The CIO office’s view of the week ahead.Last week, President Trump announced a 5% tariff on all imports from Mexico to take effect from 10 June unless the Mexican government moves to stem illegal immigration across the US-Mexico border. This rate could then rise by 5% each month to reach 25% by October if the US is not satisfied with Mexico’s response. Mexico has been one of the beneficiary countries of the US-China trade war, its trade balance with the US widening as China’s narrows....

Read More »US dollar update – path of least resistance remains to the downside

Given a deteriorating global growth outlook and higher trade tensions, we are reducing our bearish stance on the US dollar. However, we believe that most factors suggest the US dollar continues to face downside risks.Despite a more dovish Fed, the US dollar has remained strong since the start of the year (as of 28 May, only the Canadian dollar and the Japanese yen had fared better). Weak global economic growth, notably as a result of trade tensions, has favoured the US dollar given its...

Read More »Avenues worth exploring in strategic asset allocation

The prospect of diminishing returns for classic, and previously highly effective, 60/40 portfolios (60% equities, 40% bonds) is leading to changes in strategic asset allocation. Efforts to improve prospects include identifying macroeconomic regimes to guide investments and refining how diversification is understood. Interest in endowment-style investing is also growing as private assets are incorporated into strategic...

Read More »Avenues worth exploring in strategic asset allocation

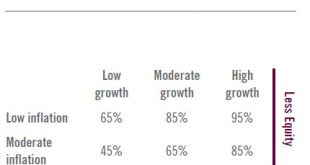

The prospect of diminishing returns for classic, and previously highly effective, 60/40 portfolios (60% equities, 40% bonds) is leading to changes in strategic asset allocation. Efforts to improve prospects include identifying macroeconomic regimes to guide investments and refining how diversification is understood. Interest in endowment-style investing is also growing as private assets are incorporated into strategic asset allocation to boost portfolio returns.Using macroeconomic regimes...

Read More »Tory Brexiteers likely to be galvanised by Euro parliament results

The results mean the next Conservative Party leader could veer towards a harder stance on Brexit, with implications for sterling and UK stocks.The European Parliament elections produced mixed results in the UK and do not seem to offer a clear path out of the current Brexit limbo.Nigel Farage’s Brexit Party came first, while the Tory (Conservative) party suffered heavily. This is likely to induce a new Tory leader to adopt a harder stance on Brexit in the coming months, as the party faces a...

Read More »European elections – a more diverse but still pro-Europe parliament

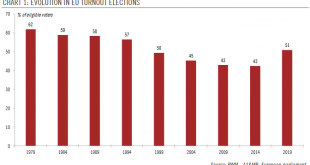

Voter turnout for European parliament elections surged across the continent, exceeding 50% for the first time in a quarter century and breaking the downward trend of the last four decades. However, differences in turnout across the EU have been substantial and a more fragmented parliament has emerged.Voter turnout was up for the first time ever and at 51%, higher than in any election since 1994. The results delivered a parliament with a pro-European majority, broadly in line with opinion...

Read More »European elections – a more diverse but still pro-Europe parliament

Voter turnout for European parliament elections surged across the continent, exceeding 50% for the first time in a quarter century and breaking the downward trend of the last four decades. However, differences in turnout across the EU have been substantial and a more fragmented parliament has emerged. Voter turnout was up for the first time ever and at 51%, higher than in any election since 1994. The results delivered...

Read More »Weekly View – MAY DAY, MAY DAY

The CIO office’s view of the week ahead.As the results of European Parliament elections roll in, some unexpected outcomes are taking shape. While populists across the Union did win new seats, they did not fare as well as expected, while Green parties gained significant ground as voter turnout rose for the first time in four decades. Surprises at the country level could also lead to greater political instability for some constituents. In Greece, Alexis Tsipras’s Syriza party defeat means the...

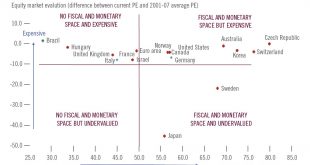

Read More »Policy space may help only a few markets

Risk markets where there is room to loosen policy but are undervalued look more attractive than those where the authorities have room to manoeuvre but markets are expensiveAt this mature stage of the business cycle, it makes sense to consider the possible next steps in economic policy, given that we believe it is likely that central banks and governments will do their utmost to prop up the bull equity market as well as economic growth. (This will be especially true in the US as the 2020...

Read More »Rising downside risks to euro area growth

While our forecasts remain unchanged for now, external drags on growth prospects for the euro area look set to persist for longer than we had previously expected. A potential improvement in euro area growth in H2 2019 on the back of a revival in the global economy is in jeopardy due to the intensifying trade dispute between the US and China. The euro area is not directly affected, but its indirect exposure to this...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org