Recent policy meetings at important central banks chime with our currency outlook for major currencies in the coming months.US dollar/euro. The recent break to a fresh 14-year price low after 21 months of consolidation opens the way for a move towards parity in the EUR/USD rate in the next few months. Still, growth in the US is likely to be hurt in the coming months by the ongoing tightening in monetary conditions brought about by the stronger USD and the rise in interest rates before the positive impact of a potential US fiscal stimulus kicks in. Coupled with our relatively cautious expectations for the Fed funds rate, the scope for a sustained break below parity in the EUR/USD rate is limited in the first half of 2017.Meanwhile, the decision this month by the European Central Bank (ECB) to extend quantitative easing should curb any sharp increase in long-term nominal rates just when upward pressures are building in US long-term rates. Consequently, both real long-term and short-term rate differentials call for a lower euro against the US dollar.Yen. Long-term real rate divergence means prospects are negative for the Japanese yen in 2017. Indeed, increasing price pressures, the hard cap on the 10-year yield and the Bank of Japan’s (BoJ) commitment to inflation overshooting should mean significant downward pressure on Japanese long-term real rates next year.

Topics:

Luc Luyet considers the following as important: Currency outlook, Macroview, US dollar strength, USD/EUR rate, Yen weakness

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

Recent policy meetings at important central banks chime with our currency outlook for major currencies in the coming months.

US dollar/euro. The recent break to a fresh 14-year price low after 21 months of consolidation opens the way for a move towards parity in the EUR/USD rate in the next few months. Still, growth in the US is likely to be hurt in the coming months by the ongoing tightening in monetary conditions brought about by the stronger USD and the rise in interest rates before the positive impact of a potential US fiscal stimulus kicks in. Coupled with our relatively cautious expectations for the Fed funds rate, the scope for a sustained break below parity in the EUR/USD rate is limited in the first half of 2017.

Meanwhile, the decision this month by the European Central Bank (ECB) to extend quantitative easing should curb any sharp increase in long-term nominal rates just when upward pressures are building in US long-term rates. Consequently, both real long-term and short-term rate differentials call for a lower euro against the US dollar.

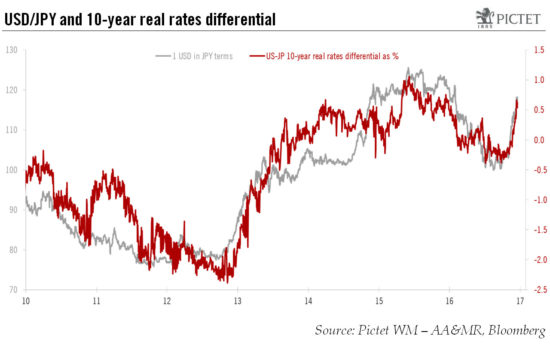

Yen. Long-term real rate divergence means prospects are negative for the Japanese yen in 2017. Indeed, increasing price pressures, the hard cap on the 10-year yield and the Bank of Japan’s (BoJ) commitment to inflation overshooting should mean significant downward pressure on Japanese long-term real rates next year. Given our scenario of robust risk appetite in 2017, the USD/JPY rate is likely to test, and potentially exceed, its 2015’s top of around JPY125 per USD.

British pound. The Bank of England’s (BoE) current neutral stance is unlikely to change in the next few months given moderate growth in activity and recent sterling appreciation has slightly damped the inflation outlook. How Brexit negotiations evolve and their impact on the economy will remain the key driver in the British pound’s performance. Caution is warranted, but the large undervaluation of the GBP (by almost 30% compared with the US dollar based on purchasing power parity taking account of consumer inflation) and the BoE’s limited tolerance for above-target inflation should limit the GBP’s downside potential.

Swiss franc. The downward pressure on the euro should weigh on the EUR/CHF rate. As the Swiss National Bank (SNB) seems to be placing more emphasis on the franc’s trade-weighted basis value, it may be willing to tolerate CHF appreciation against the EUR as long as it is offset by depreciation against the USD. However, the SNB is unlikely to tolerate too strong an appreciation of the Swiss franc against the euro.