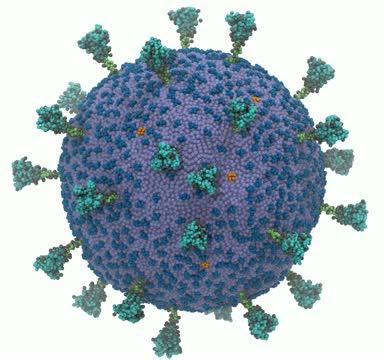

Overview: A pessimistic assessment offered by the CEO of Moderna shattered the fragile calm seen yesterday after the pre-weekend turmoil. Risk appetites shriveled, sending equity markets lower and the bond markets higher. Funding currencies rallied, with the euro and yen moving above last week's highs. The uncertainty weighs on sentiment and makes investors question what they previously were certain of. The MSCI Asia Pacific Index fell over 1% before the weekend and again yesterday. Today, South Korea's 2% slide led the regional decline that saw Japan and Hong Kong fall more than 1%. Australia, Taiwan, and India managed to post minor gains. Europe's Stoxx 600 is off over 1.5%, giving back all of yesterday's gain (~0.7%) after the pre-weekend 3.6% drop. US

Topics:

Marc Chandler considers the following as important: 4.) Marc to Market, 4) FX Trends, COVID, Currency Movement, Featured, inflation, newsletter, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Overview: A pessimistic assessment offered by the CEO of Moderna shattered the fragile calm seen yesterday after the pre-weekend turmoil. Risk appetites shriveled, sending equity markets lower and the bond markets higher. Funding currencies rallied, with the euro and yen moving above last week's highs. The uncertainty weighs on sentiment and makes investors question what they previously were certain of.

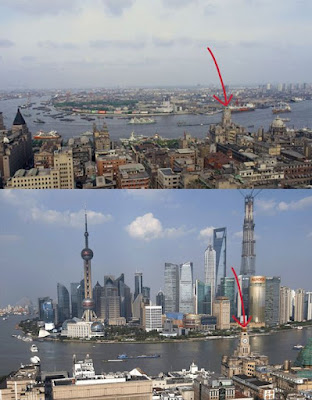

The MSCI Asia Pacific Index fell over 1% before the weekend and again yesterday. Today, South Korea's 2% slide led the regional decline that saw Japan and Hong Kong fall more than 1%. Australia, Taiwan, and India managed to post minor gains. Europe's Stoxx 600 is off over 1.5%, giving back all of yesterday's gain (~0.7%) after the pre-weekend 3.6% drop. US futures are sharply lower. Bond yields are tumbling, led by an 8 bp decline in the US 10-year yield, bringing it to around 1.42%. European benchmark yields are 3-5 bp lower. In the foreign exchange market, the dollar-bloc currencies and Norwegian krone are under pressure, while the funding currencies--euro, yen, and Swiss franc--have risen through last week's highs. Emerging market currencies are mixed, though several central European currencies appear to be pulled higher by the euro. Gold is firm but below $1800. Recall the high from the end of last week was near $1815.50. Oil prices are sliding. January WTI fell through last week's low and took out the 200-day moving average (~$67.45). While US natural gas prices fell and are near two-week lows, European (Dutch) gas prices are up more than 4% on top of yesterday's 7.5% rally. Iron ore prices are paring yesterday's 6.8% rise, while copper is off around 0.5% after recovering 1.25% yesterday.

Asia Pacific

The Moderna CEO warned that the vaccines will likely prove less effective against the Omicron variant, and it will take months to create a vaccine specific to this mutation. This unhinged the markets again. The news overshadowed favorable economic news. China's November PMI was stronger than expected, and Japan reported the first increase in industrial output in four months. China's manufacturing PMI rose above the 50 boom/bust level for the first time since August, albeit barely (50.1), and the non-manufacturing PMI slipped less than expected (52.3 vs. 52.4 in October, while the median Bloomberg forecast) was for 52.3). The composite rose to 52.2 from 50.8, its best reading since July. Japan's industrial output rose 1.1%, which was less than expected, but still the first gain since June. The unemployment rate unexpectedly fell to 2.7% from 2.8%, even though the job-to-applicant ratio slipped to 1.15 from 1.16. October housing starts jumped 10.4%, nearly twice the pace expected.

