Despite September's setback in credit flows, the credit impulse improved further in Q3, still consistent with growth in domestic demand of close to 2%. Euro area M3 and credit data surprised on the downside in September, contradicting the positive message from the ECB’s Bank Lending Survey (BLS) published last week. Overall, we believe these volatile bank credit flows are likely to rebound strongly in the months ahead, closing the gap with upbeat leading indicators like the BLS (see chart below). The annual rate of growth in M3 was unchanged in September, at 4.9% y-o-y. Meanwhile, the annual M1 growth rate quickened slightly to 11.7% y-o-y on the back of another strong (€42bn) increase in overnight deposits. More surprisingly, credit flows to Non-Financial Corporations (NFC) recorded a large €15bn drop in September, once accounting for sales, securitisation and de-recognised loans, the largest monthly drop since February 2014. However, a closer look at the breakdown by country suggests that this setback was exaggerated by a steep drop in lending in the Netherlands, and unlikely to be repeated. Meanwhile, bank lending to households was much more resilient, expanding by €9bn in September, or roughly the average of the past six months. All in all, today’s M3 report may come as a disappointment to the ECB, but it is unlikely to herald a new trend of credit stagnation.

Topics:

Perspectives Pictet considers the following as important: Macroview, Uncategorized

This could be interesting, too:

Claudio Grass writes The Case Against Fordism

Claudio Grass writes “Does The West Have Any Hope? What Can We All Do?”

Claudio Grass writes Predictions vs. Convictions

Claudio Grass writes Swissgrams: the natural progression of the Krugerrand in the digital age

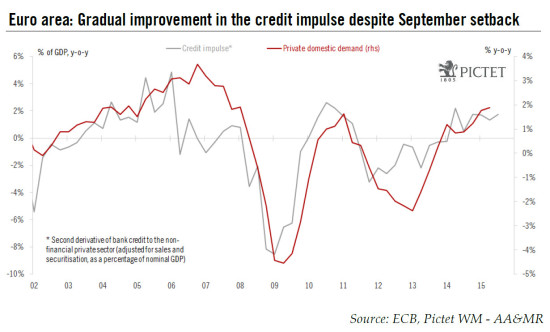

Despite September's setback in credit flows, the credit impulse improved further in Q3, still consistent with growth in domestic demand of close to 2%.

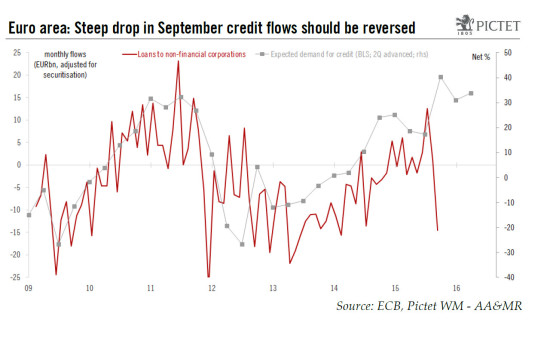

Euro area M3 and credit data surprised on the downside in September, contradicting the positive message from the ECB’s Bank Lending Survey (BLS) published last week. Overall, we believe these volatile bank credit flows are likely to rebound strongly in the months ahead, closing the gap with upbeat leading indicators like the BLS (see chart below).

The annual rate of growth in M3 was unchanged in September, at 4.9% y-o-y. Meanwhile, the annual M1 growth rate quickened slightly to 11.7% y-o-y on the back of another strong (€42bn) increase in overnight deposits.

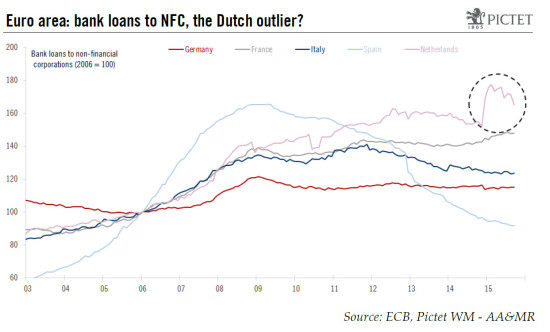

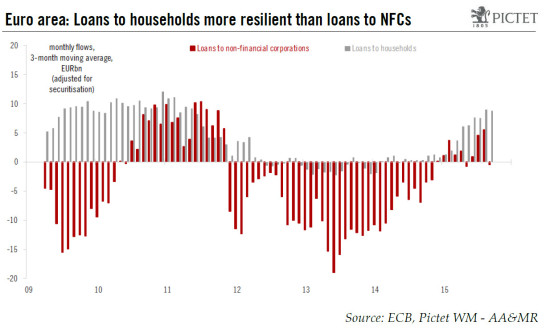

More surprisingly, credit flows to Non-Financial Corporations (NFC) recorded a large €15bn drop in September, once accounting for sales, securitisation and de-recognised loans, the largest monthly drop since February 2014. However, a closer look at the breakdown by country suggests that this setback was exaggerated by a steep drop in lending in the Netherlands, and unlikely to be repeated. Meanwhile, bank lending to households was much more resilient, expanding by €9bn in September, or roughly the average of the past six months.

