GDP grew by a soft 1.5% q-o-q annualised in Q3, marginally below consensus expectations. Growth was dampened by a sharp drop in the pace of stockbuilding (negative contribution of 1.4 percentage points) and another massive fall in energy-sector investment. US real GDP, curbed by lower stockbuilding, grew by a soft 1.5% in Q3. However, final demand increased by a buoyant 2.8%. Our forecasts for Q4 (+2.6%) and 2016 (+2.4%) remain unchanged. In Q3 2015, US real GDP grew by a soft 1.5% q-o-q annualised, just a fraction below consensus estimates (+1.6%). So far this year, average growth has worked out at 2.0%, marginally slower than the average pace recorded since the US economy bottomed out in Q2 2009 (2.1%). However, as expected, growth rates in most components of demand were actually quite upbeat in the last quarter. The main reason behind the softness of Q3 GDP was a severe slowdown in the pace of stockbuilding (see below). Final demand grew by a buoyant 2.8% in Q3 As widely expected, consumption remained pretty strong, growing by 3.2% q-o-q annualised in Q3 (+3.6% in Q2), and residential investment posted another quarter of solid growth of 6.1% (see table below). Non-residential investment grew more modestly (+2.1%). Investment in equipment was surprisingly solid (+5.3%), but investment in intellectual property increased rather modestly (+1.

Topics:

Bernard Lambert considers the following as important: Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

GDP grew by a soft 1.5% q-o-q annualised in Q3, marginally below consensus expectations. Growth was dampened by a sharp drop in the pace of stockbuilding (negative contribution of 1.4 percentage points) and another massive fall in energy-sector investment.

US real GDP, curbed by lower stockbuilding, grew by a soft 1.5% in Q3. However, final demand increased by a buoyant 2.8%. Our forecasts for Q4 (+2.6%) and 2016 (+2.4%) remain unchanged.

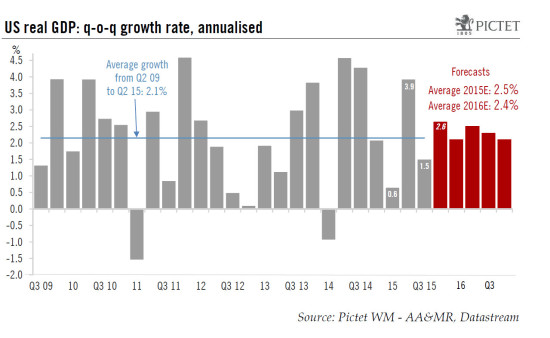

In Q3 2015, US real GDP grew by a soft 1.5% q-o-q annualised, just a fraction below consensus estimates (+1.6%). So far this year, average growth has worked out at 2.0%, marginally slower than the average pace recorded since the US economy bottomed out in Q2 2009 (2.1%).

However, as expected, growth rates in most components of demand were actually quite upbeat in the last quarter. The main reason behind the softness of Q3 GDP was a severe slowdown in the pace of stockbuilding (see below).

Final demand grew by a buoyant 2.8% in Q3

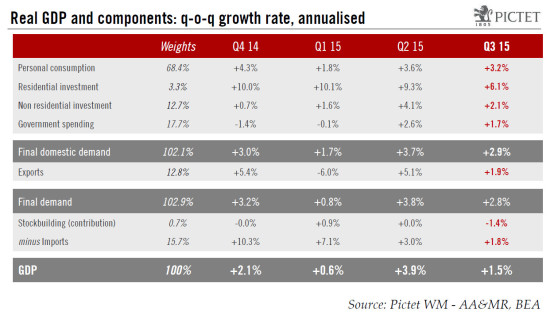

As widely expected, consumption remained pretty strong, growing by 3.2% q-o-q annualised in Q3 (+3.6% in Q2), and residential investment posted another quarter of solid growth of 6.1% (see table below). Non-residential investment grew more modestly (+2.1%). Investment in equipment was surprisingly solid (+5.3%), but investment in intellectual property increased rather modestly (+1.8%) whereas investment in structures surprised with a sharp contraction (-4.0%). A much slower decline in the number of rigs in operation last quarter had been pointing to a parallel movement for investment in structures in the oil sector, but that still plunged surprisingly steeply: -47.1% q-o-q annualised in Q3, after -67.9% in Q2. Investment in structures in the oil sector may have represented only 0.5% of GDP in Q2 2015, but its negative contribution to annualised q-o-q GDP growth in Q3 worked out at a still hefty -0.3 percentage points (after -0.7% points in Q2 and -0.5 points in Q1). The drag on growth from this specific component eased in Q3, but by less than expected.