Still, not all the economic data from the region was upbeat. Building approvals in Australia slumped 12.9% in October. The median forecast (Bloomberg) was for a 1.5% decline. October industrial output in South Korea fell 3%, while the market looked for a 0.1% decline. The September series was revised to -1.1% from -0.8%. South Korea's industrial production has not risen since July.

The dollar was sold to about JPY112.70, which is its lowest level since October 11. The JPY112.30 is the next technical target, corresponding to (50%) retracement of the rally since September 22 low near JPY109. A break of JPY112.00 could see JPY111.50. The Australian dollar has been sold to a new low for the year below $0.7100. The $0.7050 area corresponds to the (38.2%) retracement of the rally since the March 2020 low near $0.5500. Initial resistance is seen near $0.7140. The Chinese yuan is unflappable. The dollar continues to trade within the range set on November 16 (~CNY6.3670-CNY6.3965), though it traded at CNY6.37 for the first time since then. The reference rate was set at CNY6.3794, while the market (Bloomberg survey) projected CNY6.3790.

Europe

The eurozone's preliminary estimate of November CPI surprised on the upside. The month-over-month gain of 0.5% compares with the median forecast (Bloomberg survey) for a 0.1% gain. The year-over-year rate rose to 4.9% from 4.1%. Economists anticipated an increase to 4.5%. The core rate rose to 2.6% from 2.0%, also well above expectations.

The euro dipped briefly below $1.12 last Wednesday and Thursday before spiking to about $1.1330 ahead of the weekend. After being confined to a narrow consolidative range yesterday, the euro has been bid slightly above $1.1365 today. The $1.1375-$1.1380 area offers a nearby target. Surpassing it could spur a move toward $1.1440. The intraday momentum indicators are stretched. Initial support may be found around $1.1330. Sterling is firm but unimpressive. It barely has risen through the pre-weekend high (~$1.3365). Last week's high was closer to $1.3465. Yet, the rise has been sufficient to stretch the intraday momentum indicators. Support may be found around the $1.3320 area initially. The market continues to scale back expectations for a BOE rate hike next month. The December short-sterling futures contract's implied yield is higher for the ninth session of the past 10. Yesterday was the exception, and today's move offset it.

America

Federal Reserve Chair Powell recognized that the Omicron variant injects a new unknown into the mix. It adds to the inflation uncertainty while adding to the downside economic risks. His prepared remarks ahead for today's testimony did not refer to monetary policy or the pace of the tapering.

The US federal spending authorization expires at the end of the week. Democrats are talking about a continuing resolution to keep the government open until mid-to-late January. Separately, the debt ceiling looms, though the exact deadline is not clear. Treasury Secretary Yellen has suggested that it may be around the middle of the next month.

The market's focus today is clearly not on the economic data, which in the US consists of house prices, the Chicago PMI, and the Conference Board's consumer confidence report. Canada is to report Q3 GDP and September's monthly figure. Even with a flat September, Q3 GDP is expected to have risen 3% at an annualized pace after a 1.1% contraction in Q2. In addition to Powell and Yellen's testimony, the Fed's Williams and Clarida also speak. Recall that OPEC has shifted its key meetings until tomorrow and Thursday to buy more time before deciding on next month's output plans.

The US dollar briefly traded above last week's high against the Canadian dollar (~CAD1.28). It has been trading sideways near the highs since they were recorded in Asia. Initial support may be seen around CAD1.2770, while more formidable support is closer to CAD1.2730. The greenback remains within the pre-weekend range against the Mexican peso (~MXN21.5360-MXN22.1550). It is trading around yesterday's low (~MXN21.6360) and briefly traded to about MXN21.6220. The peso appears more resilient than justified by the broad risk-off mood. The question is whether it can maintain its resilience through the North American session today, and the intraday momentum indicators suggest probably not.

Tags: #USD,COVID,Currency Movement,Featured,inflation,newsletter