The EU has granted a Brexit deadline extension to 31 October of this year. The next step after this extension could be another extension.Following the EU Council summit, 31 October 2019 is the new Brexit deadline. Given that we see limited probability of a sudden unknotting of the current UK parliamentary gridlock, our core scenario is that the deadline will be extended again. The current timeframe is too short to really work on an alternative to the current ‘Withdrawal Agreement’, which has already been rejected three times by parliament.This creates a bizarre situation, in which the UK is obliged to participate in the EU Parliament elections this May and subsequently send MEPs to Brussels. The question is how restive the Tory party becomes. While technically it is difficult to topple

Topics:

Team Asset Allocation and Macro Research considers the following as important: Brexit, Macroview, UK sterling

This could be interesting, too:

Claudio Grass writes “Inflation it is not an act of God”

Claudio Grass writes “Inflation it is not an act of God”

Dirk Niepelt writes The Economics of Brexit

Marc Chandler writes High Anxiety: China’s Covid and US Inflation

The EU has granted a Brexit deadline extension to 31 October of this year. The next step after this extension could be another extension.

Following the EU Council summit, 31 October 2019 is the new Brexit deadline. Given that we see limited probability of a sudden unknotting of the current UK parliamentary gridlock, our core scenario is that the deadline will be extended again. The current timeframe is too short to really work on an alternative to the current ‘Withdrawal Agreement’, which has already been rejected three times by parliament.

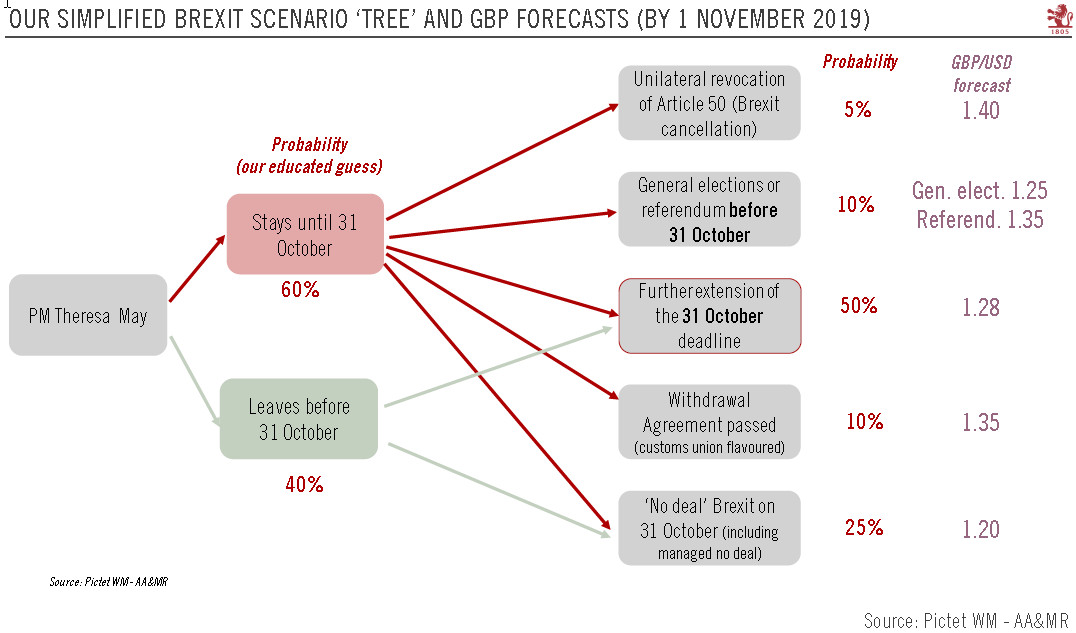

This creates a bizarre situation, in which the UK is obliged to participate in the EU Parliament elections this May and subsequently send MEPs to Brussels. The question is how restive the Tory party becomes. While technically it is difficult to topple Prime Minister Theresa May, the pressure she is under is likely to grow, especially as her double promise of leaving the EU in March and not participating in the EU Parliament elections has been broken. The risk is that she might be replaced by a ‘hard Brexiteer’ that actively seeks a ‘no-deal’ Brexit by the October deadline.

The extension will mean that UK GDP growth remains depressed by corporate underinvestment (we reduce our 2019 GDP growth forecast to 1.1%, from 1.4% previously), and we now believe the Bank of England will keep rates flat (versus one rate hike expected this summer). Our central scenario of a further ‘fudging’ of the EU’s deadline would mean the pound stays constrained due to the weak macro backdrop. Our forecast is USD 1.28 by 1 November. By contrast, a no-deal Brexit would see pound fall to USD 1.20.

Meanwhile, ongoing Brexit-related uncertainty could provide an additional ‘dovish’ excuse for the US Federal Reserve to keep rates on hold, despite the strength of the US economy.