All in all, today’s M3 report may come as a disappointment to the ECB, but it is unlikely to herald a new trend of credit stagnation. Instead, the reversal we expect in the coming months should also be supported by existing (TLTRO) and upcoming (QE expansion) measures by the ECB. In turn, improvement in the credit cycle is a key factor behind our forecast for euro area GDP to expand by 1.7% in 2016.

Looking at the three-month moving average of credit flows to the private sector, the trend has remained positive for loans to households, but today’s report suggests loans to NFCs are struggling to maintain an uptrend despite more favourable conditions overall.

The setback in September credit flows has also translated into a slower year-on-year growth rate for loans to NFC (down to +0.1% in September, from 0.4% in August), although M3 growth remained above the ECB’s reference value of 4.5%.

A closer look at credit data at the national level confirms our view that the September report should be treated as an outlier rather than a change in trend. The only country which recorded a meaningful decline in lending to NFC was the Netherlands (-€14bn), which could be the result of accounting changes in late 2014. Meanwhile, corresponding flows were only marginally negative in Germany, Belgium, Greece, Portugal or Ireland. On the contrary, credit flows to NFC were positive in Italy (+€2.3bn) and in Spain (+€1.7bn) where the dynamics remain favourable as well.

The credit cycle is key to the outlook for euro area growth

There are several reasons why developments in the credit cycle can be expected to have an even greater impact than usual on the ongoing recovery.

Firstly, narrow money aggregates have been forward-leading indicators of the cycle in the past, with real M1 leading real GDP growth by around one year. One explanation put forward by the ECB has been that “changes in money can lead to changes in private sector portfolios and in yields on financial and real assets, which in turn affect real spending decisions “. In September, annual M1 growth in real terms stabilised at around 13.5% y-o-y, still consistent with GDP growth of more than 3%, thus pointing to upside risks to our euro area GDP growth, although this leading indicator has overstated the pace of economic expansion in the last two upturns.

Second, in a highly bank-based economy like the euro area, the credit impulse – the second derivative of credit to the non-financial private sector – has been a reliable indicator of growth in domestic demand. Significant constraints remain on banks’ balance sheets, but the end of deleveraging in the aftermath of the Asset Quality Review in 2014 suggests that credit traction can increase further. Despite the setback in September flows, the credit impulse has improved further in Q3, to 1.77% y-o-y (see chart below). Again, leading indicators, like business confidence and the BLS, point to further improvement in the credit impulse, helped by ECB support.

Third, improvements in the credit cycle are self-reinforcing thanks to ECB support, including the Targeted Longer-Term Refinancing Operations (TLTROs) conducted every quarter since September 2014 and until June 2016. Indeed, the more banks lend to households (excluding mortgages) and non-financial corporations, the more extra funds they can borrow from the ECB (at the main refinancing rate). Conversely, should a commercial bank fail to respect the TLTRO rule, which compares actual lending to the private sector against a benchmark based on past behaviour, the full amount of TLTRO money will need to be repaid to the ECB in September 2016 (unless the rules are changed). The September 2015 TLTRO attracted less demand than expected, but, at €400bn, the total outstanding amount of TLTRO liquidity has contributed to expansion in the ECB’s balance sheet. The trend is expected to continue, especially in Spain, Italy or France where banks can still borrow, in theory, a lot more from the ECB.

In the end, we and the ECB remain confident that the euro area credit cycle has turned for good, and that it will contribute to a strengthening of domestic demand, with upside risks likely to build as we move into next year. As banks plan to expand their balance sheets through new loans or asset purchases, the ECB should draw comfort from the fact that transmission of its policy stance to the real economy is improving. Meanwhile, the cost of credit continues to decline in terms of both wholesale market funding and bank lending to households, and large and small businesses. All this should provide the ECB with another useful justification for expanding QE in December as more liquidity finds its way into the real economy.