European investment opportunities remain, despite financial repression in the region. The European Central Bank (ECB) surprised market watchers with its dovish turn in January, wiping out any prospect of an interest-rate rise this year and revising its growth projections for the euro area downward for 2019. With Europeans set to live with interest rates at zero (or negative) for longer, many are wondering if Europe now faces “Japanisation”, meaning that it is stuck in a low-growth and low-rate environment indefinitely, presenting particular challenges for European investors. Given the current environment and the already low yield level reached by both European sovereign and credit markets, generating returns out of

Topics:

Alexandre Tavazzi considers the following as important: 2) Swiss and European Macro, ECB, European GDP, European inflation, Featured, German Bund yield, Macroview, newsletter, Pictet Macro Analysis

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

|

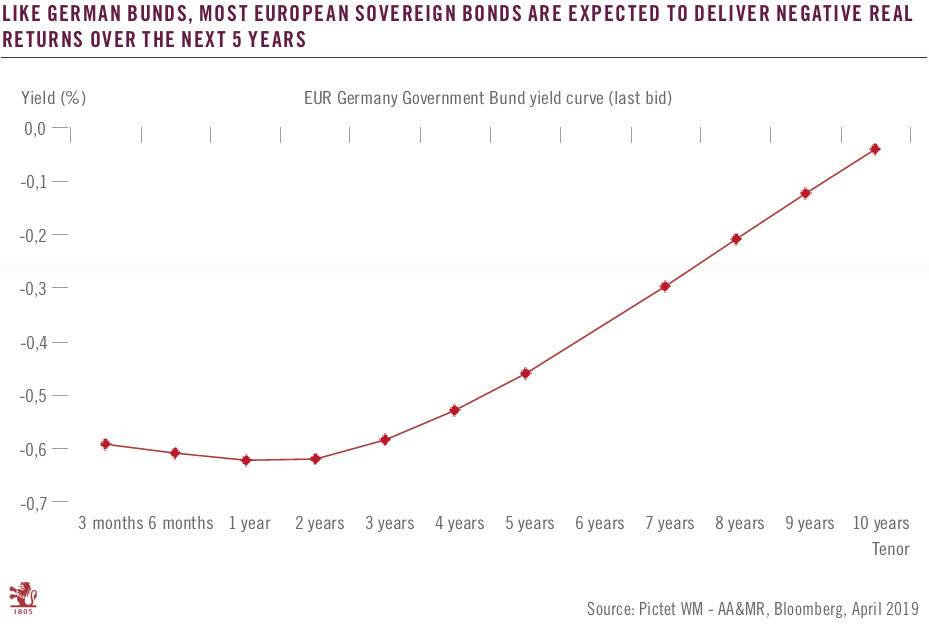

European investment opportunities remain, despite financial repression in the region. The European Central Bank (ECB) surprised market watchers with its dovish turn in January, wiping out any prospect of an interest-rate rise this year and revising its growth projections for the euro area downward for 2019. With Europeans set to live with interest rates at zero (or negative) for longer, many are wondering if Europe now faces “Japanisation”, meaning that it is stuck in a low-growth and low-rate environment indefinitely, presenting particular challenges for European investors. Given the current environment and the already low yield level reached by both European sovereign and credit markets, generating returns out of safe assets will be challenging for investors. We can expect negative returns for European investment grade and German sovereign bonds to persist over the next five years. Hence, European investors need to take a different path to generate some income out of their savings. |

German Bunds Yield, curve(see more posts on German Bund yield, ) |

Tags: ECB,European GDP,European inflation,Featured,German Bund yield,Macroview,newsletter