Prof. Qiang Yang, founding head of Huawei Technologies' AI research lab, believes that big data paves the way for greater use of artificial intelligence in finance. Extracts from a recent interview.What’s the next step for AI?Artificial Intelligence has been successful mostly in fairly limited and well understood domains. A prime example is Go, where the rules are set and the range of data is confined to predetermined board locations. In the area of chatbots, the best chatbot today can do...

Read More »Sovereign yields to rise as reflation takes hold

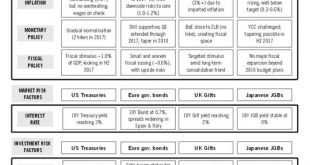

Total returns from government bonds could come under pressure in 2017.Our central scenario for developed markets sovereign bond yields in 2017 is based on our in-house risk-factor analysis, which is leading us to conclude that there is a 65% probability that 2017 will be a year of reflation (see table).Underpinning the economic environment will be the following three macroeconomic factors:Inflation, which should accelerate in the US, the euro area, the UK and Japan.Monetary policy, which...

Read More »The crisis in the Middle East and oil prices

We expect oil prices broadly to stabilise in 2017—but prices will continue to be affected by geopolitical shocks in the region, which will also create tremors on financial markets.Oil currently seems to have reached its fair value at around USD50 per barrel for Brent crude. We expect prices to average around USD55/b in 2017, while supply continues to adapt to sluggish demand. The agreement between OPEC members on 30 November and with non-OPEC producers a week later should reinforce the trend...

Read More »Solid US job figures, wages accelerate

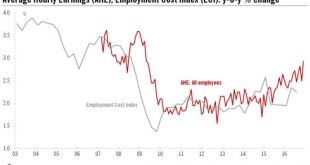

The US jobs market ends 2016 in good shape and wage growth reaches a new cyclical high.Non-farm payroll employment in the US rose by 156,000 month on month in December, slightly below consensus expectations of 175,000, while payroll growth figures for the previous two months were raised by 19,000. The unemployment rate rebounded slightly to 4.7% in December, only partly reversing the sharp decline of the previous month. The broader U6 unemployment rate fell to a new low of 9.2%.Looking...

Read More »Geopolitics and investing: assessing rising instability

With the rise of emerging powers and the relative decline of the US, geopolitical instability is increasing and the world is moving out of a unipolar order towards a predominantly one.We believe US-China competition will be the overriding geopolitical issue in the coming years. History suggests there is a strong chance that China’s rise will not be incorporated peacefully. Three forms of geopolitical competition between China and the US could dominate the next decade: over international...

Read More »Euro area headline inflation rises at fastest pace since September 2013

Nonetheless, the acceleration in headline figures in December masks subdued core inflation. We believe weak core prices will mean the rise in headline inflation will soon stall.Euro area flash HICP inflation rose from 0.6% in November to 1.1% year on year (y-o-y) in December, while core inflation increased slightly to 0.9%, both above consensus expectations. The breakdown by components showed that the main driver of the increase was energy prices.In the next few months, euro area inflation...

Read More »Equity total returns could reach double digits in 2017

According to our risk factor-based analysis, equities are likely to provide a total return of around 10% on average next year.Major equity markets are likely to deliver a total return of around 10% in 2017 according to our risk factor-based analysis framework. This projection is contingent on two market risk factors, i.e. equity and interest rates.We use four building blocks in our calculation of projected equity returns: dividend yield, buyback yield, valuation and earnings growth.The...

Read More »Limited short-term potential for dollar, yen will continue to weaken

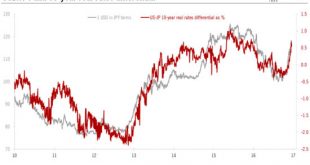

Recent policy meetings at important central banks chime with our currency outlook for major currencies in the coming months.US dollar/euro. The recent break to a fresh 14-year price low after 21 months of consolidation opens the way for a move towards parity in the EUR/USD rate in the next few months. Still, growth in the US is likely to be hurt in the coming months by the ongoing tightening in monetary conditions brought about by the stronger USD and the rise in interest rates before the...

Read More »Fed revises rate projections higher: ours remain unchanged

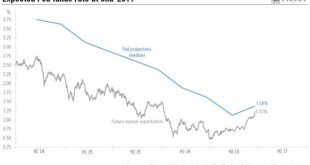

Given the ongoing tightening in monetary conditions, we are leaving our forecasts for two Fed rate hikes next year unchanged for the time being.The decision by the Fed this week to raise the Fed funds rate target range by 25bp to 0.5%-0.75% was widely expected. More surprisingly for the market was certainly the upward revisions in the (in)famous ‘dot plot’. The Federal Open Market Committee’s (FOMC) median forecast for Fed funds rates at the end of 2017 was shifted up by 25bp, to 1.375%,...

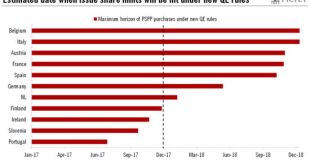

Read More »Sizing up the changes in ECB’s monetary policy

Along with extending its asset-buying programme, the ECB has made a number of changes to the parameters of that programme in a bid to deal with the issue of ‘bond scarcity’. But will it succeed?In December, the ECB made important changes to its quantitative easing (QE) programme, deciding to extend it by at least nine months to December 2017 while scaling down the pace of its asset purchases from EUR80 bn to EUR60 bn from April. The ECB also announced the easing of technical constraints...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org