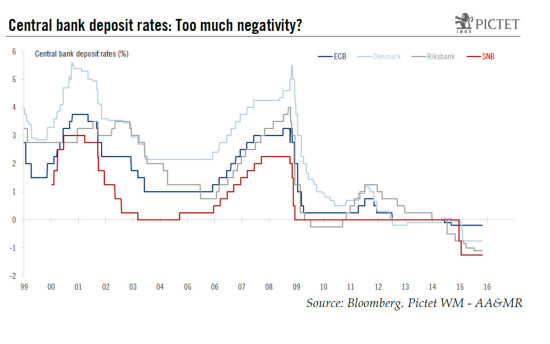

The ECB has explicitly (re-)opened the door to further cuts in the rate applied to its deposit facility, currently standing at -0.20%. The ECB is one of four major central banks to have lowered one of its policy rates into negative territory; the ECB’s rate on the deposit facility used to remunerate banks’ reserves – or the ‘depo rate’ – currently stands at ‑0.20%. The other negative experimenters, in Switzerland, Denmark and Sweden, have even lower repo and deposit rates (see chart below). At the 22 October policy meeting, Mario Draghi surprised the market by (re-)opening the door to further cuts in the deposit rate, despite stating before that policy rates had reached their lower bound. In this Q&A, we have addressed questions raised by a potential cut in the ECB’s depo rate. For a general discussion about negative rates, the Zero Lower Bound (ZLB) or the experience of other central banks, we refer readers to a note by the Norges Bank or various working papers (e.g. here or here). Our main conclusions are threefold: 1) a rate cut is the appropriate tool for tackling “unwarranted tightening” in financial conditions, including through the exchange rate, hence the decision should be largely FX-dependent; 2) we believe the ECB will cut rates in December if the EUR/USD still stands above their implicit ‘target’ of 1.

Topics:

Perspectives Pictet considers the following as important: Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

The ECB has explicitly (re-)opened the door to further cuts in the rate applied to its deposit facility, currently standing at -0.20%.

The ECB is one of four major central banks to have lowered one of its policy rates into negative territory; the ECB’s rate on the deposit facility used to remunerate banks’ reserves – or the ‘depo rate’ – currently stands at ‑0.20%. The other negative experimenters, in Switzerland, Denmark and Sweden, have even lower repo and deposit rates (see chart below). At the 22 October policy meeting, Mario Draghi surprised the market by (re-)opening the door to further cuts in the deposit rate, despite stating before that policy rates had reached their lower bound.

In this Q&A, we have addressed questions raised by a potential cut in the ECB’s depo rate. For a general discussion about negative rates, the Zero Lower Bound (ZLB) or the experience of other central banks, we refer readers to a note by the Norges Bank or various working papers (e.g. here or here).

Our main conclusions are threefold: 1) a rate cut is the appropriate tool for tackling “unwarranted tightening” in financial conditions, including through the exchange rate, hence the decision should be largely FX-dependent; 2) we believe the ECB will cut rates in December if the EUR/USD still stands above their implicit ‘target’ of 1.10 by mid-November (the cut-off date for staff projections); 3) if and when the ECB delivers, what matters most for markets is what the next move will be – the ECB would be likely to cut the depo rate by 10bp while signalling that further cuts are not ruled out. Lastly, we have briefly covered the consequences for other European central banks that are likely to remain under pressure to ease further as a result of ECB activism.

Q1 – How are negative rates implemented in the euro area?

