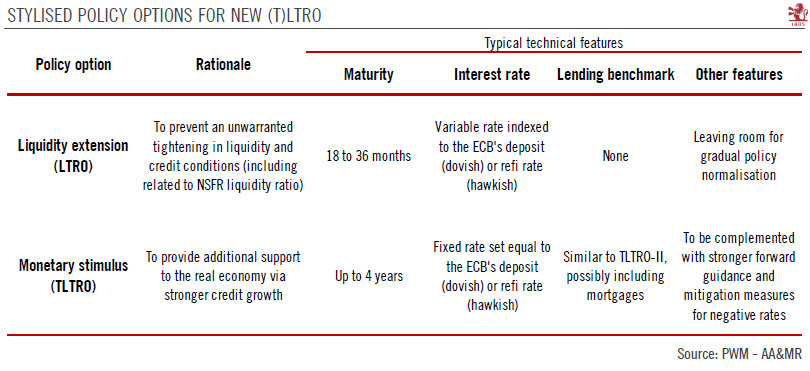

The ECB’s decision on (T)LTRO will matter most to the euro area periphery banks who have been the biggest consumers of current TLTROs.Considering the weakness in most economic indicators the ECB should maintain an adequate degree of monetary accommodation. This will likely require delivering another longer-term refinancing operation (LTRO, targeted or not) to avoid any tightening in liquidity and credit conditions.We expect the ECB to send out a strong signal at its March meeting that it will soon offer a new (T)LTRO, with details likely to be announced in April or June.The ECB’s decision on (T)LTRO will, of course, matter to euro area banks, mostly for the periphery’s banks who have been the biggest consumers of current TLTROs.Read full report here

Topics:

Team Asset Allocation and Macro Research considers the following as important: Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

The ECB’s decision on (T)LTRO will matter most to the euro area periphery banks who have been the biggest consumers of current TLTROs.

Considering the weakness in most economic indicators the ECB should maintain an adequate degree of monetary accommodation. This will likely require delivering another longer-term refinancing operation (LTRO, targeted or not) to avoid any tightening in liquidity and credit conditions.

We expect the ECB to send out a strong signal at its March meeting that it will soon offer a new (T)LTRO, with details likely to be announced in April or June.

The ECB’s decision on (T)LTRO will, of course, matter to euro area banks, mostly for the periphery’s banks who have been the biggest consumers of current TLTROs.