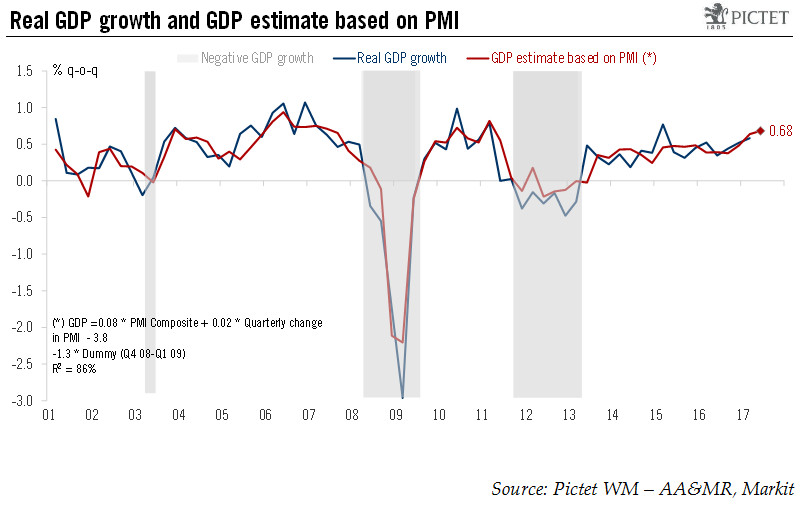

Euro area PMI indices showed some signs of moderation in June, but suggest that there is still plenty of growth momentum.PMI indices showed some signs of moderation in June. The composite PMI decreased from 56.8 in May to 55.7 in June, below consensus expectations (56.6).The PMI’s forward-looking components remained pretty strong in June, with some bright spots in new orders and employment.On average, composite PMI in Q2 was the highest in six years and points to GDP growth of 0.68% q-o-q, after 0.60% in Q1.Soft data continue to be more upbeat than hard data, but the divergence has slightly narrowed. We are keeping unchanged our GDP growth forecast at 1.9% for 2017 as a whole. We continue to see a number of headwinds leading to a modest slowdown in the pace of economic expansion, which

Topics:

Nadia Gharbi considers the following as important: Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

Euro area PMI indices showed some signs of moderation in June, but suggest that there is still plenty of growth momentum.

PMI indices showed some signs of moderation in June. The composite PMI decreased from 56.8 in May to 55.7 in June, below consensus expectations (56.6).

The PMI’s forward-looking components remained pretty strong in June, with some bright spots in new orders and employment.

On average, composite PMI in Q2 was the highest in six years and points to GDP growth of 0.68% q-o-q, after 0.60% in Q1.

Soft data continue to be more upbeat than hard data, but the divergence has slightly narrowed. We are keeping unchanged our GDP growth forecast at 1.9% for 2017 as a whole. We continue to see a number of headwinds leading to a modest slowdown in the pace of economic expansion, which should nonetheless remain comfortably above potential this year, at around 1.75% in annualised terms.