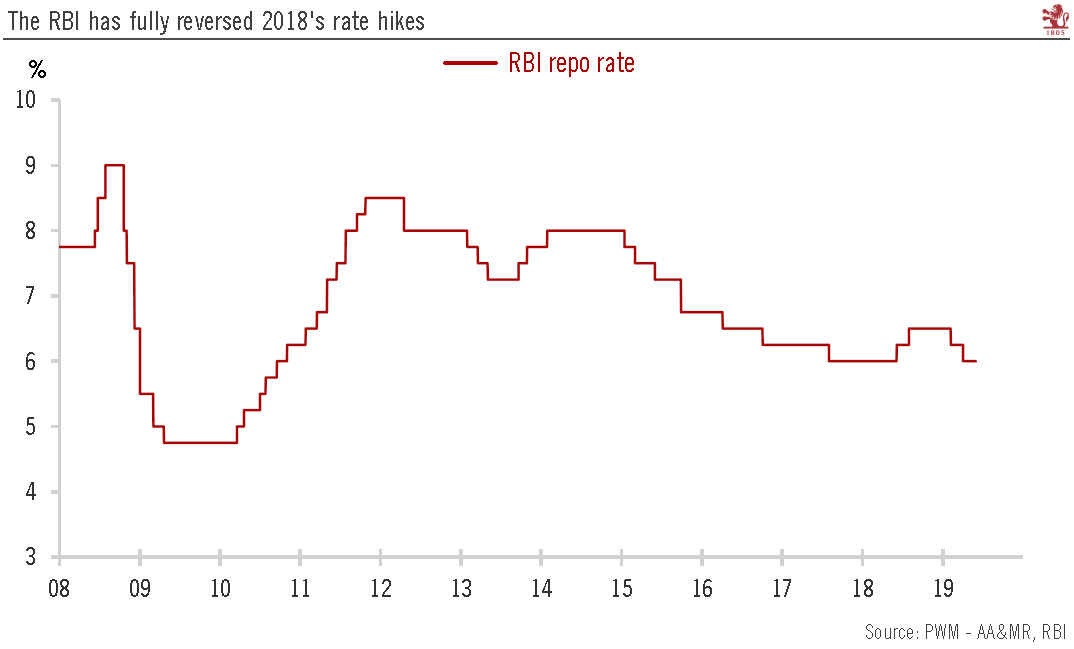

As widely expected, the Reserve Bank of India announced a cut to its policy interest rate last week. We expect that monetary policy will likely stay accommodative in order to support growth going forward.The Reserve Bank of India (RBI) cut its policy interest rate (RBI repo rate) by 25 basis points (bps) last week, bringing it down to 6.0%. This was the RBI’s second interest rate cut this year under its new governor Shaktikanta Das. With this move, the RBI has fully reversed last year’s rate hikes. Since the change of RBI governor in December 2018, there has been a U-turn in the Indian central bank’s monetary policy to “neutral” from “calibrated tightening”.The latest cut is confirmation of this change, following a previous rate cut in February. The move was widely expected given the

Topics:

Dong Chen considers the following as important: India economy, Macroview, Monetary Policy

This could be interesting, too:

Joaquimma Anna writes Exploring the Impact of Monetary Policy on Aggregate Supply: A Comprehensive Analysis

Joseph Y. Calhoun writes Weekly Market Pulse: Monetary Policy Is Hard

Marc Chandler writes Risk Appetites Squashed by Weak Chinese Imports/Exports and Moody’s Downgrade of 10 US Banks

Dirk Niepelt writes SNB Strategy Update

As widely expected, the Reserve Bank of India announced a cut to its policy interest rate last week. We expect that monetary policy will likely stay accommodative in order to support growth going forward.

The Reserve Bank of India (RBI) cut its policy interest rate (RBI repo rate) by 25 basis points (bps) last week, bringing it down to 6.0%. This was the RBI’s second interest rate cut this year under its new governor Shaktikanta Das. With this move, the RBI has fully reversed last year’s rate hikes. Since the change of RBI governor in December 2018, there has been a U-turn in the Indian central bank’s monetary policy to “neutral” from “calibrated tightening”.

The latest cut is confirmation of this change, following a previous rate cut in February. The move was widely expected given the current context of slowing growth, sluggish inflation and a strengthened rupee.

Looking forward, we expect the RBI to conduct at least one more rate cut this year to support growth. Our current GDP forecast for India in FY19-20 remains 7.2%.