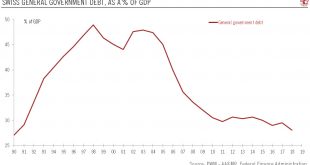

Despite a record of federal budget surpluses, don’t count on fiscal policy to relieve pressure on the SNB The Swiss federal budget is governed by a strict expenditure rule, which is enshrined in the Constitution. Since its introduction, the ratio of public debt-to-GDP has been significantly reduced, falling back to its early-90’s level. At the close of 2018, the Swiss federal budget registered a significant surplus of...

Read More »Swiss policy mix review

Despite a record of federal budget surpluses, don't count on fiscal policy to relieve pressure on the SNBThe Swiss federal budget is governed by a strict expenditure rule, which is enshrined in the Constitution. Since its introduction, the ratio of public debt-to-GDP has been significantly reduced, falling back to its early-90’s level. At the close of 2018, the Swiss federal budget registered a significant surplus of CHF 2.9 billion, compared with budget projections for a surplus of CHF 295...

Read More »China: strong credit growth in March again

Chinese credit data surprised on the upside in March, following a surge in January and a sharp fall in February, but stimulus to the real economy may not be as strong.Chinese credit data surprised on the upside in March, following a surge in January and a sharp fall in February. Monthly total social financing (TSF) came in at Rmb2.86 trillion, much stronger than the market consensus forecast of Rmb1.85 trillion. New bank loans also surprised on the upside at Rmb1.69 trillion, compared with...

Read More »Weekly View—Eyes on guidance

The CIO office's view of the week aheadLast week delivered encouraging news on the outlook for global trade as improved Chinese exports and credit figures were seen as signs that the global trade slowdown would soon turn. On the back of March’s rebound in Chinese purchasing manager indices (PMIs), this means that as well as good news for the global trade outlook, the world’s second-largest economy may report better-than-expected Q1 2019 GDP this week.Last week, the European Central Bank...

Read More »Switzerland: Lower growth, lower inflation

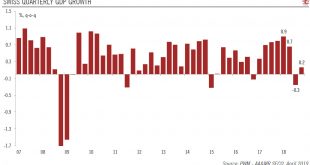

Growth and price rises should moderate in 2019. The Swiss economy posted impressive GDP growth in 2018, although there was significant divergence between strong growth in the first half and stagnation in the second. Overall, we expect Swiss GDP to expand by 1.3% in 2019, down substantially from 2.5% in 2018. Risks to our growth outlook for Switzerland are tilted to the downside. Looking ahead, we expect the Swiss...

Read More »Brexit update: a very British fudge

The EU has granted a Brexit deadline extension to 31 October of this year. The next step after this extension could be another extension.Following the EU Council summit, 31 October 2019 is the new Brexit deadline. Given that we see limited probability of a sudden unknotting of the current UK parliamentary gridlock, our core scenario is that the deadline will be extended again. The current timeframe is too short to really work on an alternative to the current ‘Withdrawal Agreement’, which has...

Read More »Switzerland: Lower growth, lower inflation

Growth and price rises should moderate in 2019.The Swiss economy posted impressive GDP growth in 2018, although there was significant divergence between strong growth in the first half and stagnation in the second. Overall, we expect Swiss GDP to expand by 1.3% in 2019, down substantially from 2.5% in 2018. Risks to our growth outlook for Switzerland are tilted to the downside.Looking ahead, we expect the Swiss economy to slow. Fundamentals supporting domestic demand remain solid, but the...

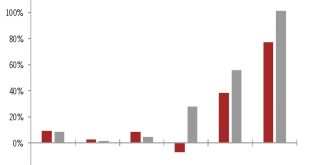

Read More »Update to our earnings scenario

After a stellar 2018, earnings expectations for the S&P 500 have been ratcheted down for this year. Total returns will increasingly come from sources other than earnings.Earnings estimates in developed markets have been cut continuously over the past six months. The consensus expectation for earnings growth in 2019 for the S&P 500 is now around 3.5%. This compares with stellar earnings growth of 24.1% in the US in 2018, thanks in large part to the end-2017 US tax cuts announced by...

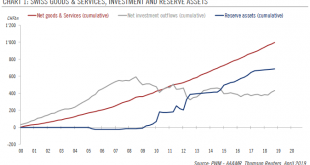

Read More »Limited room for Swiss franc depreciation

Even should global economic momentum stabilise in the coming months and political risks abate, the franc still has important structural underpinnings. The Swiss franc has been supported by a structural current account surplus and by reduced investment flows out of Switzerland since the 2008 financial crisis. In addition, the decline in global yields since the Fed’s dovish shift early this year has rendered interest...

Read More »Indian elections start today

Understanding what is at stake and what it means for markets as the world's largest elections commence.Today, India’s 2019 general elections to determine the next Lok Sabha (the lower house) kick off. India is divided into 543 constituencies, each represented by one member of the Lok Sabha. The party or the coalition that wins a simple majority (272 seats) will form the government. Nearly 900 million voters across the nation will head to election booths to cast their votes over the next five...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org