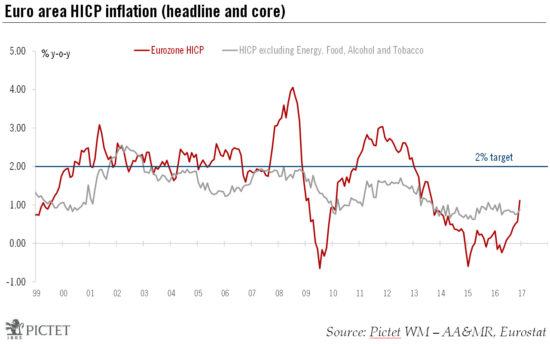

Nonetheless, the acceleration in headline figures in December masks subdued core inflation. We believe weak core prices will mean the rise in headline inflation will soon stall.Euro area flash HICP inflation rose from 0.6% in November to 1.1% year on year (y-o-y) in December, while core inflation increased slightly to 0.9%, both above consensus expectations. The breakdown by components showed that the main driver of the increase was energy prices.In the next few months, euro area inflation is likely to move higher, driven by energy-base effects. Headline HICP will peak at close to 1.5% y-o-y by the end of Q1 2017 according to our forecasts, using market expectations for oil prices and the currency. We then think price rises will stabilise as core inflation (excluding food and energy) is unlikely to rise significantly above 1% this year. Our 2017 forecasts remain unchanged at an average of 1.3% and 1.1% for headline and core inflation respectively, with risks modestly tilted to the upside in the short term.Overall, despite the sharp rise in headline inflation, the ECB is unlikely to reconsider its monetary policy support as core inflation remains extremely subdued. The latest rise in prices appears in line with its expectations for headline inflation to increase sharply in the early months of 2017 due to energy base effects.

Topics:

Nadia Gharbi considers the following as important: euro area core inflation, euro area headline inflation, HICP inflation, inflation forecast, Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

Nonetheless, the acceleration in headline figures in December masks subdued core inflation. We believe weak core prices will mean the rise in headline inflation will soon stall.

Euro area flash HICP inflation rose from 0.6% in November to 1.1% year on year (y-o-y) in December, while core inflation increased slightly to 0.9%, both above consensus expectations. The breakdown by components showed that the main driver of the increase was energy prices.

In the next few months, euro area inflation is likely to move higher, driven by energy-base effects. Headline HICP will peak at close to 1.5% y-o-y by the end of Q1 2017 according to our forecasts, using market expectations for oil prices and the currency. We then think price rises will stabilise as core inflation (excluding food and energy) is unlikely to rise significantly above 1% this year. Our 2017 forecasts remain unchanged at an average of 1.3% and 1.1% for headline and core inflation respectively, with risks modestly tilted to the upside in the short term.

Overall, despite the sharp rise in headline inflation, the ECB is unlikely to reconsider its monetary policy support as core inflation remains extremely subdued. The latest rise in prices appears in line with its expectations for headline inflation to increase sharply in the early months of 2017 due to energy base effects. However, core inflation remains extremely subdued and most of the underlying price measures show a lack of upward momentum: there is still a long way to go before the ECB is confident that a sustained adjustment in prices is on hand. Therefore, the ECB’s accommodative monetary policy is likely to remain until core inflation rises to above 1.2% -1.3% on a sustained basis. Our forecasts suggest that this is unlikely to happen before early 2018.