Last Thursday, when we reported that Ben Bernanke was to "secretly" meet with Kuroda and Abe this week (he is said to have already met with Japan's central bank head earlier today), we said that "something big was coming" out of Japan which had "helicopter money" on the agenda. And sure enough, after a dramatic victory for Abe in Japan's upper house elections which gave his party an even greater majority, Abe announced the first hints of helicopter money when Nikkei reported, and Abe later confirmed that Japan would unveil a new JPY 10 trillion (0 billion) stimulus and the government would consider issuing new Japanese government debt for the first time in 4 years in order to "make most of zero interest rate environment to utilize fiscal investments" in order to "support domestic demand." We also said that "if anyone is still holding on to USDJPY shorts, now may be a good time to quietly close them out, because if Reuters is right, and a "helicopter money" is about to be served for the first time in modern history, things are about to get very volatile, very fast." Sure enough, overnight the USDJPY has soared by by over 150 pips, which in turn sent the Nikkei higher by a whopping 600 points, or 4%, to over 15,700 - the biggest one day jump since February. On the heels of the surge in Japan, the MSCI Asia Pacific Index climbed 2%.

Topics:

Tyler Durden considers the following as important: 10 Year Treasury, Abenomics, Bank Index, Bank of Japan, Bear Market, Ben Bernanke, BOE, Boeing, Bond, Borrowing Costs, Central Banks, China, Citigroup, Consumer Credit, Copper, CPI, Crude, Crude Oil, Deutsche Bank, Equity Markets, European Union, Federal Reserve, fixed, France, Germany, Glencore, Government Stimulus, India, Italy, Japan, Japanification, Jim Reid, Market Conditions, Mars, Medicare, Monetary Policy, Monte Paschi, Morgan Stanley, natural gas, Nikkei, Price Action, Quantitative Easing, RANSquawk, Reuters, Saxo Bank, Stress Test, Tata, Transparency, Unemployment, Wells Fargo, Yen, Yield Curve, Yuan, Zurich

This could be interesting, too:

investrends.ch writes Bloomberg: DWS stoppt Private-Credit-Geschäft in Asien

investrends.ch writes Deutsche Bank bleibt auf Rekordkurs

investrends.ch writes DWS mit neuem Vertriebsleiter für Institutionelle

investrends.ch writes Glencore schreibt im Halbjahr erneut einen Verlust

Last Thursday, when we reported that Ben Bernanke was to "secretly" meet with Kuroda and Abe this week (he is said to have already met with Japan's central bank head earlier today), we said that "something big was coming" out of Japan which had "helicopter money" on the agenda. And sure enough, after a dramatic victory for Abe in Japan's upper house elections which gave his party an even greater majority, Abe announced the first hints of helicopter money when Nikkei reported, and Abe later confirmed that Japan would unveil a new JPY 10 trillion ($100 billion) stimulus and the government would consider issuing new Japanese government debt for the first time in 4 years in order to "make most of zero interest rate environment to utilize fiscal investments" in order to "support domestic demand."

We also said that "if anyone is still holding on to USDJPY shorts, now may be a good time to quietly close them out, because if Reuters is right, and a "helicopter money" is about to be served for the first time in modern history, things are about to get very volatile, very fast." Sure enough, overnight the USDJPY has soared by by over 150 pips, which in turn sent the Nikkei higher by a whopping 600 points, or 4%, to over 15,700 - the biggest one day jump since February.

On the heels of the surge in Japan, the MSCI Asia Pacific Index climbed 2%. The win for Abe’s ruling coalition in upper-house elections at the weekend will help the premier press ahead with stimulus and on Sunday he reiterated a pledge to take action. The Bank of Japan is set to announce an expansion of its monthly bond and equity purchases on July 29 and Abe will probably introduce fiscal stimulus by year-end, according to Macquarie Bank Ltd. Nintendo Co. soared 25 percent in Tokyo as its new Pokemon Go game topped smartphone app rankings.

The surge in the Nikkei, and the market's exuberant reaction to this helicopter money lite meant that US futures took another big move higher, and are now poised to open at all time highs when the market opens for trading. Additonally, the MSCI All-Country World Index rose for a third day with the Brexit losses now a distant memory. The dollar strengthened and Treasuries fell amid speculation the Federal Reserve will stand out among major central banks by not loosening monetary policy this year. Nickel advanced with copper and crude oil fell to less than $45 a barrel.