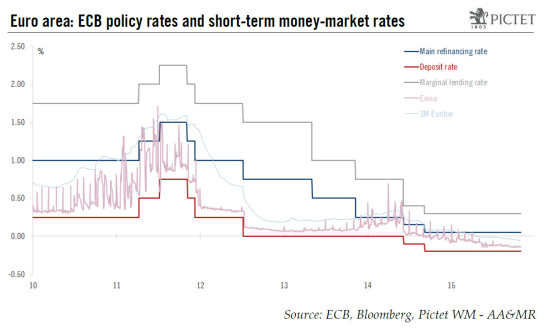

Like several other central banks, the ECB operates under a rates corridor framework to steer short-term interest rates. The main refinancing rate (‘refi rate’, still positive at +0.05%) is the reference rate used to supply both short-term (weekly) and longer-term (from 1-month to 4-year) liquidity to commercial banks against collateral. The rate on the marginal lending facility (+0.30%) is the penalty rate at which banks can borrow from the ECB overnight, also against collateral. The deposit rate (-0.20%) is applied to the bottom of the rates corridor, to the facility on which banks can leave their excess reserves at the ECB overnight, in excess of the required reserves which are parked in banks’ current accounts with the ECB and remunerated at the refi rate. In practice, the overnight interbank rate (Eonia) cannot deviate from this rates corridor, fluctuating between the deposit rate and the marginal lending rate.

In pre-crisis times, the Eonia fixing used to hover close to the refi rate as the ECB generated a structural liquidity deficit in the interbank markets in order to manage liquidity supply and to stabilise short-term money market rates. Since October 2008, however, all regular refinancing operations have been conducted using a fixed-rate full-allotment procedure, meaning that excess liquidity is only driven by commercial banks’ demand for cash outside the ECB’s direct control. The resultant increase in excess liquidity, boosted by ECB’s new lending initiatives (1Y LTRO; 3Y LTROs; 4Y TLTROs; QE), further pushed short-term market rates down to levels close to the depo rate.

In short, as the result of a negative deposit rate and rising excess liquidity (currently above €500bn, and set to rise much further), the ECB’s effective policy rate has shifted from being anchored to the refi rate to being closer to the depo rate. The latter has thus become a cleaner proxy for the ECB’s actual policy stance.

The ECB’s depo rate was first cut to zero in July 2012, then to -0.10% in June 2014. At that time, the Governing Council ruled out further cuts beyond “some little technical adjustments”, but the depo rate was eventually cut again by 10bp to -0.20% in September 2014 (the decision was not unanimous). The Eonia fixing first turned negative in August 2014 while the unsecured 3-month Euribor rate turned negative in April 2015 (see chart below).

Since then, ECB officials had always repeated that policy rates had reached the lower bound “for all practical purposes”– that is before they changed their minds again at their 22 October 2015 meeting. In fairness, we believe the decision to remove the ZLB was probably taken before that in the aftermath of the market turbulences over the summer.

Importantly, the negative rate applies to all bank reserves in excess of the minimum reserve requirements, contrary to the other central banks with negative rates (more on this below).

Q2 – What are negative rates supposed to achieve? What are the pros and cons of a depo rate cut?

In the general case, negative rates can be used to fight different battles once policy rates have reached the zero bound, including currency appreciation, a broader tightening in financial conditions, or deflation risks. Negative rates still represent a terra incognita as policymakers and economists continue to debate both their micro and macro implications as well as the extent to which policy rates can be lowered below zero before a large arbitrage with cash holdings can take place [1]. The ECB has contributed towards fuelling the debate with its recent decisions, admitting that it drew new conclusions from foreign experiences.

[1] See, for instance, the recent speech by BoE’s Andrew Haldane on 18 September 2015, “How low can you go?” on the options to overcome the inability to set negative interest rates on currency.

In the case of the euro area, the main arguments against negative rates relate to the importance of the banking sector for the funding of the economy. With excess liquidity at €500bn, a -0.20% negative rate represents a €1bn tax on the banking system on an annualised basis, and a 10bp rate cut would add an extra cost of €500m. Assuming surplus liquidity rises towards €1,000bn eventually as QE proceeds, a -0.30% depo rate cut would represent an annualised ‘tax’ of €3bn. Spread over the entire euro area banking system, this may sound like a manageable amount, but the signal is certainly not supportive at a time when lots of efforts have been put together to clean banks’ balance sheets and help kick-start the credit cycle.

