After a long period when market volatility was relatively subdued, it has risen sharply this year. The Vix, a widely used measure of equity-market volatility, was in a systemic risk regime for 15 days this year, compared with just two days in 2014 and none at all in 2013, as shown by the chart below. This year’s experience of volatility is still not extensive in a historical comparison, but it still represents a marked change from very subdued conditions in the previous two years. What...

Read More »US ISM surveys: marked contrast between activity in manufacturing and services

The ISM indices are diverging quite noticeably. The Manufacturing index fell to almost 50% in September, whereas its Non-Manufacturing counterpart – though steeply down m-o-m in September – remained pitched at much higher levels. Taken together, they point towards economic growth running above 3.5% in Q3. We continue to expect healthy growth in H2 2015 and 2016. The US economy is currently being confronted simultaneously with strong negative forces (much firmer dollar; weak foreign...

Read More »US employment: a clearly disappointing report

We revise down our GDP growth forecasts from 2.5% to 2.2% for Q3, and from 2.9% to 2.6% for Q4. Our forecast for 2015 remains unchanged at 2.5% whilst our forecast for 2016 is mechanically cut from 2.5% to 2.4%. September’s report was weak on all fronts. Job creation came in below expectations, numbers for previous months were revised down, wages were flat m-o-m and the proxy for household wage incomes fell m-o-m. We now believe the most likely scenario is for the Fed to wait till March...

Read More »Hedge funds: the added value of long/short equity

Macroview Long/short equity managers demonstrate positive alpha generation and protect on the downside as markets succumb to China-led global deflation fears. The end of the summer proved rather turbulent when China weakness caused global markets to freefall. Whilst equities worldwide nosedived, long/short equity managers trimmed their exposures only marginally and took advantage of the sell-off to add to core positions or adapt their short books, outperforming markets in relative terms....

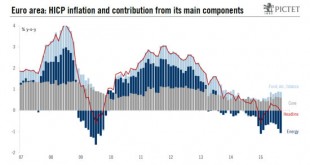

Read More »Euro area: Inflation turns negative in September

– It’s the energy, stupid! The euro area HICP ‘flash’ estimate fell, almost entirely due to the recent drop in commodity prices. But core HICP inflation remained unchanged. The ‘flash’ estimate of euro area Harmonised Index of Consumer Prices (HICP) confirmed what most economists, including at the European Central Bank (ECB), were expecting after the renewed fall in commodity prices over the summer, namely that inflation turned negative again in September. Having reached a trough at -0.6%...

Read More »United States: consumption growth stronger than expected so far in Q3

Today’s data on August’s consumer spending were strong, and data for the previous months were revised up. We now expect consumption growth to reach some 3.3% in Q3 and remain robust thereafter. Consumption growth above expectations in August August data on household consumption and income were published today. Real consumption rose by a strong 0.4% m-o-m in August, slightly above consensus estimates (+0.3%). Already published data on retail sales and car sales for August had been quite...

Read More »Equities: storm raging on the markets

Fears about the slowdown in China unleashed a wave of panic through the markets. The authorities in Beijing probably did not think the change in the way the exchange rate was fixed would detonate such an explosive correction on financial markets. The Shanghai Composite tumbled almost 27% in the week after that decision. It had already fallen 22% prior to that since mid-June. In China’s slipstream, the S&P 500 fell by 11%, the Stoxx Europe 600 by 15% and the Topix by 13% in local...

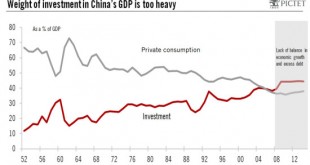

Read More »Exports slump as China rebalances

In the wake of China's slowdown, emerging markets have become a source of concern for investors. As China’s economy slows, exports by its trading partners have slumped, adding to concerns about the outlook for the global economy and for emerging markets in particular. Moreover, this comes on top of a structural slowdown in world trade growth, which has been sluggish in recent years. Exports from South Korea dropped by 14.7% y-o-y in August, their sharpest fall since 2009. China accounts for...

Read More »China shaking, but global economy holding firm

The slide recorded by Chinese leading indicators has ignited fears of a severe slowdown in the making. Nevertheless, the Beijing authorities still have plenty of firepower to hand to counter deflationary threats. China may be giving rise to much concern, but growth in the world economy is still being driven by the quickening US economy and the, admittedly, gentler acceleration in Europe. China’s authorities have a target for economic growth of around 6.5%. To offset the threat of a...

Read More »Despite concerns about China, the global economy remains on track

It has been a turbulent end to the summer for financial markets. The renewed market sell-off in China has reverberated across markets globally, as it amplified concerns, following the recent devaluation of the yuan, about the outlook for economic growth in China. We view recent developments on Chinese markets as a sharp correction rather than the start of a long-term bear market. In the meantime, the economic recovery in the US and the euro area continues to gain traction. Recent...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org