In Italy, hope of more bailouts was the catalyst to push bank stocks higher in early trade, with Monte Paschi rising as much as 9.2%, the best performer on SX7P bank index after reports Italy's bank situation would be discussed at the upcoming Ecofin meeting, Corriere reports. Mediobanca says meetings possible catalysts to better understand the chances of success of the Italian Authorities’ strategy, while Morgan Stanley strategists Greg Case and Jackie Ineke expect a scenario where Atlante fund is topped up via the state and used to both acquire NPLs and recapitalize Monte as required.

However, in later trading the Italian euphoria reversed and banks stocks dropped after Germany said there was no change in its position on Italian banks. “There’s no update” German Finance Ministry spokeswoman Friederike von Tiesenhausen says when asked about calls for major Italian bank rescue. “I have nothing new to offer on that front." As a result, Italian banks reversed earlier gains, with exception of Paschi which was still green - the FTSE Italia All-Share Banks Index was down 0.9% as of 11:45am CET, led by UniCredit which was among the biggest decliners on the SX7P, down 2.9% (as much as 5.1% today); while Pop. Emilia dropped 2.0%, after Equita mentioned no evolution in the government intervention plan for banks, and referred to news flow over the weekend.

The Stoxx Europe 600 Index added 0.6 percent at 10:39 a.m. in London for a third daily advance. All 19 industry groups rose, with gains exceeding 4 percent in ArcelorMittal and Glencore Plc pushing commodity producers to the best performance. The FTSE 100 Index climbed 0.7 percent, moving toward a bull market. The U.K. benchmark has erased its post-Brexit drop thanks to a weaker pound and is up more than 19 percent from its February low.

S&P 500 futures gained 0.2 percent. Alcoa Inc. unofficially kicks off the second-quarter earnings season as it releases results after markets close Monday. The aluminum producer rose 1.8 percent in premarket trading. Analysts forecast profit at S&P 500 firms will drop 5.7 percent in the period, which would make it the fifth straight quarterly decline, the longest streak since 2009.

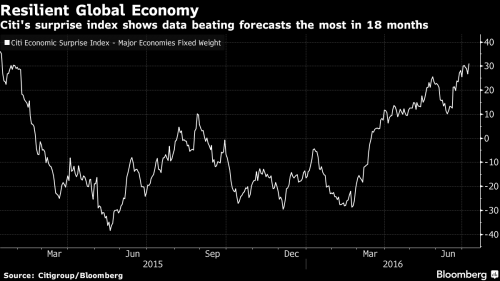

In summary, global stocks are almost back to where they were at the time of the U.K.’s June 23 vote to leave the European Union, which wiped almost $4 trillion off the value of the securities. Helped mostly by the stunning Friday jobs report, Citigroup’s Surprise Index is showing data in the developed world that’s beating analysts forecasts by the most since January 2015, while shares are getting additional support from the prospect of fresh fiscal and monetary stimulus to contain the fallout from the Brexit vote.

“We had good news globally -- the jobs report in the U.S. was strong and over the weekend we also had quite a clear decision in Japan,” said Christian Gattiker, head of research at Julius Baer Group Ltd. in Zurich. “A lot of things are now meeting a very cautious European investor and make life not easy, but less threatening than just a week or two weeks ago.”

Not everything was surging however, and the energy complex dipped this morning with Brent declining as much as 86c to the lowest since May 11, while WTI mirrored Brent momentum, falling as much as 88c to $44.53, also lowest since May 11. "A stronger dollar combined with a rise in rigs seems to be the main focus," says Ole Hansen, head of commodity strategy at Saxo Bank.

Treasuries also fell, lifting 10-year yields by two basis points to 1.38 percent. Similar-maturity debt in Japan yielded minus 0.28 percent, after the rate touched an all-time low of minus 0.30 percent on Friday. Still, today's modest selloff will hardly persist: Japan’s biggest bond bulls say the plunge in yields below zero in Tokyo foreshadows record-breaking gains for U.S. Treasuries. Mitsubishi UFJ Kokusai Asset Management says U.S. 10-year yields will drop to 1 percent as soon as this month, having touched an unprecedented 1.32 percent last week. Sumitomo Mitsui Trust Asset Management says it’s likely in 2017, and Mizuho Asset Management predicts the figure may go even lower. “Welcome to the world of Japanification,” said Hideo Shimomura, the chief fund investor at Mitsubishi UFJ Kokusai in Tokyo. “One percent is inevitable.”