Since negative rates are generally not passed on to private depositors, there is a chance that in some countries more negative policy rates lead to lower bank margins that could be partly compensated for by higher, not lower lending rates, all else equal.

Arguments in favour of a cut in the deposit rate include the damping effects on the currency (reducing the attractiveness of EUR holdings by foreign investors) as well as downward pressures on the yield curve. In theory, reduced financial fragmentation would mean transmission of lower rates to the real economy can be amplified, especially in the periphery. ECB’s forward guidance would also be reinforced.

On balance, barring some sort of policy co-ordination, we believe an ECB rate cut could add to the current financial volatility and further damp global growth prospects, which is the main reason why we wrote that the least bad option for the ECB could just be to leave the threat of lower rates hanging in the air while hoping that actually delivering on the threat might not be needed.

[1] See, for instance, the recent speech by BoE’s Andrew Haldane on 18 September 2015, “How low can you go?” on the options to overcome the inability to set negative interest rates on currency.

Q3 – How does it play out with QE? Can we realistically expect a mutually (and positive) reinforcing effect of negative rates and asset purchases?

The ECB and the Riksbank have used negative rates in combination with asset purchases. One underlying idea would be that a penalty rate on excess bank reserves will add to the incentive to circulate the cash to other banks more rapidly – the ‘hot potato’ effect. While this could be true to some extent and interbank lending volumes have been relatively resilient, there is one widespread misconception that needs to be cleared up.

The euro area banking system is a closed one, so excess liquidity cannot simply be ‘transformed’ into lending to the real economy. The only way for banks to reduce excess liquidity in aggregate is to reduce borrowing at the ECB, including by paying TLTROs back early. To simplify, if Bank A increases lending to households or enterprises as a result of rising liquidity or deposits, as evidence suggests, then the resulting loan will find its way to Bank B in the form of a new deposit, and deposited back at the ECB’s current account or deposit facility one way or another. Lending volumes can and should increase over time as a result of ECB support, but negative rates are unlikely to play a major role in the process. In short, a depo rate cut is not an appropriate tool to boost bank lending.

Lastly, spill-overs from a potential rate cut to the ECB’s QE programme will depend on the threshold applied to asset purchases. Purchases of government and agency debt at a negative yield are permissible as long as the yield is above the deposit facility rate. We believe that the ECB would keep a yield floor on QE purchases equal to the deposit rate and that the whole yield curve would adjust to a depo rate cut, with only limited implications for the universe of eligible asset purchases.

Q4 – So, why did the ECB change its mind and signal a potential rate cut?

It’s the FX, stupid! For good and bad reasons, the ECB has long become more sensitive to the exchange rate as a key variable to reduce imported deflation. Officially, the exchange rate is “not a policy target”, but this shift in stance has become more visible at various levels, including in the staff forecasts (discussing an alternative path for the EUR and their influence on inflation projections) or in ECB speak, with mounting emphasis on the trade-weighted exchange rate and importance of diverging monetary-policy cycles with the US (a diplomatic way of saying that the ECB is targeting a weaker currency).

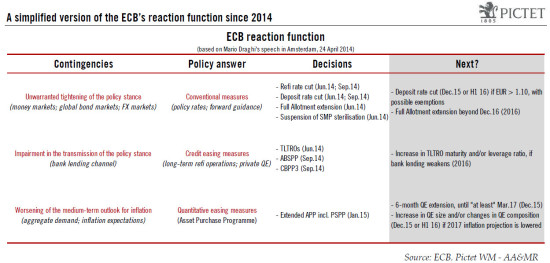

In an important speech in Amsterdam in April 2014, Mario Draghi described what the ECB reaction function looked like, based on three main contingencies (see table below):

- “Unwarranted tightening of the monetary policy stance”, stemming from rising short-term rates, long-term rates, or indeed a stronger currency, should be tackled through more “conventional measures”, i.e. policy rates.

