The easing package delivered by the ECB at its 3 December policy meeting fell short of market expectations. However, the new measures are still likely to boost the on-going recovery. The ECB’s President Mario Draghi was under a great deal of pressure not to disappoint today. In the end, the ECB delivered a policy package that was largely in line with our baseline, but fell short of (extremely high) expectations. However, we would not get carried away by short-term market disappointment....

Read More »Chinese yuan gains in stature after IMF’s seal of approval

Given the persistent disinflationary pressures in China, monetary policy divergence lends itself to a gradual depreciation of the Chinese yuan against the greenback in 2016 towards 6.70 yuan per US dollar. On 30 November, the International Monetary Fund (IMF) officially decided to make the Chinese yuan (also called renminbi) the fifth sovereign currency in the Special Drawing Right (SDR), joining the US dollar, the euro, the British pound and the Japanese yen in this prestigious basket....

Read More »Switzerland: growth stagnating, but likely to accelerate in 2016

We expect Swiss real GDP growth to slightly pick up from an estimated 0.7% for 2015 to 1.1% in 2016. According to SECO’s estimate, Swiss real GDP stagnated q-o-q in Q3 (-0.1% q-o-q annualised; 0.8% y-o-y), below consensus expectations (0.2%). It came after GDP growth of 0.2% q-o-q in Q2 and a downwardly revised Q1 figure of -0.3% q-o-q. Although we cannot say that the Swiss economy is in a technical recession, it is worth highlighting that the economy is 0.1% below its level in Q4 2014...

Read More »Last call before easing: the ECB needs to surprise while saving ammunition for 2016

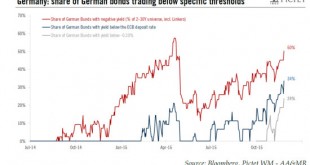

Among its various options, we believe that the ECB would have to cut the deposit rate by at least 20bp to surprise the market. We have laid out our baseline scenario for this week’s ECB policy meeting, including a 10bp deposit rate cut, a 6-month QE extension and a possible broadening of the scope of asset purchases. Recent ECB rhetoric suggests that risks are tilted towards a more aggressive policy package. It would not be the first time that Mario Draghi over-delivers, although this time...

Read More »Japan: a year of normalisation – still appealing, but risk-reward is not as good as before

Our 2016 scenario reaffirmed our preference for developed equities over emerging equities. Overall our total return expectation in Japan is similar to expectations in the US and Europe in a 7%-10% range. A number of concerns hang over the outlook for Japanese equities in 2016. The first phase of Abenomics had only mixed success, and plans for the second phase are still vague. Although there are some encouraging signs, the economy’s trajectory remains weak. Earnings have been resilient,...

Read More »Euro area: strong rebound in bank credit flows in October, with more to come

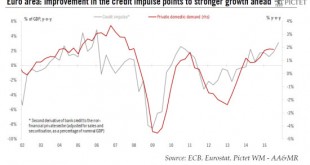

Further loosening of broad monetary and financial conditions likely, adding to upside risks to the outlook for growth. We were looking for a rebound in euro area bank credit flows in October following a large and unexpected decline in September, largely due to a collapse in lending to non-financial corporations in the Netherlands. In the end, bank lending to the non-financial private sector did recover quite strongly in October and we continue to believe that the credit cycle has legs, in...

Read More »Business surveys in the euro area: solid growth in services sector

November’s upside surprises in surveys (PMI and IFO in particular) are unlikely to dissuade ECB policymakers that more needs to be done at their December 3 meeting. November’s euro area business surveys highlighted that the recovery continues to be largely led by domestic strength. In terms of countries, German surveys (PMI, IFO) surprised on the upside, whereas in France, surveys (PMI, INSEE) were less upbeat than in the previous month, partly reflecting the loss of confidence after the...

Read More »2016 macroeconomic and strategic alternative scenarios

Macroview Last week, on November 18th, we published our key takeaways for our 2016 macroeconomic and strategic scenario. In the following post, we feature the conditions under which two alternative scenarios for 2016 , one positive and one negative, could materialize. Please see our “Macroeconomic and Strategic Scenario for 2016: Key takeaways” post for a detailed overview. Upside risks for a positive alternative scenario Greater acceleration of economic growth in Europe, driven by...

Read More »Secular outlook for the global economy and financial markets: key takeaways

Macroview There is an ongoing debate about whether the world is facing secular stagnation and deflation. In the inflation/deflation debate, we are in the deflationist camp. If economic mechanisms are left unchecked, deflationary forces will rise. DM central banks will struggle to hit their 2% inflation targets. The inflation targeting monetary policy style of the 1990s and early 2000s was followed by the quantitative easing (QE) style after the 2008-11 US subprime and euro area debt...

Read More »US monetary policy: a December hike remains the most likely scenario

The minutes of October’s FOMC meeting confirmed that a December hike is firmly on the table. Although monetary conditions have tightened noticeably so far in November, the most likely scenario remains that the Fed will hike rates in December. Conditions for a hike “could well be met” in December The FOMC statement published after the 27-28 October meeting has sounded more hawkish than expected, as it put a December hike more firmly on the table. The minutes of this same meeting,...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org