Market Snapshot

- S&P 500 futures up 0.3% to 2125

- Stoxx 600 up 0.5% to 329

- FTSE 100 up 0.6% to 6632

- DAX up 1.3% to 9754

- German 10Yr yield down less than 1bp to -0.19%

- Italian 10Yr yield up 2bps to 1.21%

- Spanish 10Yr yield up 2bps to 1.16%

- S&P GSCI Index down less than 0.1% to 357.9

- MSCI Asia Pacific up 1.9% to 131

- Nikkei 225 up 4% to 15709

- Hang Seng up 1.5% to 20881

- Shanghai Composite up 0.2% to 2995

- S&P/ASX 200 up 2% to 5337

- US 10-yr yield up 2bps to 1.38%

- Dollar Index up 0.48% to 96.76

- WTI Crude futures down 1.1% to $44.89

- Brent Futures down 1% to $46.30

- Gold spot down 0.5% to $1,359

- Silver spot up 0.2% to $20.33

Top Global News

- Abe’s Fiscal Stimulus Plans to Take Shape After Election Win: He has pledged “broad, bold” action to support economy

- Boeing Sees $5.9t Airplane Market Despite Recent Turmoil: “Middle of market” aircraft will drive demand, company says; Boeing to Sell Up to $3.39b of Planes to Xiamen Airlines: order is for 737 Max 200 planes

- Airbus Said to Near $12.6b AirAsia Deal for A321neos: Deal might be announced as early as tomorrow

- Southern Expands Gas Footprint With $1.5b Kinder Deal: Buys 50% stake in Kinder Morgan southern natural gas pipeline system

- Nichi-Iko Pharmaceutical to Buy Sagent in $736m Cash Deal: Bid represents 40 percent premium of over last closing price

- UFC Said to Sell Itself to WME-IMG-Led Group for About $4b: NYT: Cites unidentified people with direct knowledge of the matter

- ‘Pets’ Hijinks Deliver Box-Office Victory for Universal: Picture collected an estimated $103.2m in U.S., Canadian theaters

- Citigroup Is ‘Bullish Commodities’ for 2017 as Brexit to Fade: Sees U.S., China growth to lift demand into next year

- Falling U.S. Oil Output Not Enticing Enough for Wary Investors: American crude production slipped to lowest since May 2014

- WellCare, Centene Said to Make Bids for Aetna Plans: Reuters: Made competing bids for Aetna’s Medicare Advantage plans that the insurer is looking to sell, Reuters says

Looking at regional markets, strong start to the week for Asian stocks having taken the impetus from Wall Street after the Friday's NFP report showed a large beat on the headline. Nikkei 225 (+4.0%) was buoyed by easing political uncertainty after PM Abe's LDP secured a super majority in the upper house election with the PM expected to announce fresh stimulus measures into the economy. Similarly, the ASX 200 (+2.0%) was supported by the diminished risks surrounding the outcome of the general election with Australian PM Turnbull declaring a narrow victory. The Shanghai Composite (+0.2%) rose albeit modestly so as the latest CPI reading slipped to its lowest since January, indicating that domestic demand remains somewhat sluggish. In credit markets, price action had been relatively muted with the Japanese 10-yr benchmark a touch softer while the Japanese yield curve saw some notable bear flattening. PBoC sets the CNY mid-point at 6.6843.

Top Asian News:

- China Tightens Corporate Bond Borrowing Rules as Defaults Spread: Hua Chuang says possibility of more rules can’t be excluded

- Pokemon Go Hit Underscores Nintendo’s Potential in Mobile Gaming: Nintendo shares soar as much as 25%

- Line Prices IPO at Top of Range in Year’s Biggest Tech Debut: Messaging app to fully exercise greenshoe to sell more stock

- China Pension Readies $300 Billion Warchest for Market Foray: Pension funds seen entering equity market in 2H

In Europe, equity markets opened in the green this morning, continuing the bullish tone in Asia overnight. EUROSTOXX opened higher and still trades in the green up 0.4% with the DAX outperforming up 1.2%. Material names lead the way higher on a sector breakdown, with a potential venture deal on the cards for Thyssenkrupp and Tata steel seeing the former currently +5%. In fixed income market, Bunds opened lower amid the upbeat sentiment, however shrugged off some of the initially losses to close the opening gap and hovering around the 168 level in what has been a largely uneventful session in terms of price action. The BoE is set to slash interest rates this week, with markets looking for a 25bps cut to 0.25%. However, many economists argue that such a small shift in borrowing costs would have little effect and expect the Bank to go further. This could see Bank rate reduced to 0% and a restart of the money-printing quantitative easing (QE) programme this summer.