- Further “impairment in the transmission of the monetary policy stance”, in particular via the bank lending channel, should be tackled through credit easing measures, including “a targeted LTRO or an ABS purchase programme” which were both implemented in 2014.

- “Worsening of the medium-term outlook for inflation” should warrant a more broad-based asset-purchase programme, which was announced in January 2015 and implemented in March.

We believe this simple framework still applies, which is why we see the decision to cut the depo rate as largely influenced by developments in FX markets. The ECB is likely to favour QE expansion in order to tackle deterioration in the inflation outlook.

One immediate limitation is that the decision entails a large degree of circularity: once the ECB flags a rate cut, the EUR will depreciate, down to levels that reduce the need for an actual rate cut, although, if the ECB fails to deliver, then the exchange rate will adjust upwards, forcing the ECB’s hand eventually… unless the global environment has changed in the meantime.

Q5 – What factors will drive the ECB’s timing and final decision? What are the likely scenarios for December?

Both QE expansion and a depo rate cut are controversial measures for the most hawkish members of the ECB’s Governing Council. Therefore, there might be a trade-off when it comes to the decision to be made at the 3 December meeting.

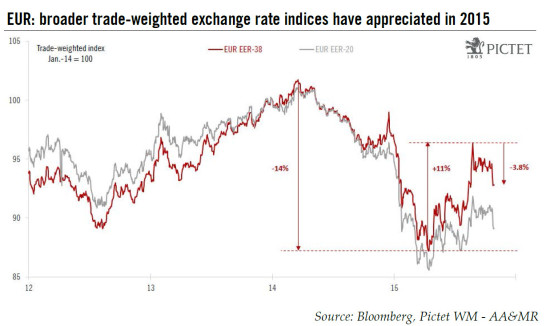

Several factors will come into play but in the end, we believe the ECB will cut the deposit rate by 10bp in December if the EUR/USD still stands above their implicit ‘target’ of 1.10 which was the level assumed in the September staff forecasts. The cut-off date for staff projections is likely to be set around 12 November, with market values left unchanged over the forecast horizon. There will be room for interpretation based on those assumptions since the ECB’s implicit FX target might have been lowered in the past three months and much of the focus has fallen on the trade-weighted exchange rate, including the broader EER-38 index which has appreciated by 6.5% so far in 2015 (see chart below).

Alternatively if the EUR/USD weakens in the run-up to the December meeting, to 1.05 or below, then the ECB is more likely to keep its powder dry and leave the threat of a depo rate cut for later, hoping that the Fed hikes rates in early 2016.

Lastly, if the EUR/USD stands in a 1.05-1.10 range, the decision could be a close one.

Crucially, if and when the ECB delivers, what matters most for markets is what the next move will be – the ECB would be likely to cut the depo rate by 10bp while signalling that further cuts are not ruled out.

Either way, we continue to expect a 6-month QE extension to be announced in December, “until at least March 2017”. A small increase in the monthly pace of asset purchases (from €60bn), a broadening of asset purchases towards corporate bonds or other riskier assets, and some tweaks to QE modalities (departing further from capital keys) are all live options as well. If the ECB does cut rates, then chances are that QE expansion will be less radical in terms of size or composition.

Q6 – Is a deposit rate cut priced in?

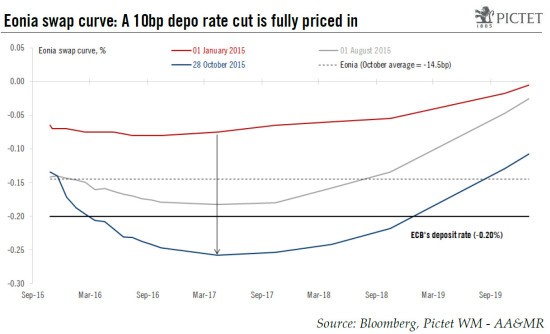

Yes, a depo rate cut has been fully priced in by the rates markets, with some uncertainty about the timing. The Eonia swap curve had shifted downwards even before the ECB opened the door to a rate cut, and the trough for Eonia swaps currently stands at around -25bp in early 2017. This would imply a 5bp spread with a deposit rate at -0.30%, for instance, the tightest ever. Several assumptions have to be made in terms of the rates corridor and excess liquidity (hence, in terms of asset purchases), but, overall, the probability of a 10bp cut is close to 100%, with a possibility of the market pricing in several cuts (with a lower probability). Another way to look at it is to use the 2Y yield on German bonds, currently at -0.34%, which has responded to expectations of future changes in the ECB’s depo rate and QE.

