Our GDP growth forecasts for Q4 (+2.6%) and 2016 (+2.4% on a yearly average basis) remain unchanged. The ISM indices continue to diverge quite markedly. The Manufacturing index ticked down to almost 50% in October, whereas its Non-Manufacturing counterpart bounced back sharply, reaching its second highest reading in a decade. Taken together, they point towards economic growth running at around 3.8% in October. We continue to expect GDP growth to settle at 2.6% in Q4. ISM Manufacturing...

Read More »Gold: challenging environment in the short term

The expected March 2016 lift-off and negative short-term seasonal patterns are likely to result in a challenging short-term environment for the gold price. Our scenario favours a medium-term consolidation above the $1000/oz threshold. The recent trend of the gold price has been closely linked to how the Fed’s tightening cycle is likely to pan out. The rationale is that higher rates make gold less attractive. While gold has no credit risk, it is a non-yielding asset. As a result, when...

Read More »Hedge funds: bull or bear on China?

Macroview Global managers are developing a pronounced bearish stance towards China, while several local managers are building up their exposure to Chinese equities, arguing the rest of the world is far too pessimistic. China has been slowing down and the outlook for emerging markets is far from positive. Summer events in China shook markets worldwide and the consensus is that the worst is yet to come. Chinese economic data has been below expectations for the past year and a half, with the...

Read More »US wages and monetary policy: surprisingly hawkish FOMC statement in October

Quarterly wage data (ECI) for Q3 pointed to modest increases, and core PCE inflation remained stable at a low 1.3% in September. Although the October FOMC statement was surprisingly hawkish, we continue to believe that the most likely scenario will see the Fed biding its time until March next year before making a start on lifting rates. Friday saw some key data being published: the quarterly Employment Cost Index (ECI), admittedly the most reliable measure of wages and salaries....

Read More »Spain: solid rate of growth in the third quarter

Spain is the first country of the four biggest economies to publish Q3 figures. Its good performance bodes well for the euro area as a whole. According to INE’s flash estimate, Spanish real GDP expanded by 0.8% q‑o‑q (3.4% y-o-y) in Q3, in line with consensus expectations. This comes after GDP grew by 1.0% q-o-q in Q2 and 0.9% q-o-q in Q1. Details of the expenditure breakdown for Q3 are not yet available (to be published on 26 November). Nevertheless, based on monthly macroeconomic...

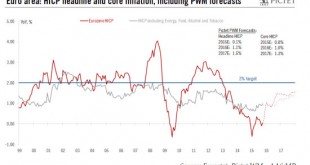

Read More »Inflation in the euro area: the beginning of the end of negative base effects

Whatever the ECB does in the coming months, this threat of “low-flation for ever” is likely to keep the central bank under pressure The euro area HICP flash estimate rebounded to zero in October, or +0.04% y-o-y, after -0.08% in the previous month, as negative energy-related base effects diminished. Looking at HICP components, energy inflation continued to drag the headline rate down, rising only slightly from -8.9% to -8.7% y-o-y as Brent oil prices more or less stabilised in euro terms...

Read More »United States: strong final demand, but soft GDP growth in Q3

GDP grew by a soft 1.5% q-o-q annualised in Q3, marginally below consensus expectations. Growth was dampened by a sharp drop in the pace of stockbuilding (negative contribution of 1.4 percentage points) and another massive fall in energy-sector investment. US real GDP, curbed by lower stockbuilding, grew by a soft 1.5% in Q3. However, final demand increased by a buoyant 2.8%. Our forecasts for Q4 (+2.6%) and 2016 (+2.4%) remain unchanged. In Q3 2015, US real GDP grew by a soft 1.5%...

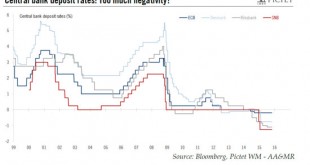

Read More »Q&A on the ECB’s negative rates – Its decision to cut rates again should be FX-dependent

The ECB has explicitly (re-)opened the door to further cuts in the rate applied to its deposit facility, currently standing at -0.20%. The ECB is one of four major central banks to have lowered one of its policy rates into negative territory; the ECB’s rate on the deposit facility used to remunerate banks’ reserves – or the ‘depo rate’ – currently stands at ‑0.20%. The other negative experimenters, in Switzerland, Denmark and Sweden, have even lower repo and deposit rates (see chart below)....

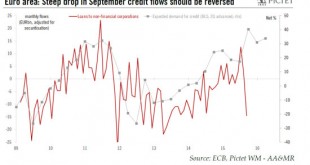

Read More »Euro area: big drop in credit flows in September to be reversed

Despite September's setback in credit flows, the credit impulse improved further in Q3, still consistent with growth in domestic demand of close to 2%. Euro area M3 and credit data surprised on the downside in September, contradicting the positive message from the ECB’s Bank Lending Survey (BLS) published last week. Overall, we believe these volatile bank credit flows are likely to rebound strongly in the months ahead, closing the gap with upbeat leading indicators like the BLS (see chart...

Read More »Equity markets: is it time to move out of Growth stocks and into Value ones?

Growth investing has been very profitable in the US equity market since 2009, outperforming Value investing by 55% since April 2009. A great period for Growth investing Since equity markets bottomed out in March 2009, the Growth style (as measured, for the purposes of this Flash Note, by the MSCI US Growth index ) has handsomely outperformed the Value style (MSCI US Value Index). Price-wise, the performance gap worked out at 55% for the period from April 2009 to end-September 2015, its...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org