Top European News

- LafargeHolcim to Sell India Unit to Nirma for $1.4 Billion: Company confident of reaching CHF3.5 billion disposal goal

- Rolls-Royce to Buy Remainder of Engine Components Business: s Agreed to buy the stake it doesn’t already own in Industria de Turbo Propulsores for EU720m

- Osborne Heads to Wall Street as Disarray Roils U.K. Politics: Chancellor to lobby investors in U.S., China, Singapore; May Vows to Share U.K. Prosperity in Tory Leadership Bid

- Italian Industrial Production Falls in Challenge for Renzi: Output dropped 0.6% in May, missing analysts’ median estimate

- Merkel Sees Brexit as Unavoidable Once Next U.K. Leader in Place: U.K.’s ‘decision has been taken,’ German chancellor says

- Telefonica Cuts China Unicom Stake in Effort to Slash Debt: Carrier raising cash after shelving U.K. sale amid Brexit vote

- Aberdeen CEO Sees Property Fund Reopening Today After Outflows: Expects to reopen its GBP3.2b U.K. property fund after outflows slowed and some investors decided against selling

In commodities, the Bloomberg Commodity Index rose 0.4 percent, rebounding from a 3.7 percent weekly loss that marked its steepest slide since January. Nickel jumped 2.5 percent in London as copper climbed 1.4 percent. Gold fell 0.6 percent, retreating from its highest close since March 2014. Corn gained 1 percent, rallying for the third day in Chicago since entering a bear market on Wednesday.Commodities are poised to strengthen in the second half and through 2017 as spending cuts restrain supply and demand continues to grow at a moderate pace, according to Citigroup. The bank is “especially bullish” for next year as inventory reductions become more pronounced, analysts led by Ed Morse said in an e-mailed note received Monday. West Texas Intermediate crude fell 1.4 percent to $44.76 a barrel, after tumbling 7.3 percent last week. Crude resumed losses after data from Baker Hughes Inc. showed U.S. drillers boosted the number of rigs targeting oil to the highest in 12 weeks. Natural gas futures rose as much as 2.2 percent, the most this month, as above-average temperatures are forecast across much of the U.S.

In FX, the yen slipped 1.6 percent to 102.17 per dollar, heading for its steepest slide since June 23. The Korean won strengthened 1.3 percent, its biggest advance in a month, as last week’s U.S. jobs report boosted the outlook for the nation’s exporters. The Bloomberg Dollar Spot Index, a gauge of the greenback against 10 major peers, rose 0.5 percent after slipping 0.3 percent in the last session. Futures put the odds of a Fed rate increase this year at 21 percent, up from 12 percent before Friday’s payrolls figures. They showed zero odds of a cut before the end of the year. “The U.S. dollar is only slightly firmer as interest-rate markets have only slightly firmed the chances of a Fed rate hike this year,” said Imre Speizer, a market strategist at Westpac Banking Corp. in Auckland. “That still appears too light, so there’s scope for further upside in both during the week ahead, as long as a decent average pace of payrolls gains is sustained during the months ahead.” The MSCI Emerging Markets Currency Index advanced for a third day, rising 0.3 percent. The offshore yuan ended a four-day retreat as data released over the weekend signaled that growth in the world’s second-largest economy is beginning to stabilize. China’s factory-gate deflation eased for the sixth month in a row, while consumer inflation accelerated more than expected.

* * *

Bulletin Headline Summary From RanSquawk and Bloomberg

- European equities enter the North American in positive territory as Japanese stimulus hopes underpinned sentiment overnight

- GBP continues to remain out of favour as mounting expectations for BoE action on Thursday dictates price action

- Looking ahead, highlights include potential comments from Fed's George and a US 3yr Note Auction

- Treasuries lower in overnight trading as global equities almost back to where they were at the time of the U.K.’s June 23 Brexit vote; week’s auctions begin with $24b 3Y notes, WI 0.745%; sold at 0.93% in June, was first 3Y auction to tail since March.