Meanwhile, government consumption grew by 1.7% q-o-q annualised in Q3, following on from +2.6% in Q2 and two consecutive quarters of contraction in Q4 2014 and Q1 2015 (see table above).

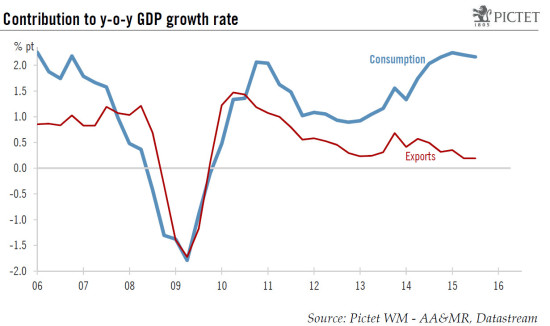

In the aftermath of very downbeat August trade data, there were plenty of fears about Q3 exports. However, the advanced trade report for September, published yesterday, revealed a sharp m-o-m rebound in exports (and monthly fall in imports). The result was that total exports managed to rise by 1.9% q-o-q annualised in Q3. Nevertheless, hit by the firmer dollar and soft worldwide growth, export growth has weakened markedly so far this year. Between Q4 2014 and Q3 2015, exports almost stagnated (+0.2% annualised).

The end-result of all the above is that final demand grew by a robust 2.8% q-o-q annualised in Q3, following an even stronger 3.8% in Q2.

However, after a marked upturn in H1, the pace of stockbuilding fell back from 0.7% of GDP in Q2 2015 to 0.35% in Q3, a ratio now slightly below the long-term average of 0.4%. As a corollary, stockbuilding made a decidedly negative contribution to GDP growth in Q3 (-1.4 percentage points; see table above).

Healthy, but unspectacular, growth likely in 2016

Although the few economic data available for October have not been particularly encouraging overall, we remain relatively optimistic about economic growth in Q4. Admittedly, the manufacturing sector should remain quite weak, and net exports will continue to constitute a marked drag. However, another sharp negative contribution from stockbuilding looks very unlikely, the still sizeable negative drag coming from investment in the oil sector should recede further and, after the steep fall in gasoline prices recorded so far in H2 2015, consumption growth should remain quite solid.

As a result, our forecast that GDP will grow by 2.6% q-o-q annualised in Q4 remains unchanged.

Turning our eyes to 2016, the analysis looks challenging. On the one side, the dollar’s sharp increase will continue to weigh heavily on economic growth. Admittedly, most of the dollar’s rise is probably behind us, but time lags between exchange rate movements and their maximum impact on the economy are relatively long. Moreover, we expect the real trade-weighted dollar to appreciate by an extra 3%-4% over the coming year or so. All this means that the peak for the drag coming from the stronger dollar will probably not occur before Q3 2016 and, on a yearly average basis, the drag will probably reach some 0.5 of a percentage point next year.

On the other side, we expect world growth to recover progressively over the coming year, and we remain quite sanguine about the US domestic economy:

(1) The recovery in the housing market is alive and kicking.

(2) With investment in the oil sector likely to stabilise, non-residential investment should grow more robustly next year.

(3) Public spending is at last growing more solidly, and the upturn should continue. On that front, the fact that the political deal just concluded on the debt ceiling includes a plan to raise spending caps for the next two years is a welcome plus.

(4) Consumption growth should remain robust next year. Admittedly, this year, support coming from the fall in oil prices will not be repeated next year. However, the pace of job creation should remain healthy overall, consumer confidence is high (though volatile), house prices have continued to rise, and some upturn in wage increases seems likely in 2016.

In conclusion, we continue to expect healthy, though unspectacular, growth in 2016. On a yearly average basis, our forecast is unchanged at 2.4% (after 2.5% in 2015).

The October FOMC statement published yesterday sounded more hawkish than expected. The Fed did its best to convince markets that the door was still open for a December hike. Tomorrow, we will write more on this subject. We will also comment on forthcoming Q3 wage data.