While Trump’s weekend tweets have created fresh uncertainties around US trade talks with China, some perspective is needed. At the weekend, US President Trump threatened to increase the tariff rate on Chinese imports as he believes that US-China trade negotiations are going “too slowly”. Importantly, Trump’s threats do not mean bilateral talks are breaking down. Indeed, the Chinese government confirmed today that its trade delegation would still go to Washington DC this week for another round of talks. We have long expected the path to a US-China trade deal to be bumpy, but we still think some sort of short-term agreement can be found. However, it is bound to be fragile, leaving a lot of deep-rooted issues

Topics:

Team Asset Allocation and Macro Research considers the following as important: 5) Global Macro, China, Chinese equities, Featured, Macroview, newsletter, Trade tensions, Trade War, us china trade

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

| While Trump’s weekend tweets have created fresh uncertainties around US trade talks with China, some perspective is needed.

At the weekend, US President Trump threatened to increase the tariff rate on Chinese imports as he believes that US-China trade negotiations are going “too slowly”. Importantly, Trump’s threats do not mean bilateral talks are breaking down. Indeed, the Chinese government confirmed today that its trade delegation would still go to Washington DC this week for another round of talks. We have long expected the path to a US-China trade deal to be bumpy, but we still think some sort of short-term agreement can be found. However, it is bound to be fragile, leaving a lot of deep-rooted issues unresolved. Indeed, we believe US-China trade will remain a key issue beyond the 2020 presidential election given the bipartisan animosity towards China in Washington. While Trump’s tweets increase uncertainty, just as with the initial tariffs on Chinese goods, it is likely that the new ones threatened by Trump will have only a limited impact on growth (c. 0.1ppt of GDP). They will not alter the chance of a US recession, which remains moderate, although financial conditions and the reaction of the stock market will bear watching. Although long-term trade would remain an issue, the US equity market could cope with some additional tariffs, as margin pressure remains contained. European and Japanese indices are more exposed to emerging-market assets and would likely suffer more from a tariff-related market correction. |

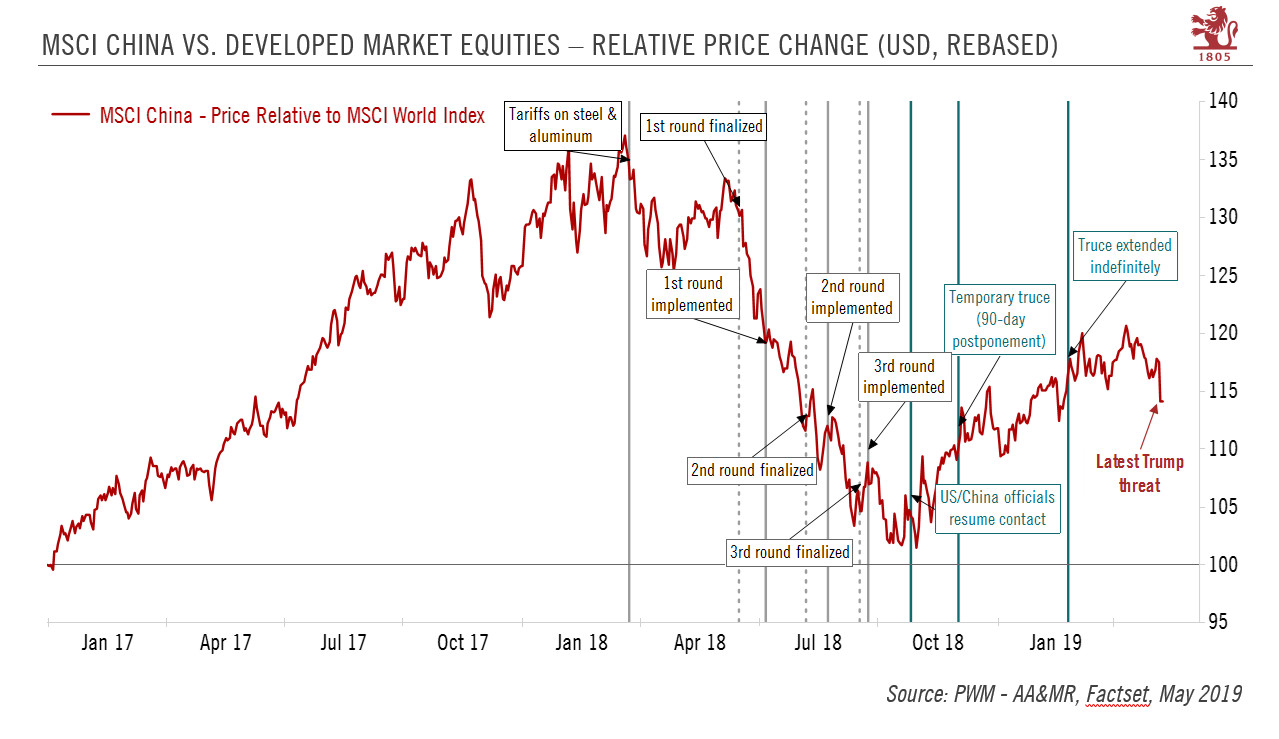

MSCI China vs. Developed Market Equities - Relative Price Change, 2017-2019 |

The impact on China of new tariffs would be larger, knocking about 0.3% off Chinese GDP. Combined with the existing tariffs, the total impact on GDP would be 0.8% per year, assuming that the tariffs are not withdrawn at some stage, fully or partially. Should the case arise, we would expect the Chinese government to step up the domestic policy stimulus it has already introduced to support the economy this year.

Chinese equity markets were clearly taken by surprise by the latest Trump threats and corrected sharply. Yesterday’s strong market reaction might even be seen as a healthy antidote to the increasing complacency that has prevailed since the beginning of the year and triggered a sharp rebound in Chinese equities since November. A number of factors could still support Chinese equities in 2019, such as Trump’s eagerness to strike a deal, the scope for further stimulus in China, and the ongoing inclusion of Chinese A-shares in major equity indices. We therefore do not see any material cause for concern at this stage, provided bilateral talks continue and China’s economic momentum holds.

Tags: Chinese equities,Featured,Macroview,newsletter,Trade tensions,Trade War,us china trade