Growth investing has been very profitable in the US equity market since 2009, outperforming Value investing by 55% since April 2009. A great period for Growth investing Since equity markets bottomed out in March 2009, the Growth style (as measured, for the purposes of this Flash Note, by the MSCI US Growth index ) has handsomely outperformed the Value style (MSCI US Value Index). Price-wise, the performance gap worked out at 55% for the period from April 2009 to end-September 2015, its widest for the past 15 years. In this Flash Note, we have investigated the sources for such disparities in performance and assessed whether factors leading to it might be reversing. To some readers, the debate about Value and Growth might sound theoretical, but it has some very practical implications. As GDP and earnings growth rates have been downgraded since the start of the year, Growth investing has attracted a lot of interest. Hence, any change for the better in the global environment could lead to a reversal in the trend established over the last 6 years. The rebound in US equity prices that started in March 2009 has seen a spectacular outperformance by companies whose earnings have been growing at rates above-average compared with those for their industry or the overall market.

Topics:

Alexandre Tavazzi considers the following as important: Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

Growth investing has been very profitable in the US equity market since 2009, outperforming Value investing by 55% since April 2009.

A great period for Growth investing

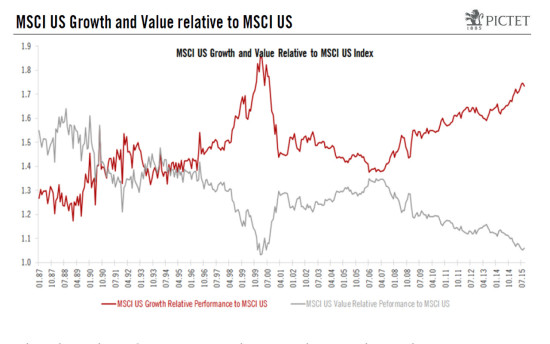

Since equity markets bottomed out in March 2009, the Growth style (as measured, for the purposes of this Flash Note, by the MSCI US Growth index ) has handsomely outperformed the Value style (MSCI US Value Index). Price-wise, the performance gap worked out at 55% for the period from April 2009 to end-September 2015, its widest for the past 15 years. In this Flash Note, we have investigated the sources for such disparities in performance and assessed whether factors leading to it might be reversing. To some readers, the debate about Value and Growth might sound theoretical, but it has some very practical implications. As GDP and earnings growth rates have been downgraded since the start of the year, Growth investing has attracted a lot of interest. Hence, any change for the better in the global environment could lead to a reversal in the trend established over the last 6 years.

The rebound in US equity prices that started in March 2009 has seen a spectacular outperformance by companies whose earnings have been growing at rates above-average compared with those for their industry or the overall market. This outperformance is unmistakable not only relative to the market overall (see the next chart), but even more when measured against companies whose valuation is below the market and where investors look for undervaluation versus long-term fundamentals. From January 2009 to October 2015, the performance gap between the two segments has stretched to 30%, a level last seen when Internet stocks were at their peak.

