Summary:

Pictet Wealth Management's latest positioning across asset classes and investment themes.Asset AllocationAt current valuations, we remain prudent about global equities’ further potential, waiting for further clarity on economic and corporate growth before moving from our present neutral stance.At the same time, we remain confident that the central banks will continue to support markets. In Europe, fiscal policy is expected to give a marginal boost to growth.Although central bank dovishness is helping corporate bonds, flagging growth and the risk of inflation mean we are underweight credits in general. We favour quality in this space, which is why our preference goes to investment-grade rather than high-yield paper.The ‘illiquidity premium’ offered by alternative’ assets such as direct

Topics:

Perspectives Pictet considers the following as important: Macroview

This could be interesting, too:

Pictet Wealth Management's latest positioning across asset classes and investment themes.Asset AllocationAt current valuations, we remain prudent about global equities’ further potential, waiting for further clarity on economic and corporate growth before moving from our present neutral stance.At the same time, we remain confident that the central banks will continue to support markets. In Europe, fiscal policy is expected to give a marginal boost to growth.Although central bank dovishness is helping corporate bonds, flagging growth and the risk of inflation mean we are underweight credits in general. We favour quality in this space, which is why our preference goes to investment-grade rather than high-yield paper.The ‘illiquidity premium’ offered by alternative’ assets such as direct

Topics:

Perspectives Pictet considers the following as important: Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

Pictet Wealth Management's latest positioning across asset classes and investment themes.

- At current valuations, we remain prudent about global equities’ further potential, waiting for further clarity on economic and corporate growth before moving from our present neutral stance.

- At the same time, we remain confident that the central banks will continue to support markets. In Europe, fiscal policy is expected to give a marginal boost to growth.

- Although central bank dovishness is helping corporate bonds, flagging growth and the risk of inflation mean we are underweight credits in general. We favour quality in this space, which is why our preference goes to investment-grade rather than high-yield paper.

- The ‘illiquidity premium’ offered by alternative’ assets such as direct real estate and private equity remains attractive.

Commodities

- Our spot price forecast for Brent remains unchanged at USD70 for the end of the year. We continue to expect a slight increase in the equilibrium price, backed by moderate global economic growth and a slight depreciation of the US dollar.

Currencies

- The growth differential should turn more supportive of the euro against the USD, should our scenario of abating political risks prove to be correct. As such, we continue to favour a gradual appreciation of the euro against the US dollar in the next months.

Equities

- Economic and geopolitical news flow has been supportive of equities (potential stop to Fed balance sheet shrinkage in 2019, rebound in China’s credit growth, progress on US/China trade negotiations), prolonging the positive momentum year to date.

- Despite improving sentiment, clear signs that earnings expectations are stabilising (especially for Q4 2019 earnings) will be needed to provide a further catalyst to equity markets.

- After a strong year-to-date performance, we would need more positive messages on earnings to drive performance higher given current valuations.

- We continue to see limited value in core euro government bonds due to our expectations of rising German sovereign yields and remain underweight.

- As fundamentals continue to improve more in EM than in US companies across both the HY and IG segments, we favour an underweight stance in US credit and a neutral stance in EM credit.

Alternatives

- Given current uncertainty, we support hedge fund managers with discretionary trading and tactical mindsets who can quickly shift from long to short when needed.

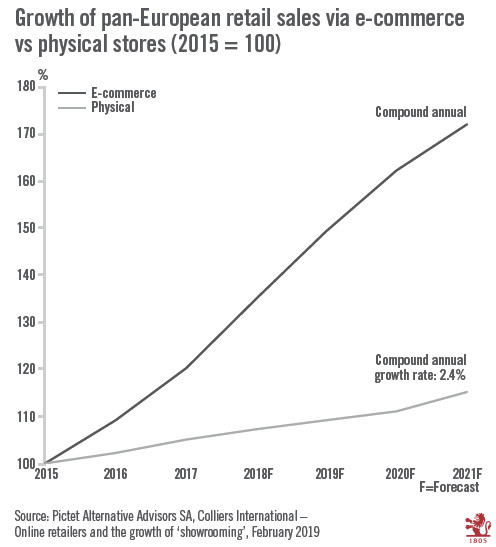

- We are constructive on e-commerce logistics hubs in gateway cities and urban areas in real estate.