- After the ruling party scored a convincing victory in Sunday’s upper house election, the focus now turns to Japanese Prime Minister Shinzo Abe’s plans for fiscal stimulus

- Japanese shares posted their biggest gain in almost five months, as an election win by Prime Minister Shinzo Abe ignited optimism that government stimulus will come sooner than expected

- Less than three weeks before the BOJ’s next scheduled policy meeting, Governor Haruhiko Kuroda met with former Federal Reserve Chairman Ben S. Bernanke over lunch on Monday. Japan has a tradition of seeking the advice of overseas experts

- Japan’s biggest bond bulls, seasoned by two decades of economic stagnation, say the plunge in yields below zero in Tokyo foreshadows record-breaking gains for U.S. Treasuries

- China’s pension funds, which have about 2 trillion yuan ($300 billion) for investment, are handing over some of their cash to the National Council for Social Security Fund, which will oversee their investments in securities including equities

- China has tightened rules on leverage in the corporate bond market, highlighting authorities’ concern about rising financial risks as defaults spread

- China’s producer-price index fell 2.6% in June compared with a 2.8% drop a month earlier, giving policy makers fresh evidence falling prices are turning a corner after more than four years of declines.

- Italian industrial production in May decreased 0.6% from April, when it rose a revised 0.4%, creating further difficulties for Prime Minister Matteo Renzi’s plans to put the economy on a stable footing

- Global cross-border investment may decline by as much as 15% this year as trade remains sluggish, China’s commerce minister said after a Group of 20 trade ministers meeting Sunday

- Europe urgently needs a 150 billion-euro ($166 billion) bailout fund to recapitalize its beleaguered banks, particularly those in Italy, Deutsche Bank AG’s chief economist said in an interview with Welt am Sonntag

* * *

US Event Calendar

- 10am: Labor Market Conditions Index Change, June (prior -4.8)

- 10am: Fed’s George speaks in Lake Ozark, Mo.

- 9:30pm: Fed’s Mester speaks in Sydney

DB's Jim Reid concludes the overnight wrap

One can't help hoping that article 50 activation, Brexit and a possible subsequent Scottish referendum gets delayed as long as possible to ensure that us Brits can celebrate Andy Murray for as long as possible. It was an impressive Wimbledon win yesterday. Perhaps more impressive than the cagey Euro 2016 final last night where the highlight was an extreme moth invasion before kickoff caused by ground staff leaving the floodlights on the night before. I think moths only live a few days or weeks and it makes me sad that hundreds of thousands of them at the Stade de France will go to their makers seeing this match only and thinking it representative of the great game!! On a serious note congratulations to our Portuguese readers and commiserations to those in France.

Markets were certainly exciting on Friday with Payrolls soaring by +287k (107k above expectations) and 10 and 30 year Treasuries hitting fresh record yields lows (at 1.359% and 2.099% respectively). In addition the S&P 500 (+1.53%) closed only 1pt below its record high. If you were a Martian visiting for a day you may be forgiven for wondering what on earth (or Mars) was going on. On a fascinating day for markets another landmark occurred with Dutch 10 year yields closing below zero yield for the first time. This gives us the perfect opportunity to update one of our favourite charts namely Dutch 10 year yields back to 1517, the longest history of Government bond yield proxies we have anywhere in the world.

So why did yields fall after the bumper report? Well the 3-month moving average was still only +147k (2015 average +229k, 2014 +251k) and the unemployment rate edged up 0.2% to 4.9%. Average hourly earnings also rose a little less than expected during the month (+0.1% mom vs. +0.2% expected). Crucially Fed hiking probabilities didn’t budge much with the probability of a move by September going from 2% to 10% and a move by December going from 12% to 21%. So still very low. Even a move by December 2017 is now at just 43% from 41% prior to the data.

DB's Dominic Konstam continues to think that “late cycle” labour market dynamics are in full swing. He thinks sagging productivity relative to labour input growth suggests that unless productivity accelerates, firms could reduce labour demand to protect profits. He thinks the difference between price and unit labor costs also shows a squeeze on profits. Their productivity/labour input and price/unit labor cost metrics both imply labour input could slow to less than 1 percent next year, which translates into roughly 60K in monthly job gains. His 1.25% 10 year Treasury target looks closer and closer.

