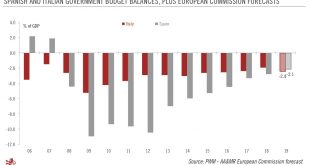

We remain underweight peripheral euro area bonds in general due to continued political uncertainty, which will feed volatility.On April 28, Spain held its third general election in less than four years. As was expected, the centre-left Socialists (PSOE) emerged the largest party, but it does not have an absolute majority, so negotiations with other parties will be needed. But the political fog in Spain is unlikely to lift much before the regional and European elections on May 26.The misty...

Read More »Weekly View – A Socialist victory

The CIO office’s view of the week ahead.Spain’s governing Socialist party swept to victory at the weekend’s general elections, which enjoyed the highest turnout since 2008, with a 75% participation rate. Taking 29% of the vote however, the Socialist PSOE party is far short of an absolute majority and will need to form a coalition, which will likely be fragmented and unstable given the election results. Furthermore, an alliance is not likely to be confirmed before Spain’s regional elections...

Read More »Euro area Q1 GDP growth could be stronger than expected

The general improvement in hard data holds out the possibility of a positive surprise when preliminary GDP figures are announced next week.Next week will be a busy one for Europe, with lots of data releases: European Commission business survey (April); advance GDP (Q1); M3 money supply (March); HICP flash estimate of inflation (April); and final manufacturing purchasing manager indices (PMIs, April). The advance Q1 GDP will be especially closely watched. No euro area GDP breakdown will be...

Read More »Weekly View – Europe’s “black hole”

The CIO office’s view of the week ahead.Positive economic data has sent relief through markets, with encouraging news coming out of the world’s two biggest economies. The Chinese economy grew faster than expected in the first quarter, as the government’s stimulus policy begins to take effect. In the US, a rebound in consumer spending resulted in retails sales posting their biggest gain since 2017 in March. However, as astronomers published the first image of a black hole, the European...

Read More »China: Q1 growth beats expectations

The Chinese economy grew at a faster rate than expected in the first quarter as policy stimulus effects kick in.The National Bureau of Statistics of China published Q1 GDP figures along with some key economic indicators for March. The data generally surprised on the upside. While we had previously flagged the upside risk to our earlier GDP forecast following the rebound in PMIs and strong credit numbers, the latest data releases still surprised to the upside. In light of the strong Q1...

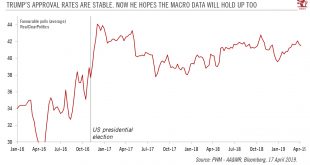

Read More »Business cycle could define Trump’s re-election chances

President Trump’s focus on getting re-elected in November 2020 may have implications for his economic policy choices.As we move closer to the 2020 presidential election, Trump has been blatantly leaning on the Federal Reserve to be more accommodative and has been trying to appoint nominees who share his preference for loose monetary policy to the Fed board. The countdown to the 2020 elections also seems to be prompting Trump to adopt a mellower stance than before on Chinese trade talks so...

Read More »Swiss policy mix review

Despite a record of federal budget surpluses, don't count on fiscal policy to relieve pressure on the SNBThe Swiss federal budget is governed by a strict expenditure rule, which is enshrined in the Constitution. Since its introduction, the ratio of public debt-to-GDP has been significantly reduced, falling back to its early-90’s level. At the close of 2018, the Swiss federal budget registered a significant surplus of CHF 2.9 billion, compared with budget projections for a surplus of CHF 295...

Read More »China: strong credit growth in March again

Chinese credit data surprised on the upside in March, following a surge in January and a sharp fall in February, but stimulus to the real economy may not be as strong.Chinese credit data surprised on the upside in March, following a surge in January and a sharp fall in February. Monthly total social financing (TSF) came in at Rmb2.86 trillion, much stronger than the market consensus forecast of Rmb1.85 trillion. New bank loans also surprised on the upside at Rmb1.69 trillion, compared with...

Read More »Weekly View—Eyes on guidance

The CIO office's view of the week aheadLast week delivered encouraging news on the outlook for global trade as improved Chinese exports and credit figures were seen as signs that the global trade slowdown would soon turn. On the back of March’s rebound in Chinese purchasing manager indices (PMIs), this means that as well as good news for the global trade outlook, the world’s second-largest economy may report better-than-expected Q1 2019 GDP this week.Last week, the European Central Bank...

Read More »The year of the doves

Download issue:English /Français /Deutsch /Español /ItalianoWith all major central banks now having turned dovish, we can expect the continuation of ultra-low global interest rates in 2019. This is a relief for markets, which have already rallied in response. The greater concern is whether global growth can make a comeback.César Pérez Ruiz, Pictet Wealth Management’s (PWM) Head of Investments & CIO, will be looking for stabilisation in earnings revisions against the current backdrop of...

Read More » Perspectives Pictet

Perspectives Pictet