After a stellar 2018, earnings expectations for the S&P 500 have been ratcheted down for this year. Total returns will increasingly come from sources other than earnings.Earnings estimates in developed markets have been cut continuously over the past six months. The consensus expectation for earnings growth in 2019 for the S&P 500 is now around 3.5%. This compares with stellar earnings growth of 24.1% in the US in 2018, thanks in large part to the end-2017 US tax cuts announced by the Trump administration.Although year-on-year earnings are expected to have declined by 4% in Q1 19 and to be relatively flat in the following two quarters, expected US earnings growth is just below 3.5% for the full year (see chart). This means that most of the earnings growth is expected in the final quarter

Topics:

Wilhelm Sissener and Jacques Henry considers the following as important: earnings growth, Earnings growth expectations, Macroview, Market forecast, Market valuations

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

After a stellar 2018, earnings expectations for the S&P 500 have been ratcheted down for this year. Total returns will increasingly come from sources other than earnings.

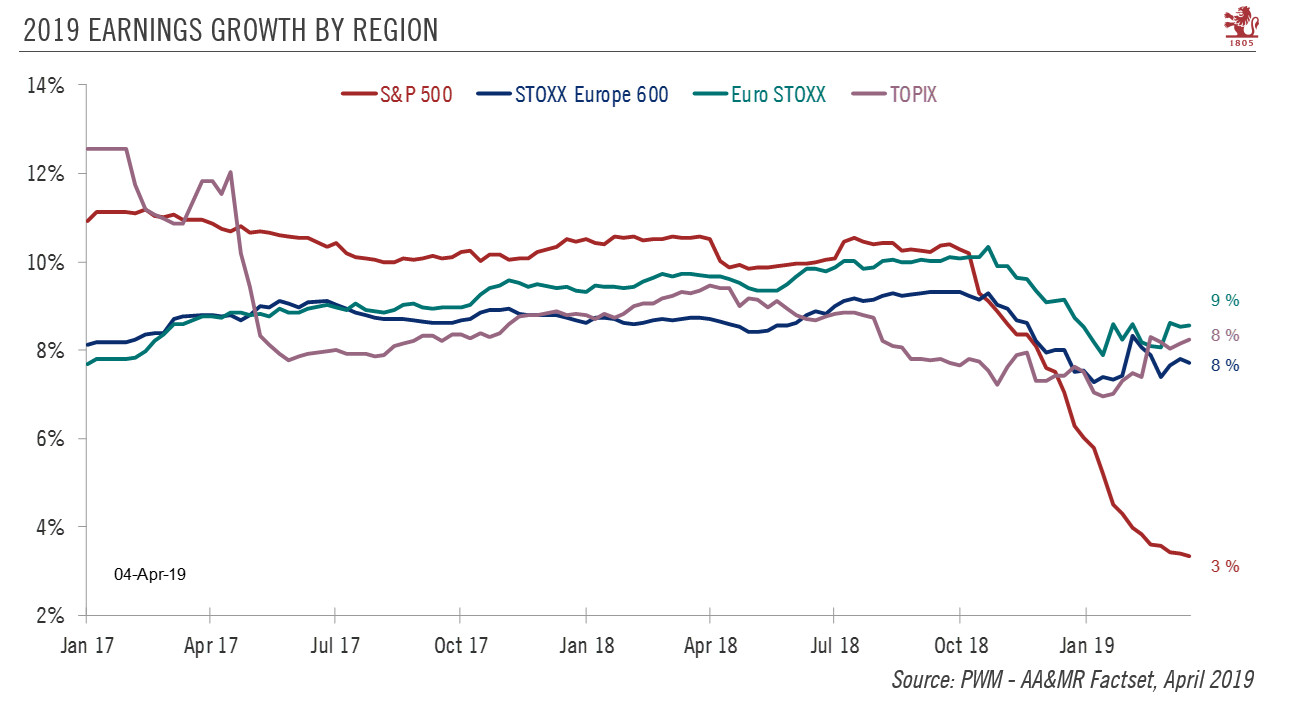

Earnings estimates in developed markets have been cut continuously over the past six months. The consensus expectation for earnings growth in 2019 for the S&P 500 is now around 3.5%. This compares with stellar earnings growth of 24.1% in the US in 2018, thanks in large part to the end-2017 US tax cuts announced by the Trump administration.

Although year-on-year earnings are expected to have declined by 4% in Q1 19 and to be relatively flat in the following two quarters, expected US earnings growth is just below 3.5% for the full year (see chart). This means that most of the earnings growth is expected in the final quarter of 2019, when the base effect will be easier than for the first three quarters.

Earnings growth for the Stoxx Europe 600 and Japan’s Topix index is expected to be higher than for the S&P 500 (of the order of 8-9%), mainly due to base effects (2018 earnings growth was weak in both Europe and Japan). The Q1 reporting season will be closely scrutinised by investors, with expectations that earnings growth was negative during the quarter.

A massive rerating has driven the year-to-date equity market rally, erasing the Q4 18 correction. In our core scenario, the upside for equity markets looks modest. Taking into account the volatility environment and sovereign yield levels, current equity market valuations are now near fair value and leave little room for further upside. We believe most of the price increase for this year was achieved in Q1 thanks to the attractive entry point provided by the end-2018 sell-off. In such an environment, the dividend and buyback yield will contribute a greater share of total returns than earnings by the end of the year.

However, an alternative upside scenario should not be ruled out. The current strong momentum in equities could lead systematic strategy traders to increase their equity allocation, which could push stock markets further up, even though fundamentals currently do not provide much of a catalyst. Such a scenario requires the avoidance of fresh shocks, the continued dovishness of central banks and the abatement of trade tensions.