth Management's latest positioning across asset classes and investment themes.Asset AllocationThere were no changes to our asset allocation in April. While we are encouraged by better-than-expected Q1 earnings and some improvement in earnings expectations, we remain neutral on global equities as we await new catalysts to justify current valuations. At the same time, we have a positive view of Chinese and Indian equities.We remain underweight government bonds given low yields,...

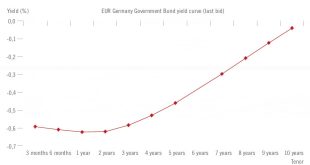

Read More »Is Europe turning Japanese?

European investment opportunities remain, despite financial repression in the region. The European Central Bank (ECB) surprised market watchers with its dovish turn in January, wiping out any prospect of an interest-rate rise this year and revising its growth projections for the euro area downward for 2019. With Europeans set to live with interest rates at zero (or negative) for longer, many are wondering if Europe now...

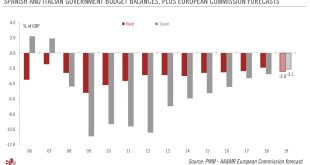

Read More »Peripheral bonds after the Spanish election

We remain underweight peripheral euro area bonds in general due to continued political uncertainty, which will feed volatility. On April 28, Spain held its third general election in less than four years. As was expected, the centre-left Socialists (PSOE) emerged the largest party, but it does not have an absolute majority, so negotiations with other parties will be needed. But the political fog in Spain is unlikely to...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org