While we expect the Fed to stay on hold, it could supply new insight into the threshold for a rate cut (which we consider improbable).The Fed meeting concluding on 1 May should provide only limited new information.The domestic growth backdrop is good and equity markets are buoyant, but low core inflation and the proximity of the theoretical ‘neutral rate’ will likely stifle the Fed’s temptations to raise rates. Instead, the Fed should signal it is happy to stay on hold for now.While the...

Read More »Is Europe turning Japanese?

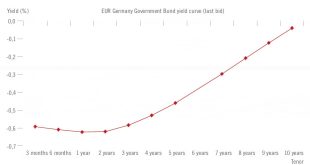

European investment opportunities remain, despite financial repression in the region.The European Central Bank (ECB) surprised market watchers with its dovish turn in January, wiping out any prospect of an interest-rate rise this year and revising its growth projections for the euro area downward for 2019. With Europeans set to live with interest rates at zero (or negative) for longer, many are wondering if Europe now faces “Japanisation”, meaning that it is stuck in a low-growth and...

Read More »Peripheral bonds after the Spanish election

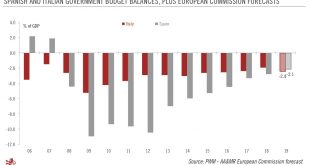

We remain underweight peripheral euro area bonds in general due to continued political uncertainty, which will feed volatility.On April 28, Spain held its third general election in less than four years. As was expected, the centre-left Socialists (PSOE) emerged the largest party, but it does not have an absolute majority, so negotiations with other parties will be needed. But the political fog in Spain is unlikely to lift much before the regional and European elections on May 26.The misty...

Read More »Weekly View – A Socialist victory

The CIO office’s view of the week ahead.Spain’s governing Socialist party swept to victory at the weekend’s general elections, which enjoyed the highest turnout since 2008, with a 75% participation rate. Taking 29% of the vote however, the Socialist PSOE party is far short of an absolute majority and will need to form a coalition, which will likely be fragmented and unstable given the election results. Furthermore, an alliance is not likely to be confirmed before Spain’s regional elections...

Read More »Euro area Q1 GDP growth could be stronger than expected

The general improvement in hard data holds out the possibility of a positive surprise when preliminary GDP figures are announced next week.Next week will be a busy one for Europe, with lots of data releases: European Commission business survey (April); advance GDP (Q1); M3 money supply (March); HICP flash estimate of inflation (April); and final manufacturing purchasing manager indices (PMIs, April). The advance Q1 GDP will be especially closely watched. No euro area GDP breakdown will be...

Read More »Weekly View – Europe’s “black hole”

The CIO office’s view of the week ahead.Positive economic data has sent relief through markets, with encouraging news coming out of the world’s two biggest economies. The Chinese economy grew faster than expected in the first quarter, as the government’s stimulus policy begins to take effect. In the US, a rebound in consumer spending resulted in retails sales posting their biggest gain since 2017 in March. However, as astronomers published the first image of a black hole, the European...

Read More »China: Q1 growth beats expectations

The Chinese economy grew at a faster rate than expected in the first quarter as policy stimulus effects kick in. The National Bureau of Statistics of China published Q1 GDP figures along with some key economic indicators for March. The data generally surprised on the upside. While we had previously flagged the upside risk to our earlier GDP forecast following the rebound in PMIs and strong credit numbers, the latest...

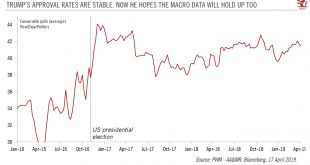

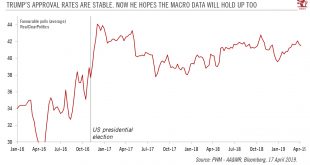

Read More »Business cycle could define Trump’s re-election chances

President Trump’s focus on getting re-elected in November 2020 may have implications for his economic policy choices. As we move closer to the 2020 presidential election, Trump has been blatantly leaning on the Federal Reserve to be more accommodative and has been trying to appoint nominees who share his preference for loose monetary policy to the Fed board. The countdown to the 2020 elections also seems to be prompting...

Read More »China: Q1 growth beats expectations

The Chinese economy grew at a faster rate than expected in the first quarter as policy stimulus effects kick in.The National Bureau of Statistics of China published Q1 GDP figures along with some key economic indicators for March. The data generally surprised on the upside. While we had previously flagged the upside risk to our earlier GDP forecast following the rebound in PMIs and strong credit numbers, the latest data releases still surprised to the upside. In light of the strong Q1...

Read More »Business cycle could define Trump’s re-election chances

President Trump’s focus on getting re-elected in November 2020 may have implications for his economic policy choices.As we move closer to the 2020 presidential election, Trump has been blatantly leaning on the Federal Reserve to be more accommodative and has been trying to appoint nominees who share his preference for loose monetary policy to the Fed board. The countdown to the 2020 elections also seems to be prompting Trump to adopt a mellower stance than before on Chinese trade talks so...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org