The ECB’s increasingly dovish tone continues to support our expectation of a 6-month QE extension to be announced at the 3 December meeting. Mario Draghi was unsurprisingly dovish at today’s policy meeting, bearing our view that more monetary easing is in the pipeline, effectively signalling a move at the 3 December meeting. By saying that “the degree of monetary policy accommodation will need to be re-examined in December” and that the ECB was not in “wait-and-see” but in “work-and-assess”...

Read More »Financial markets likely to rebound further

Macroview Economic cycles are desynchronised; monetary policies are also desynchronised and noncooperative; corporate earnings have been downgraded; and uncertainty has compressed valuation ratios. Concerns about China’s slowdown and the Fed’s impending interest rate rise have loomed especially large. The result has been volatile and shaky markets. However, the recent market correction has been driven by perceptions rather than reality. Economic fundamentals have not deteriorated and,...

Read More »Euro area: banking on stronger credit flows to boost investment

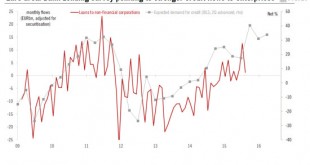

The ECB’s October Bank Lending Survey reveals a sixtieth consecutive quarter of net easing of credit conditions and a further increase in credit demand. The ECB’s October Bank Lending Survey (BLS), conducted between 15 and 30 September 2015 and released today, revealed a sixtieth consecutive quarter of net easing of credit conditions as well as a further increase in demand for loans to non-financial corporations. Moreover, forward-looking BLS indicators pointed towards banks expecting to...

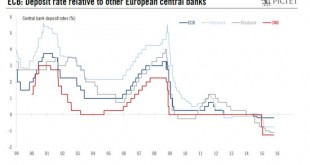

Read More »The ECB still has options to weigh on the currency

The least bad option for the ECB could just be to leave the threat of lower rates hanging in the air while hoping that actually delivering on the threat might not be needed. With a few exceptions, the recent history of ECB easing has been marked by episodes of lengthy bouts of verbal interventions, preparing the ground for actual decisions once a consensus has been reached. Several reasons can be found for the ECB’s slow responsiveness to changes in the macro-financial environment,...

Read More »United States: core inflation likely to remain relatively stable

We believe that y-o-y core CPI inflation will remain relatively stable over the coming 6-9 months. Year-on-year headline inflation fell back to zero in September, but core inflation inched up from +1.8% in August to +1.9% in September. The slack in the labour market is diminishing rapidly, and deflation is not really posing a risk in the US. However, with a higher dollar and inflation low worldwide, we believe core inflation will remain relatively stable over the coming months. The...

Read More »United States: soft retail sales report, but robust consumption overall in Q3

Today’s retail sales report was disappointing. Nevertheless, overall consumption growth is likely to have topped 3.0% q-o-q annualised in Q3, and we remain optimistic about future consumption growth. Nominal total retail sales increased by a modest 0.1% m-o-m in September, slightly below consensus expectations (+0.2%). Moreover, August’s number was revised down from +0.2% to 0.0%. As widely expected, total sales were dented by a massive (-3.2%) m-o-m fall in nominal sales at gasoline...

Read More »Euro area: Industrial production struggling to gain momentum

We are leaving unchanged our euro area real GDP growth forecast of 1.5% for 2015 as a whole. In the euro area, industrial production (excluding construction) dropped by 0.5% m-o-m in August, in line with consensus expectations (0.5%). The July figure was revised marginally up by 0.2 percentage points to 0.8% m-o-m. However, despite August’s decrease, industry is still likely to have fared better in Q3 (+0.3% q-o-q for July-August as a whole) than it did in Q2, when production fell by...

Read More »Currencies: dollar throwing off Fed shackles

The Fed decided not to hike the Fed funds rate in September, but this did not hurt the dollar unduly. Even though the Fed decided against lifting the Fed funds rate in September, the US dollar did not really struggle much. The reason for this lies with the ECB which had overtly declared on 3 September its readiness to press ahead with further quantitative easing, a statement that dented the euro’s appeal. Moreover, too steep a rise in the yen’s value would have a particularly unwelcome...

Read More »Precious metals: the “VW Effect”

The scandal that has engulfed the VW Group had a big impact on both platinum and palladium as both metals are used in catalytic converters in vehicles. VW’s deceptive practices as regards the real level of nitrogen oxide (NOx) emissions from its diesel vehicles have highlighted the un-ecofriendly features of diesel-powered cars, which can be expected to hit demand. It is also likely to boost the chances of stricter environmental standards on NOx exhaust emissions being pushed through in...

Read More »Equities: the correction rumbles on

Macroview Fears about economic growth have been spreading from China to other markets. “Just where is global growth heading?” seems to be the question uppermost in every investor’s mind. With no clear answers forthcoming to that question, the corrective spell on risk assets ran on through September, dragging all equity markets into the red zone. How steep the slides were can be traced to concerns to the fore at the moment. Markets reliant on demand from China tumbled: Latin America down...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org