Whatever the ECB does in the coming months, this threat of “low-flation for ever” is likely to keep the central bank under pressure The euro area HICP flash estimate rebounded to zero in October, or +0.04% y-o-y, after -0.08% in the previous month, as negative energy-related base effects diminished. Looking at HICP components, energy inflation continued to drag the headline rate down, rising only slightly from -8.9% to -8.7% y-o-y as Brent oil prices more or less stabilised in euro terms (but retail gasoline prices fell further) although negative base effects started to diminish (as the effect of last year’s fall in oil prices is gradually dropping out of y-o-y rates). The good news came from core HICP inflation (excluding energy, food, alcohol and tobacco) which rose from 0.88% to +0.99% y-o-y in October. Services inflation rose from 1.24% to 1.32%, its highest level in 18 months, while non-energy industrial goods inflation – the HICP component most sensitive to exchange rate fluctuations – rose from 0.28% to 0.45% in October. We view those developments as the combined result of a resilient domestic economy and the lagged effect of past euro depreciation.

Topics:

Perspectives Pictet considers the following as important: Macroview, Uncategorized

This could be interesting, too:

Claudio Grass writes The Case Against Fordism

Claudio Grass writes “Does The West Have Any Hope? What Can We All Do?”

Claudio Grass writes Predictions vs. Convictions

Claudio Grass writes Swissgrams: the natural progression of the Krugerrand in the digital age

Whatever the ECB does in the coming months, this threat of “low-flation for ever” is likely to keep the central bank under pressure

The euro area HICP flash estimate rebounded to zero in October, or +0.04% y-o-y, after -0.08% in the previous month, as negative energy-related base effects diminished. Looking at HICP components, energy inflation continued to drag the headline rate down, rising only slightly from -8.9% to -8.7% y-o-y as Brent oil prices more or less stabilised in euro terms (but retail gasoline prices fell further) although negative base effects started to diminish (as the effect of last year’s fall in oil prices is gradually dropping out of y-o-y rates).

The good news came from core HICP inflation (excluding energy, food, alcohol and tobacco) which rose from 0.88% to +0.99% y-o-y in October. Services inflation rose from 1.24% to 1.32%, its highest level in 18 months, while non-energy industrial goods inflation – the HICP component most sensitive to exchange rate fluctuations – rose from 0.28% to 0.45% in October. We view those developments as the combined result of a resilient domestic economy and the lagged effect of past euro depreciation.

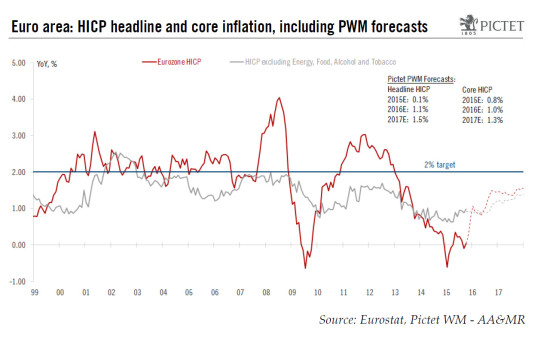

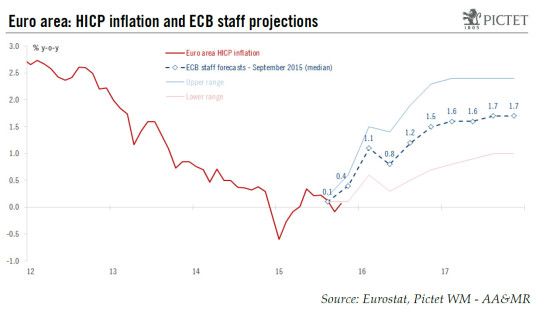

Euro area inflation looks set to rise much faster in the coming few months, to above 1% in January 2016 as per our (and ECB staff) forecasts, assuming oil prices rise by up to $5 per barrel and the EUR/USD depreciates slightly to below 1.10, on the back of even stronger base effects. Looking ahead, however, we suspect that consumer prices will rise only gradually and we forecast inflation to average 1.1% in 2016 and 1.5% in 2017, with downside risks (versus 1.1% and 1.7%, respectively, in the ECB staff projections).

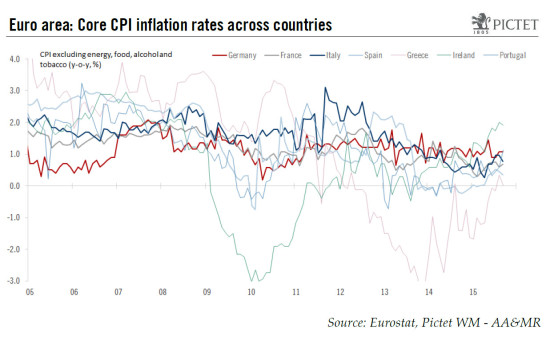

The rebound in consumer prices in October was fairly broadly based across countries. HICP inflation rose by 0.4pp in Germany (to +0.2% y-o-y), by 0.2pp in Spain (to -0.9% y-o-y) and by 0.1pp in Italy (to +0.3% y-o-y). Looking at core inflation rates, there has been some re-convergence among countries, including in most peripheral countries where core inflation has returned to positive territory.

Beyond the strong bump we are looking for in the next few months, we agree with the ECB’s assessment that downside risks to the inflation outlook persist, which is the main reason why we continue to expect further easing at the 3 December meeting (see our ECB reaction piece and our Q&A on negative rates). Headwinds to consumer prices, including a large output gap and the unemployment gap, will continue to dominate tailwinds, including the lagged effect of euro depreciation. We currently forecast euro area HICP inflation to average 0.1% in 2015, 1.1% in 2016, and 1.5% in 2017, with downside risks.

However, it may take some time before these downside risks materialise. We expect the ECB staff projection for 2017 HICP (currently at 1.7%) to be revised only marginally at the next policy meeting, to 1.6%, but eventually the ECB could be disappointed again in the course of next year if inflation indeed fails to accelerate much beyond a Q1 2016 bump.

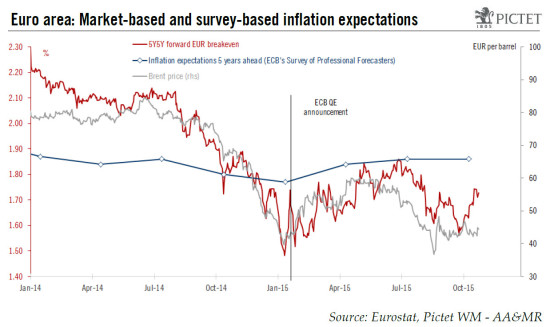

Only in late 2016 and into 2017 do we envisage a more convincing pick-up in inflation although, even then, reaching the 2% will remain challenging. The biggest risk to the inflation outlook over the medium term remains a permanent disanchoring of inflation expectations that would result in a self-reinforcing and protracted period of below-target inflation as households and businesses adjust their behaviour and pricing power accordingly. So far, this risk has not materialised. Long-term inflation expectation from surveys have stabilised, at 1.86% for instance in the ECB’s Survey of Professional Forecasters, while market-based measures of inflation expectations have managed to disconnect a little from oil prices of late (see chart below).

Whatever the ECB does in the coming months, this threat of “low-flation for ever” is likely to keep the central bank under pressure for the foreseeable future, unless the economic outlook improves much more from here.