Our GDP growth forecasts for Q4 (+2.6%) and 2016 (+2.4% on a yearly average basis) remain unchanged. The ISM indices continue to diverge quite markedly. The Manufacturing index ticked down to almost 50% in October, whereas its Non-Manufacturing counterpart bounced back sharply, reaching its second highest reading in a decade. Taken together, they point towards economic growth running at around 3.8% in October. We continue to expect GDP growth to settle at 2.6% in Q4. ISM Manufacturing index stabilised a touch above 50 points The ISM Manufacturing survey for October 2015 was published on Monday. The headline reading more or less stabilised, as it ticked down from 50.2 in September to 50.1 in October, slightly above consensus expectations (50.0). Nevertheless, this yardstick reached its lowest level since May 2013. As things stand, the Markit Manufacturing PMI (reflecting results from the other main survey on manufacturing activity) remains well above its ISM counterpart; indeed, it picked up modestly from 53.1 in September to 54.1 in October (see chart below). The details of the ISM report were mixed. On the one hand, the Employment sub-index fell heavily from 50.5 in September to 47.6 in October, its lowest level in more than six years. On the other hand, though, the Production sub-index rose by 1.1 points m-o-m to 52.9, whilst the New Orders sub-index regained 2.

Topics:

Bernard Lambert considers the following as important: Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

Our GDP growth forecasts for Q4 (+2.6%) and 2016 (+2.4% on a yearly average basis) remain unchanged.

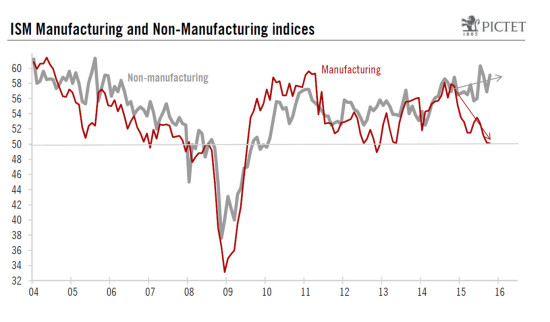

The ISM indices continue to diverge quite markedly. The Manufacturing index ticked down to almost 50% in October, whereas its Non-Manufacturing counterpart bounced back sharply, reaching its second highest reading in a decade. Taken together, they point towards economic growth running at around 3.8% in October. We continue to expect GDP growth to settle at 2.6% in Q4.

ISM Manufacturing index stabilised a touch above 50 points

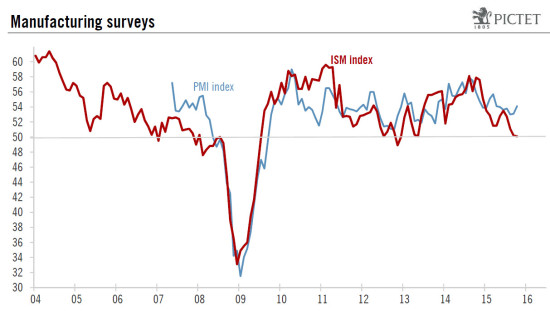

The ISM Manufacturing survey for October 2015 was published on Monday. The headline reading more or less stabilised, as it ticked down from 50.2 in September to 50.1 in October, slightly above consensus expectations (50.0). Nevertheless, this yardstick reached its lowest level since May 2013.

As things stand, the Markit Manufacturing PMI (reflecting results from the other main survey on manufacturing activity) remains well above its ISM counterpart; indeed, it picked up modestly from 53.1 in September to 54.1 in October (see chart below).

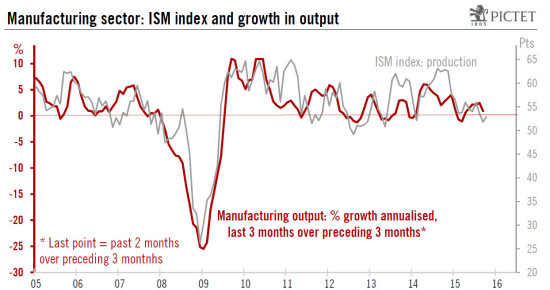

The details of the ISM report were mixed. On the one hand, the Employment sub-index fell heavily from 50.5 in September to 47.6 in October, its lowest level in more than six years. On the other hand, though, the Production sub-index rose by 1.1 points m-o-m to 52.9, whilst the New Orders sub-index regained 2.8 points to reach 52.9 as well. This latter index is reckoned to be the most forward-looking component of the survey.

In any event, as we have noticed repeatedly, the combined effect of lower oil prices, soft foreign demand and a higher dollar was – and will over the coming months continue to be – a clear, sharp negative factor for the manufacturing sector, which is much more dependent on exports and the oil-extraction sector than the whole services-oriented economy. Moreover, a downward correction in inventories has probably amplified the downturn in manufacturing activity over the past few months. Fortunately, the manufacturing sector represents only some 12% of the overall US economy.

ISM Non-Manufacturing index bounced back sharply

The ISM Non-Manufacturing survey was published yesterday. Unlike its Manufacturing counterpart, the composite Non-Manufacturing index remained at quite elevated levels. Admittedly, it did drop back sharply from 60.3 in July to 59.0 in August and 56.9 in September, but this was followed by a marked rebound to 59.1 in October, well above consensus expectations (56.5). With the exception of last July, October’s reading is at its highest level in a decade.

Last month’s sharp rebound was broad-based. Most sub-indices printed marked monthly increases. This was notably the case for the New Orders sub-index, which bounced back from 56.7 in September to 62.0 in October.

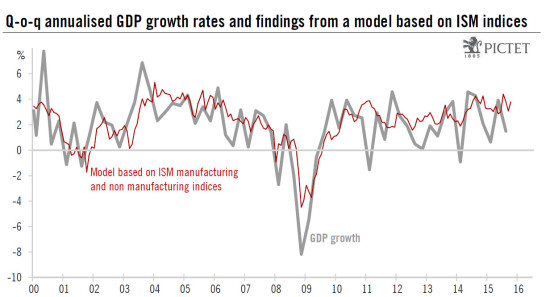

Taken together, the two ISM composite indices suggest that overall economic growth has been quite robust so far in Q4. If we use historical correspondence to try to calibrate what the ISM indices are pointing towards in terms of GDP growth (see chart below), we arrive at 3.8% in October following an average reading of 3.8% as well in Q3 (3.1% in September) and 3.1% in Q2. The ISM surveys, therefore, suggest the economy has expanded robustly so far in Q4. Nevertheless, although ISM surveys are timely and useful indicators of the strength in the economy, they are not very reliable at forecasting GDP growth in the short run. Indeed, as we have seen above, ISM indices had been pointing to 3.8% GDP growth in Q3 2015 whereas the estimate published last week for this was 1.5%.

This notwithstanding, the high level recorded by the Non-Manufacturing index in October is quite encouraging for the economy in Q4. It is also worth noting that most statistics published over the past few days (car sales, construction spending, trade balance and ADP employment) have also been quite upbeat. This was notably the case for car sales, which unexpectedly rose by 0.4% m-o-m in October to a new cycle-high of 18.2 million units (annualised). Following sharp monthly increases over Q3, a downward correction was expected in October. Consensus estimates were for a lower reading of 17.7 million units. Nevertheless, the end-result was that between Q3 and October, car sales grew by a strong 14.1% annualised, after increasing 17.2% q‑o-q in Q3, thus supporting our view that consumption should remain robust in Q4.

Regarding GDP itself, we see no reason to modify our forecasts. We continue to expect growth to settle at 2.6% q-o-q annualised in Q4 and 2.4% in 2016 on a yearly average basis.