Either way, a depo rate cut would no longer have the element of surprise attached to it.

Q7 – If the ECB cuts the depo rate, what happens to the other policy rates?

It is not clear whether the ECB would cut the refi rate in tandem with the depo rate. In the past, the ECB decided to adjust the rates corridor on several occasions, including in May 2013 and November 2013 once the depo rate reached 0% and the refi rate was cut further. For almost two years now, the rates corridor has been set at ±25bp around the refi rate.

A 10bp parallel shift in the rates corridor would leave the refi rate at -0.05%, implying that commercial banks would get remunerated for borrowing cash from the ECB (against collateral). The ECB may not feel comfortable with this state of affairs. Interbank lending volumes, however, have remained sensitive to the width of the rates corridor as a function of liquidity transformation and opportunity. In other words, it is not so much the absolute level of negative rates that matters for interbank dealers as the relative levels of deposit versus marginal lending rates.

As a consequence, the ECB could leave the refi rate unchanged at 0.05% or, alternatively, it could choose an intermediate option consisting in a 10bp cut in the deposit rate combined with a 5bp cut in the refi rate (to 0%), resulting in a 5bp widening of the corridor, hoping to mitigate potential adverse effects on interbank lending. The question of the refi rate becoming negative would persist in the event of the ECB leaving the door open to further cuts.

The question of the marginal lending rate is less problematic as the facility has barely been used in the last three years – it is likely to be reduced in a way that keeps the rates corridor symmetrical around the refi rate.

Q8 – What about the rate on the TLTROs?

The ECB’s Targeted Longer-Term Refinancing Operations (TLTROs) have been conducted at a fixed rate set equal to the refi rate, or 0.05% at present. Some 10bp were initially added over the refi rate, but eliminated for the TLTROs to be conducted between March 2015 and June 2016.

A more negative deposit rate will act as a disincentive for cash-rich banks to borrow at upcoming TLTROs. The ECB could, therefore, make TLTRO terms more favourable by lowering their rate further (in the event of the refi rate not being cut), extending their maturity (beyond September 2018), or increasing the leverage ratio applied to banks’ lending benchmark to determine their TLTRO allowances (currently x3).

Q9 – How could the ECB mitigate the adverse effects of a depo rate cut?

As we wrote in an earlier note, difficulties coming with a deposit rate cut are not insurmountable, yet nor are they negligible either, so the ECB could opt for mitigating measures to limit collateral damage on the financial system. In particular, the money market funds (MMF) industry has managed to deal with negative rates so far without changing its business model, according to an ECB study, although the environment remains highly challenging, and there might be threshold effects when and if Eonia drops below -20bp. On the bright side, the relevance of MMFs for the financing of the euro area economy has diminished as other funding sources have developed inside and outside the region. Still, other disruptions could prove hard to manage, including in the all-important repo markets.

If the ECB needs to deliver a rate cut nonetheless, it could find new ways to mitigate collateral damage on the financial system. In particular, it could decide to apply the lower deposit rate only to a certain proportion of (excess) bank reserves, contrary to what was decided when negative rates were initially introduced. Other central banks, including in Denmark and Switzerland, are managing liquidity and short-term rates based on such a system of banks’ current account limits. The problem with this solution is that it would be likely to reduce the intended effect of the rate cut.

Q10 – What are the consequences for other European central banks?

If the ECB cuts rates, other central banks are likely to remain under pressure to respond, especially if the ECB signals the ZLB has not been reached.

