Is the energy crisis something that can be resolved? Was it always inevitable? Will renewable energy make it all OK? Are Western financial policies to blame? All this and more in today’s The M3 Report! If you’re not already subscribed to GoldCoreTV then click here right now to make sure you’re all set to watch the fifth episode of our flagship show. [embedded content] Featuring Mr. Energy himself Steve St. Angelo as well as a short explanation from Brent Johnson on...

Read More »Weekly Market Pulse: A Most Unusual Economy

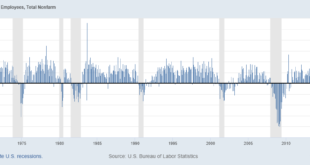

The employment report released last Friday was better than expected but the response by bulls and bears alike was exactly as expected. Both found things in the report to support their preconceived notions about the state of the economy. I do think the bulls had the better case on this particular report but there have been plenty of others recently to support the ursine side of the aisle too. My take is that everything about the economy right now, and really since...

Read More »Market Pulse: Mid-Year Update

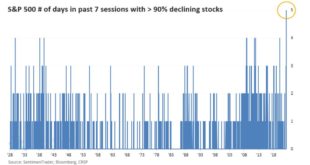

Note: This update is longer than usual but I felt a comprehensive review was necessary. The Federal Reserve panicked last week and spooked investors into the worst week for stocks since the onset of COVID in March 2020. The S&P 500 is now firmly in bear market territory but that is a fraction of the pain in stocks and other risky assets. Stocks are now down 10 of the last 11 weeks but the pain was concentrated in the last two weeks. 5 of the last 8 trading days...

Read More »Weekly Market Pulse: Oil Shock

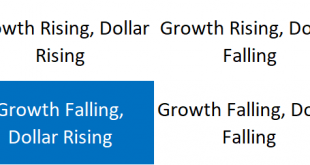

Crude oil prices rose over 25% last week and as I sit down to write this evening the overnight futures are up another 8% to around $125. Almost every other commodity on the planet rose in prices last week too, as did the dollar. Those two factors – rising dollar and rising commodity prices – mean the likelihood of recession in the coming year has risen significantly in just the last week. Rising oil prices, in particular, have been a regular feature of past...

Read More »European Energy Crisis: 4 Things You MUST Know!

European Energy Crisis: 4 Reasons You MUST Know! European households are facing rising prices on many goods and services, but one particular standout is electricity and gas bills. According to Bank of America, European household gas bills are expected to rise to €1,850 in 2022 from €1,200 in 2020 (an ~55% increase). Natural gas prices have pulled back from the December peak. However, it remained high and it could get worse over the remainder of the winter months....

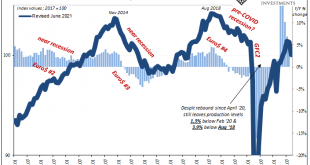

Read More »Far Longer And Deeper Than Just The Past Few Months

Hurricane Ida swept up the Gulf of Mexico and slammed into the Louisiana coastline on August 29. The storm would continue to wreak havoc even as it weakened the further inland it traversed. By September 1 and 2, the system was still causing damage and disruption into the Northeast of the United States. While absolutely tragic for those who suffered its blow, in economic terms this means that any weakness exhibited by whichever economic account during both August and...

Read More »Weekly Market Pulse: Zooming Out

How often do you check your brokerage account? There is a famous economics paper from 1997, written by some of the giants in behavioral finance (Thaler, Kahnemann, Tversky & Schwartz), that tested what is known as myopic loss aversion. What they found was that investors who check their performance less frequently are more willing to take risk and experience higher returns. Investors who check their results frequently take less risk and perform worse. And that...

Read More »If Bitcoin Is A Bubble…

Our earlier articles on bitcoin discuss the crypto asset as a currency and a commodity. Both papers focused on the consequences of bitcoin’s defining feature: the asymptotic supply limit of 21 million coins. This gives it an unusual juxtaposition of demand uncertainty and supply certainty (as well as inelasticity). As a currency, it gives rise to a tension between its use as a store of value and as medium of exchange....

Read More »Frontrunning: February 9

Airlines, Airports to Meet President Amid Travel-Ban Uncertainty (WSJ) Legal battle pits Trump's powers against his words (Reuters) Trump’s Oval Office Tweets Force CEOs to Choose Fight or Flight (BBG) Companies Plow Ahead With Moves to Mexico, Despite Trump’s Pressure (WSJ) Trump’s Labor Pick Loves Burgers, Bikinis, and Free Markets (BBG) NATO allies lock in U.S. support for stand-off with Russia (Reuters) Sessions Takes Reins at Justice Ready to Walk the Line for Trump (BBG) Washington...

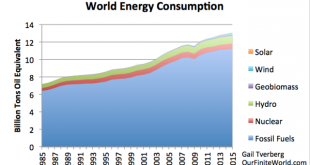

Read More »Destroying The “Wind & Solar Will Save Us” Delusion

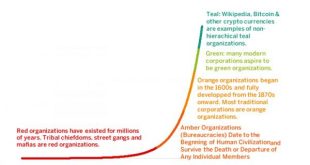

The “Wind and Solar Will Save Us” story is based on a long list of misunderstandings and apples to oranges comparisons. Somehow, people seem to believe that our economy of 7.5 billion people can get along with a very short list of energy supplies. This short list will not include fossil fuels. Some would exclude nuclear, as well. Without these energy types, we find ourselves with a short list of types of energy — what...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org