ECB officials have hinted at policy measures aimed at reducing the cost of negative rates for the banking sector, including a tiered system of bank reserves.Although back in 2016 the European Central Bank (ECB) ruled out tiering of bank reserves to mitigate the side effects of negative rates, the situation has since changed, and it could be implemented eventually if policy rates were to remain negative into 2020.Despite nearly four years of asset purchases and five years of negative rates, the downside risks to growth and inflation still dominant. Mario Draghi himself ruled out a tiered reserve system in March 2016 “exactly for the purpose of not signalling that we can go as low as we want on this”. We cannot emphasise enough how important the recent shift in conditions is from that

Topics:

Frederik Ducrozet and Nadia Gharbi considers the following as important: ECB, euro area monetary policy, Macroview

This could be interesting, too:

Marc Chandler writes US Dollar is Offered and China’s Politburo Promises more Monetary and Fiscal Support

Marc Chandler writes US-China Exchange Export Restrictions, Yuan is Sold to New Lows for the Year, while the Greenback Extends Waller’s Inspired Losses

Marc Chandler writes Markets do Cartwheels in Response to Traditional Pick for US Treasury Secretary

Marc Chandler writes FX Becalmed Ahead of the Weekend and Next Week’s Big Events

ECB officials have hinted at policy measures aimed at reducing the cost of negative rates for the banking sector, including a tiered system of bank reserves.

Although back in 2016 the European Central Bank (ECB) ruled out tiering of bank reserves to mitigate the side effects of negative rates, the situation has since changed, and it could be implemented eventually if policy rates were to remain negative into 2020.

Despite nearly four years of asset purchases and five years of negative rates, the downside risks to growth and inflation still dominant. Mario Draghi himself ruled out a tiered reserve system in March 2016 “exactly for the purpose of not signalling that we can go as low as we want on this”. We cannot emphasise enough how important the recent shift in conditions is from that perspective. If another shock led to a more protracted slowdown, rate cuts could be back on the agenda, if only by default because all other options would face higher hurdles. In that case, a tiering system may be the only option available to reduce the cost for banks in the core.

In the end, tiering is all about the credibility of forward guidance and the ECB signalling its ability to cut rates again in the next downturn.

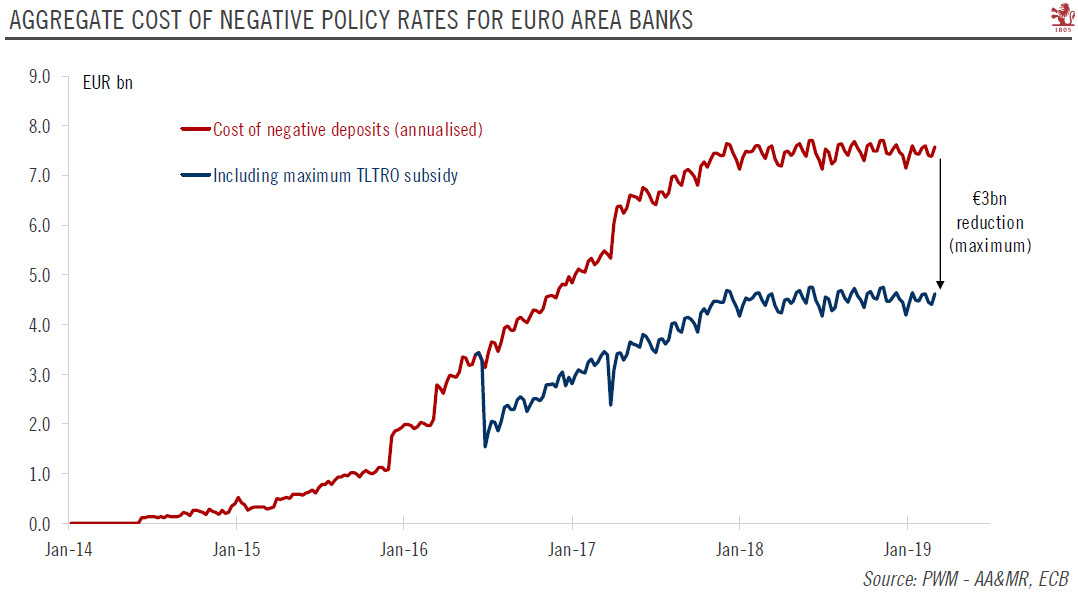

Tiering would come with technical complications and non-trivial effects on the distribution of excess liquidity across euro area countries. Our best guess is that the ECB would opt for a simple exemption system equivalent to an increase in minimum reserve requirements. For example, in a two-tiered system similar to the one adopted by the Swiss National Bank, exemptions could be set at 10x the required reserves, reducing the share of bank reserves subject to negative rates from 94% to 40% and the annual cost of negative rates by EUR 4bn, to EUR 3.5bn.

We expect the ECB to use its policy meeting on Thursday to reaffirm its assessment of the downside risks to the economic outlook, while taking solace in the resilience of domestic demand. June still looks like the best time to announce pricing for its new Targeted Longer-Term Refinancing Operations programme (TLTRO-III), while tiering could come in September if, and only if, macro and credit conditions deteriorate further.