In Switzerland, the Swiss National Bank (SNB) abandoned the CHF1.20 per euro currency ceiling in early January 2015. At the same time, to avoid the Swiss franc appreciating, the SNB lowered the interest rate on sight deposit account balances. The interest rate on sight deposits was lowered by 50bp to ‑0.75%, and the target range for the 3-month Libor was moved deeper into negative territory between -1.25% and -0.25%, from -0.75% and 0.25%. The negative interest is only charged on a portion of the sight deposit account balance that exceeds a certain threshold (exemption threshold). For individuals, the exemption threshold is fixed at CHF10m. For domestic banks, the threshold corresponds to 20 times the minimum reserve requirement minus any increase/decrease in the amount of cash held. For foreign banks, the SNB sets a fixed threshold. The Central Federal Administration, compensation funds for old-age and survivors’ insurance, disability insurance and the fund for loss of earned income are exempt from negative interest.

Meanwhile, the SNB has continued its currency intervention to stabilise the franc against the euro, albeit on a much smaller scale than before. A depo rate cut by the ECB will exert further pressure on the SNB. In response, the SNB would likely cut its interest rate on sight deposits further. Another possibility would be to modify the minimum reserve threshold, although this solution looks less likely than a rate cut as the impact on CHF is lower. In parallel, SNB currency interventions are likely to continue as well.

In Denmark, Danmarks Nationalbank (DNB) has cut rates in response to euro depreciation as the central bank’s goal has been to maintain a fixed exchange rate for the Danish krone (DKK), or peg, vis-à-vis the euro. The rate on DNB certificates of deposit has been reduced to -0.75% while the main current account rate, applied to bank deposits below a defined limit, has been left unchanged at 0% since 2012. The current account limit itself, or exemption, has been raised several times in the past few years. Meanwhile, the central bank has intervened heavily in foreign-exchange markets to stabilise the DKK against the euro, leading to a strong increase in FX reserves and downward pressures on overnight interest rates which have hovered around zero with episodes of negative readings. From a macro perspective, the effects of negative rates have been mixed at best.

Assuming the euro depreciates further as a result of ECB action, it is likely Danmarks Nationalbank would have to cut the rate on certificates of deposit in response to the ECB cutting its depo rate, probably by the same amount (10bp).

In Sweden, the implications of an ECB depo rate cut on the Riksbank’s decisions are less straightforward. From a broader macro perspective, the Swedish situation looks healthier, as GDP expanded at a solid 1.1% q-o-q (non-annualised) in Q2 and +3.3% y-o-y, domestic demand remains robust, asset prices have been supported, and the outlook for external demand has started to improve. Furthermore, while headline inflation was barely positive in September (+0.1% y-o-y), core CPIF inflation has picked up to 1.8%, in line with the Riksbank’s projections.

The one reason why the Riksbank could be forced to respond to ECB easing is the currency. The Swedish krona (SEK) has depreciated since last year, by a cumulative 10% in trade-weighted terms (around 25% against the dollar and 7% against the euro), which has so far helped offset weaker energy prices to a large extent. However, an ECB rate cut that is not matched by a policy response in Sweden would risk putting renewed upward pressure on the SEK relative to the Riksbank’s projections, eventually forcing the Swedish central bank’s hand. A cut in the Riksbank’s repo and deposit rates, from ‑0.35% and -1.10% respectively, could be decided at the 15 December meeting if the ECB pulls the trigger two weeks before at its 3 December meeting. If so, a rate cut would be combined with the extension in the Riksbank’s government bond purchase programme (QE) that has been announced today, bringing the total to SEK200bn by June 2016. If there was any doubt, today’s statement noted that “the repo rate can be cut further, which is reflected in the repo rate path, and the Riksbank can purchase more securities”.

[1] See, for instance, the recent speech by BoE’s Andrew Haldane on 18 September 2015, “How low can you go?” on the options to overcome the inability to set negative interest rates on currency.