Relatively strong credit data for October were not enough to prevent the credit impulse from continuing to soften.Euro area bank credit flows to non-financial corporations rebounded strongly in October, by EUR11 bn in adjusted terms. Bank loans to households continued to expand at a healthy pace (+EUR10 bn). The slowdown in annual growth of the broad monetary aggregate M3, from 5.1% to 4.4% year on year in October, was largely due to base effects.The rebound in credit flows to the private...

Read More »Signs of higher growth and inflation in the euro area

Surveys that show activity remains buoyant in the euro area mean growth and inflation could be higher than forecast, thus complicating the ECB’s task.Flash purchasing managers’ indices (PMI) for November, compiled by Markit, delivered upside surprises across most countries and sectors in the euro area.Business confidence remained very strong in Germany, and improved markedly in France and peripheral countries. The euro area composite PMI rose to 54.1, pointing to real quarter-over-quarter...

Read More »European populists unlikely to replicate Trump win

Political risks never completely disappear from the European landscape, but we are not convinced that the US elections have materially increased the odds of another populist ‘accident’ in the euro area.While the Italian referendum is the most obvious near-term risk, we see extremely low chances of a nationalist, anti-European party winning a major election next year or holding a legally-binding referendum on EU/EMU membership. Apart from any other consideration, electoral processes are too...

Read More »2017 growth forecast for U.S. remains unchanged for now

Recent data shows that consumer spending remains on track, but we see prospects dimming for economic growth in H1 2017, before rising again in H2 thanks to fiscal stimulus.Figures released on November 15 show that core retail sales in the US rose by a strong 0.8% month over month in October, well above consensus expectations. Moreover, figures for the previous months were revised up. We believe consumer spending will grow by around 2.5% q-o-q annualised in Q4 (2.1% in Q3) and that it should...

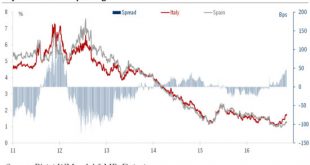

Read More »Referendum at heart of Italian uncertainties

A ‘No’ vote in the 4 December referendum would be seen as a negative by investors in Italy, adding to the challenges the country must face.The 4 December referendum on senate reform is the next big event on the European political calendar, coming just ahead of the next ECB and Fed policy meetings on 8 December and 14 December, respectively.We believe a ‘Yes’ vote would boost government confidence and marginally help Italian securities, but is unlikely to represent a significant game changer...

Read More »Implications of Trump’s election win

We are cautious about the impact of a Trump presidency and are not changing our economic forecasts at this time. Uncertainty about how Trump will govern make near-term volatility spikes likely.A Trump presidency could see major changes in policy on many themes such as fiscal policy, trade policy, immigration, the environment, financial regulation, healthcare, social security, and supervision of the Fed. However, it remains highly uncertain whether Trump will in fact pursue the policies he...

Read More »Healthy payroll number in the U.S., strong increase in wages

Latest job numbers along with acceleration in wage growth reinforces the case for December rate hike.October’s non-farm payroll figure was healthy, with upward revisions for the previous two months. The unemployment rate inched down and year-on-year (y-o-y) wage increases reached a fresh cyclical high. The latest data tend to strengthen the case for a Fed hike in December.Non-farm payroll employment in the US rose by 161,000 m-o-m in October, marginally below consensus expectations. However,...

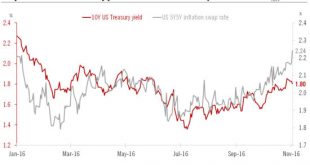

Read More »Bond yields shift higher

Recent rises in benchmark bond yields have caused us to revise upwards our year-end forecasts for US Treasury and Bund yields.We have revised our year-end target for the 10-year US Treasury yield from 1.7% to 2% and for the 10-year German Bund yield from 0.08% to 0.3%.Since the end of September, markets’ inflation expectations have rebounded, with euro and USD 5Y5Y inflation swap rates and 10-year breakeven yields rising. This rise is due to several factors, the most obvious one being the...

Read More »ISM indices point to healthy U.S. growth in October

Other data have been more mixed and our forecast for U.S. growth remains unchanged for Q4.The ISM Manufacturing index increased modestly in October, to 51.9 from 51.5 in September, slightly above consensus expectations (51.7). However, following a sharp increase to 57.1 in September, the Non-manufacturing index fell back to 54.8 in October, below consensus expectations (56.0).The rebound in the ISM manufacturing index over the past two months confirmed that the declines in the dollar’s...

Read More »Modest changes in latest Fed statement

The statement at the end of the Fed’s latest policy meeting did hint at increasing inflation and seemed to prepare the ground for a December rate hike.As widely expected, the Federal Open Market Committee (FOMC) remained on hold at its policy meeting on November 2 meeting and there were only slight modifications in the FOMC statement.The Fed modestly upgraded its assessment of inflation and provided further hints of a December rate rise, saying that the case for a hike “has continued to...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org