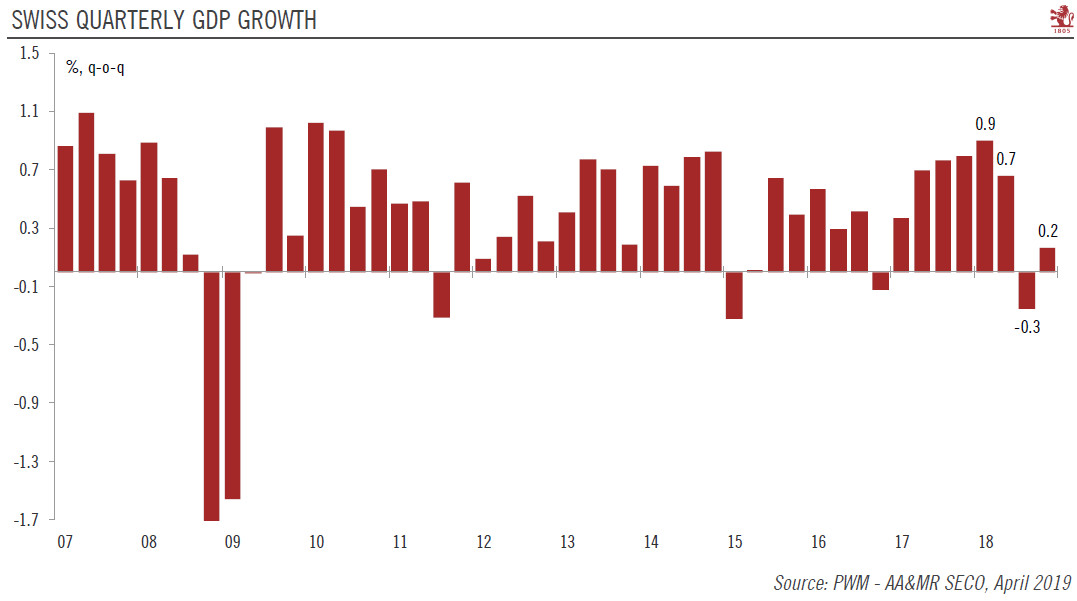

Growth and price rises should moderate in 2019.The Swiss economy posted impressive GDP growth in 2018, although there was significant divergence between strong growth in the first half and stagnation in the second. Overall, we expect Swiss GDP to expand by 1.3% in 2019, down substantially from 2.5% in 2018. Risks to our growth outlook for Switzerland are tilted to the downside.Looking ahead, we expect the Swiss economy to slow. Fundamentals supporting domestic demand remain solid, but the challenging global environment, especially the difficulties encountered by some key trading partners, are weighing on Swiss exports. Consumer price inflation should remain moderate in 2019. In the absence of any marked appreciation of the CHF, we forecast Swiss headline inflation to average 0.6% in 2019,

Topics:

Nadia Gharbi considers the following as important: Macroview, Swiss GDP, Swiss growth

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

Growth and price rises should moderate in 2019.

The Swiss economy posted impressive GDP growth in 2018, although there was significant divergence between strong growth in the first half and stagnation in the second. Overall, we expect Swiss GDP to expand by 1.3% in 2019, down substantially from 2.5% in 2018. Risks to our growth outlook for Switzerland are tilted to the downside.

Looking ahead, we expect the Swiss economy to slow. Fundamentals supporting domestic demand remain solid, but the challenging global environment, especially the difficulties encountered by some key trading partners, are weighing on Swiss exports. Consumer price inflation should remain moderate in 2019. In the absence of any marked appreciation of the CHF, we forecast Swiss headline inflation to average 0.6% in 2019, down from 1.0% in 2018.

We expect the Swiss National Bank (SNB) to maintain its accommodative monetary policy throughout 2019, with the first policy rate hike coming in H1 2020.