Justified by fundamentals

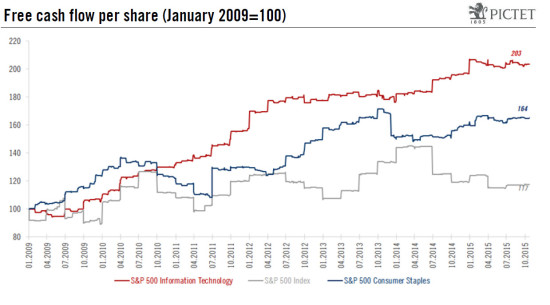

The recovery in the economic environment and equity markets that started in Q1 2009 was heavily influenced by the banking and sovereign-debt crisis and overall sub-par economic growth. Put simply, the upswing was slow and constrained by past excesses. Investors discovered, to their cost, that low valuations were not always indicators of future positive returns, but often a sign of stressed balance sheets (banking stocks) or poor profitability. Growth stocks, for their part, have delivered positive surprises, notably in terms of profit margins and cash flow generation. The best examples are to be found among consumer and technology companies. The US technology sector has been one of the best in terms of free cash flow generated over the last cycle. From 2009 to today, free cash flow (FCF) per share has doubled in the tech sector and has been multiplied by 1.6x in consumer staples. These numbers compare with an increase of just 17% for the S&P 500 over the same period. At the other end of the spectrum, the energy sector has suffered a 92% contraction in its FCF/share. In this last case, it is also worth noting the sector had not been able to improve its generation of cash flow even before oil prices plummeted. So, outperformance in this last cycle can be explained by Growth companies’ higher margins and strong cash flows. This cash generation has allowed US companies to reward shareholders through buybacks and dividends (instead of capital spending) – quite an attractive proposition in a world of very low yields on government bonds. Since 2011, US companies have returned around 4% of their market cap to shareholders. As a result, investors’ concentration on Growth stocks has been very rational.

Consensus trades and high valuations

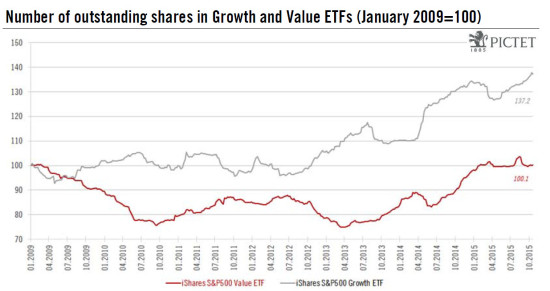

Five years of Growth outperformance have led to investor concentration and wide valuation differences. As a corollary, the number of shares issued by the iShares US Growth ETF has expanded by 37% from January 2009 to today, whereas the number of outstanding shares for the Value ETF has been unchanged – a clear indication of the concentration of trading.

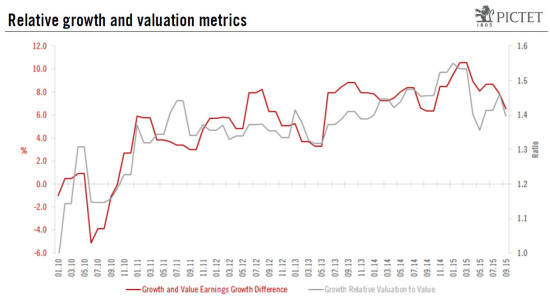

Valuations-wise, the MSCI US Growth index is currently trading at 23x historical EPS vs 16x for the MSCI US Value and 19x for the MSCI US. Growth’s 43% valuation premium over Value is the second highest for this cycle, second only to the 55% reached in Q1 2015. Such a premium could be justified by a wide differential in earnings growth, but recent data are tending to point in the opposite direction. The year-on-year EPS growth difference between the two segments peaked at 10.5% in March 2015 and has shrunk to no more than 6.5% at present. So, an investment strategy concentrated on Growth stocks is looking a lot less attractive today in light of the current high valuation premium, but weakening relative earnings momentum. Moreover, the already high concentration of investors in Growth-replicating strategies (particularly since 2012) could be a tell-tale signs of overcrowded positions.

Conclusion

The investment landscape has been quite specific since 2009 as investors had to adapt to quite a challenging environment. Over that period, investors have rewarded the production of cash flow (and its return to them) with remarkable consistency. This production has been the trademark of Growth companies, justifying why the Growth style has been outperforming.

This phase now looks to us to be gradually coming to an end, as the growth spread shrinks at a time when the valuation premium is close to its peak. We, therefore, believe that a barbell strategy is increasingly appropriate as a response to this phase, particularly as Value earnings momentum hit a bottom in February this year and will enjoy the benefit of easier year-to-year comparisons in 2016. Last, but not least, as the Value space has been a lot less popular among investors, its supply/demand situation is more conducive.