So Ben Bernanke has won a Nobel Prize for kicking a can down the road! Many will have heard the saying ‘those who do not learn from history, are doomed to repeat it’. It is often attributed to Churchill, but he was in fact quoting George Santanya. We prefer the Stephen Hawking quote, ‘“We spend a great deal of time studying history, which, let’s face it, is mostly the history of stupidity.” as this feels more apt in this day and age. Below we outline the Nobel-prize...

Read More »Another One Inverts, The Retching Cat Reaches Treasuries

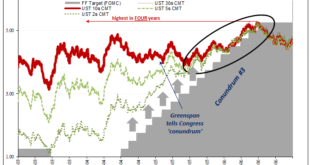

As Alan Greenspan’s rate hikes closed in, longer-term Treasury yields were forced upward as the flattening yield curve left no more room for their blatant defiance. By mid-2005, though, the market wasn’t ready to fully price the downside risks which had already led to that worrisome curve shape (very flat). While all sorts of bad potential could be reasonably surmised, none of it seemed imminent or definite. Thus, between July 2005 and June 2006, the entire curve...

Read More »The Hawks Circle Here, The Doves Win There

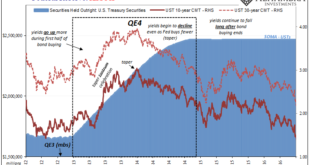

We’ve been here before, near exactly here. On this side of the Pacific Ocean, in the US particularly the situation was said to be just grand. The economy was responding nicely to QE’s 3 and 4 (yes, there were four of them by that point), Federal Reserve Chairman Ben Bernanke had said in the middle of 2013 it was becoming more than enough, creating for him and the FOMC coveted breathing space so as to begin tapering both of those ongoing programs.A full and complete...

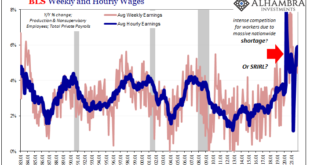

Read More »As The Fed Tapers: What If More Rapid (published) Wage Increases Are Actually Evidence of *Deflationary* Conditions?

Since the Federal Reserve is not in the money business, their recent hawkish shift toward an increasingly anti-inflationary stance is a twisted and convoluted case of subjective interpretation. Inflation is money and if the Fed was a central bank the issue of consumer prices wouldn’t necessarily be simple, it would, however, be much simpler: is there or isn’t there too much money flowing through the economy. News to the vast majority of the public, no one at any...

Read More »The Curve Is Missing Something Big

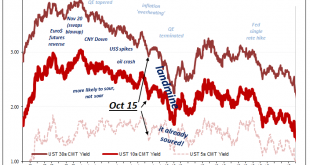

What would it look like if the Treasury market was forced into a cross between 2013 and 2018? I think it might be something like late 2021. Before getting to that, however, we have to get through the business of decoding the yield curve since Economics and the financial media have done such a thorough job of getting it entirely wrong (see: Greenspan below). And before we can even do that, some recent housekeeping at the front of the curve where bill lives. Treasury...

Read More »The Great Eurodollar Famine: The Pendulum of Money Creation Combined With Intermediation

It was one of those signals which mattered more than the seemingly trivial details surrounding the affair. The name MF Global doesn’t mean very much these days, but for a time in late 2011 it came to represent outright fear. Some were even declaring it the next “Lehman.” While the “bank” did eventually fail, and the implications of it came to be systemic, those overly melodramatic descriptions actually served to downplay the event in public imagination. The world...

Read More »Taper *Without* Tantrum

Whomever actually coined the term “taper”, using it in the context of Federal Reserve QE for the first time, it wasn’t actually Ben Bernanke. On May 22, 2013, the central bank’s Chairman sat in front of Congressman Kevin Brady and used the phrase “step down in our pace of purchases.” No good, at least from the perspective of a media-driven need for a snappy one-word summary. Taper. Then the tantrum. Except, no, it wasn’t sulking rage over the prospects for fewer...

Read More »CPI’s At Fives Yet Treasury Auctions

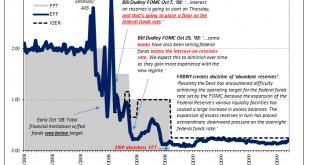

A momentous day, for sure, but one lost in what would turn out to be a seemingly endless sea of them. October 8, 2008, right in the thick of the world’s first global financial crisis (how could it have been global, surely not subprime mortgages?) the Federal Reserve took center stage; or tried to. Having bungled Lehman, botched AIG, and then surrendered to Treasury which then screwed up TARP, the world’s entire financial edifice was burning down while US...

Read More »From QE to Eternity: The Backdoor Yield Caps

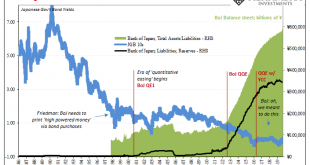

So, you’re convinced that low rates are powerful stimulus. You believe, like any good standing Economist, that reduced interest costs can only lead to more credit across-the-board. That with more credit will emerge more economic activity and, better, activity of the inflationary variety. A recovery, in other words. Ceteris paribus. What happens, however, if you also believe you’ve been responsible for bringing rates down all across the curve…and then no recovery....

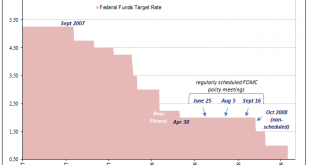

Read More »History Shows You Should Infer Nothing From Powell’s Pause

Jay Powell says that three’s not a crowd, at least not for his rate cuts, but four would be. As usual, central bankers like him always hedge and say that “should conditions warrant” the FOMC will be more than happy to indulge (the NYSE). But what he means in his heart of hearts is that there probably won’t be any need. Three should do the trick nicely. And a lot of people, from what I can tell, believe him if not simply because he’s already stopped. The last two...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org