The concerns over Italian banks are probably also continuing to keep fixed income well bid. It feels like we'll get some binary news at some point this month on this. It was actually a rally for Italian Banks which had helped support a strong European session prior to the data on Friday. The FTSE MIB closed up +4.08% (vs. Stoxx 600 at +1.62%) with the likes of Unicredit (+8.73%), Intesa (+10.00%), UBI (+8.65%) and Banco Popolare (+18.36%) all surging. The move for the latter in particular appeared to reflect comments from the Bank saying that its own internal stress tests confirmed its ‘resilience’ to adverse shocks. Meanwhile in comments to the Italian Banking Association, Bank of Italy Governor Ignazio Visco also confirmed that state or public intervention to support the sector ‘cannot be excluded’ and that the Bank of Italy was working with other authorities to ‘promote efficient market interventions’. The next key date looks set to be the EU stress test results on July 29th and will provide the latest point of transparency for analysts and investors alike. A potential recap before this date can’t be ruled out though.

So while the post payrolls reaction and focus on Brexit and Italian Banks continues to rumble on, the other weekend newsflow was centred on Asia and China and Japan in particular. Starting with the former, on Saturday China released its June inflation report. CPI was -0.1% mom for the fourth straight negative monthly reading, with food-inflation continuing to slow. That had the effect of dragging the YoY rate down one-tenth to +1.9%, although that did come in a tad higher than expectations of +1.8%. PPI, meanwhile, fell to -2.6% yoy from -2.8% meaning factory gate deflation has eased (in YoY terms) every month this year.

Elsewhere the news out of Japan is that PM Shinzo Abe’s ruling coalition party has won the upper house election, with the ruling coalition party comfortably exceeding the threshold needed for victory of 61 seats with the LDP taking 56 seats and Komeito winning 14 seats. The seats won by LDP came in just under the 57 seats required to secure a majority in its own right. This was all largely expected. Abe responded to the victory by saying that ‘I think this means I am being told to accelerate Abenomics, so I want to respond to the expectations of the people’. Our Japanese economists noted this morning that markets are likely to be more interested in the size and details of the second FY2016 supplementary budget, with discussions set to begin in earnest ahead of the expected convocation of an extraordinary Diet session in late September.

As we refresh our screens this morning the majority of bourses in Asia are continuing the positive price action in the wake of Friday’s strong payrolls numbers. Leading the way is Japan where the Nikkei and Topix are +3.55% and +3.51% respectively, while the Hang Seng (+1.82%), Shanghai Comp (+0.75%), Kospi (+1.24%) and ASX (+1.87%) are also higher. Gains have come despite Oil markets weakening 1% or so, while credit markets are also rallying this morning (iTraxx Asia and Aus indices 6bps tighter). US equity index futures are currently up half a percent.

Moving on. As we highlight at the end in the week ahead, earnings season unofficially kicks off in the US tonight when Alcoa is due to report after the closing bell. The headline releases come towards the back end of the week however when the Banks start to release their latest quarterlies. As it stands and based on Bloomberg estimates, forecast EPS growth for the S&P 500 is -5.7% yoy for the quarter. There’s a similar theme sector wise to last quarter which is weighing on that forecast. Financials are expected to decline -7.7% yoy and energy -76.9% yoy. Indeed stripping out the latter in particular means EPS growth for the S&P 500 ex-energy is at -2.2% yoy. As it stands revenue growth expectations is -0.8% yoy for the S&P 500 and +2.3% yoy ex-energy. As with last month we’ll be keeping a close out on the last minute analyst cuts and revisions which helped to somewhat artificially inflate the previous quarter beat/miss ratio.

Before we take a look at this week’s calendar, a quick recap of the rest of Friday’s data. In terms of the remainder of the US employment report, the labour force participation rate edged up one-tenth to 62.7%, while average weekly hours held steady at 34.4hrs. Consumer credit, meanwhile, came in above expectations at $18.6bn (vs. $16bn expected). Prior to this in Europe Germany reported a slight shrinking in its trade surplus as exports declined unexpectedly in May (-1.8% mom vs. +0.4% expected). French industrial production fell -0.5% mom as expected while the UK reported a slight shrinking in its deficit for May.

It’s fairly busy away from the data too. Euro area finance ministers are due to meet in Brussels today and tomorrow and the BoE’s Carney is scheduled to speak on financial stability tomorrow. Meanwhile over at the Fed we’re due to hear from George (today), Tarullo, Bullard and Kashkari (all Tuesday), Harker (Wednesday), Lockhart (Thursday) and Kaplan and Bullard again (both Friday). Also potentially of note will be the 18th bilateral two-day summit between the EU and China on Tuesday.

If that wasn’t enough, as highlighted earlier US earnings season unofficially kicks off this week with Alcoa due to report after the closing bell today. The banks are likely the highlight though with JP Morgan (Thursday), Citi and Wells Fargo (Friday) under the spotlight.