Is there anyone left out there who doesn’t know the rate of economic growth is slowing? The 10 year Treasury yield has fallen 45 basis points since peaking in mid-March. 10 year TIPS yields have fallen by the same amount and now reside below -1% again. Copper prices peaked a little later (early May), fell 16% at the recent low and are still down nearly 12% from the highs. Crude oil has recently joined in, falling 7% from its recent high. Energy stocks are in a full...

Read More »“It’s A Perfect Storm Of Negativity” – Veteran Trader Rejoins The Dark Side

Authored by Kevin Muir via The Macro Tourist blog, After many months of fighting all the naysayers predicting the next big stock market crash, I am finally succumbing to the seductive story of the dark side, and getting negative on equities. I am often early, so maybe this means the rally is about to accelerate to the upside. I am willing to take that chance. It would be just like me to pound the table on the long side,...

Read More »Bi-Weekly Economic Review

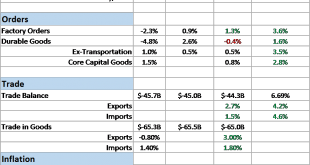

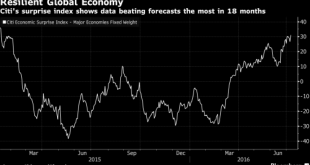

Economic Reports Scorecard The economic data since my last update has improved somewhat. It isn’t across the board and it isn’t huge but it must be acknowledged. As usual though there are positives and negatives, just with a slight emphasis on positive right now. Interestingly, the bond market has not responded to these slightly more positive readings with nominal and real yields almost exactly where they were in the...

Read More »A Biased 2017 Forecast, Part 1

“The idea that the future is unpredictable is undermined every day by the ease with which the past is explained.” – Daniel Kahneman, Thinking, Fast and Slow A couple weeks ago I was lucky enough to see a live one hour interview with Michael Lewis at the Annenberg Center about his new book The Undoing Project. Everyone attending the lecture received a complimentary copy of the book. Being a huge fan of Lewis after...

Read More »S&P 500 To Open At All Time Highs After Japan Soars, Yen Plunges On JPY10 Trillion Stimulus

Last Thursday, when we reported that Ben Bernanke was to "secretly" meet with Kuroda and Abe this week (he is said to have already met with Japan's central bank head earlier today), we said that "something big was coming" out of Japan which had "helicopter money" on the agenda. And sure enough, after a dramatic victory for Abe in Japan's upper house elections which gave his party an even greater majority, Abe announced the first hints of helicopter money when Nikkei reported, and Abe...

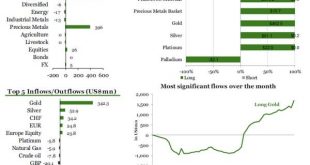

Read More »ETF Securities Reports Biggest One-Day Gold Inflow Since Financial Crisis

It never ceases to amaze how vastly different the investment styles of gold paper vs physical traders are: while we have documented previously how the latter tend to buy progressively more the lower the price (as traditional “buy low, buy more lower” investing would suggest), “investors” in gold paper-derivatives such as ETFs and ETPs are quite the opposite: in fact, they rarely buy until someone else is buying and...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org