Crude oil prices rose over 25% last week and as I sit down to write this evening the overnight futures are up another 8% to around $125. Almost every other commodity on the planet rose in prices last week too, as did the dollar. Those two factors – rising dollar and rising commodity prices – mean the likelihood of recession in the coming year has risen significantly in just the last week. Rising oil prices, in particular, have been a regular feature of past...

Read More »Lagarde Channels Past Self As To Japan Going Global

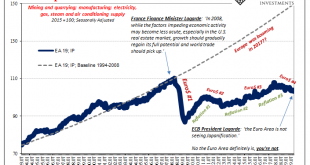

As France’s Finance Minister, Christine Lagarde objected strenuously to Ben Bernanke’s second act. Hinted at in August 2010, QE2 was finally unleashed in November to global condemnation. Where “trade wars” fill media pages today, “currency wars” did back then. The Americans were undertaking beggar-thy-neighbor policies to unfairly weaken the dollar. The neighbor everyone though most likely to be sponged off of was Europe. The day after the Fed’s second launch,...

Read More »REAL RECOVERY OR MARKET TRICKERY? Claudio Grass On The Everything Bubble – And The Asset Class That’s Still Cheap

[embedded content] Mainstream analysts and market bulls have some powerful numbers on their side: government-published unemployment figures remain low, America just had the best first quarter of a year for stocks since 1998, and the U.S. dollar is still the world’s reserve currency. But is all of this really indicative of a strong economy and a sustainable market, or is it just an illusion? You have a right to know the truth, so Portfolio Wealth Global just published a powerful interview...

Read More »Is the Dollar Bull Market Over?

Even in the fast-changing world of foreign exchange, investors have been able to count on one thing for the last two years – that the interest rate policies of central banks would be the primary driver of currency movements. The so-called divergence trade hinged on the Federal Reserve’s tightening bias relative to the easing bias of the European Central Bank and Bank of Japan and was a fairly reliable organizing principle for foreign-exchange investors. On a trade-weighted basis, the...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org