Published: 12th May 2016 Download issue: Central banks contributed to halting the financial crisis (starting with the US Federal Reserve’s first quantitative easing package, launched in late 2008), with successive rate cuts helping companies and households in the West to deleverage. The Bank of Japan (BoJ) and European Central Bank (ECB) followed with aggressive policies at a later stage, when the US recovery was already underway. Central banks’ commitment to their mandates has been fundamental in supporting market valuations, but these desynchronized monetary policies have caused market volatility. At the same time, central banks’ credibility is at risk as inflation remains chronically low throughout much of the developed world and global economic growth is sluggish in spite of almost eight years of increasingly accommodative policies. The European Central Bank’s (ECB) second series of targeted long-term refinancing operations (TLTRO II), announced in March, is a good example of how the credibility of central banks plays a role in lifting market sentiment. Last December, the ECB introduced negative interest rates on deposits in an effort to boost inflation and growth. But the repercussions of negative rates on the margins of already hard-pressed banks quickly became apparent. The ECB addressed the issue with TLTRO II just three months later.

Topics:

Perspectives Pictet considers the following as important: carousel, central bank credibility, central bank policy, loss of credibility, Perspectives, Publications

This could be interesting, too:

Stéphane Bob writes What can investors do in uncertain times?

Claudio Grass writes The Fed’s Capitulation: What It Means For Gold Investors

Claudio Grass writes THE FED’S CAPITULATION: WHAT IT MEANS FOR GOLD INVESTORS

Claudio Grass writes THE FED’S CAPITULATION: WHAT IT MEANS FOR GOLD INVESTORS

Download issue:

Central banks contributed to halting the financial crisis (starting with the US Federal Reserve’s first quantitative easing package, launched in late 2008), with successive rate cuts helping companies and households in the West to deleverage. The Bank of Japan (BoJ) and European Central Bank (ECB) followed with aggressive policies at a later stage, when the US recovery was already underway. Central banks’ commitment to their mandates has been fundamental in supporting market valuations, but these desynchronized monetary policies have caused market volatility. At the same time, central banks’ credibility is at risk as inflation remains chronically low throughout much of the developed world and global economic growth is sluggish in spite of almost eight years of increasingly accommodative policies.

The European Central Bank’s (ECB) second series of targeted long-term refinancing operations (TLTRO II), announced in March, is a good example of how the credibility of central banks plays a role in lifting market sentiment. Last December, the ECB introduced negative interest rates on deposits in an effort to boost inflation and growth. But the repercussions of negative rates on the margins of already hard-pressed banks quickly became apparent. The ECB addressed the issue with TLTRO II just three months later. Not only does TLTRO II help to ease monetary conditions and support credit flows to the private sector (at least on the margin), but it also mitigates the pressure of negative rates on banks’ margins by actually ‘paying’ them to lend. Most importantly of all, the technical details of TLTRO II, along with additional measures adopted by the ECB such as the purchase of corporate debt, firms up the impression that the ECB will continue to take a flexible, but determined approach to policy to stabilise the European economy.

Back in July 2012, the comment by ECB president Mario Draghi that the central bank would do “whatever it takes” to save the euro was seen as a decisive turning point in the euro area’s sovereign debt crisis. Now, the ECB is using its tool kit to try boost credit and help the banking sector. Bank shares have responded positively, and there are indications that the ECB’s policies are beginning to work in the real economy: euro area credit flows in the first quarter grew at their fastest level since 2011.

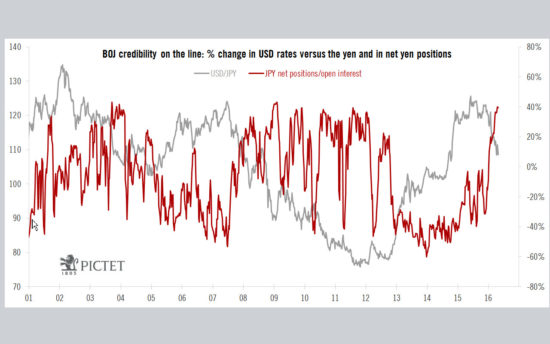

In contrast, Japan’s monetary policies have had mixed results so far. Negative interest rates (introduced in January) have not stopped the yen from pushing higher, and recent inflation figures have cast serious doubt on the ability of the BoJ to reach its 2% inflation target any time soon. When it met at the end of April, the BoJ thus found itself under pressure to make another effort to stimulate the economy and/or to adopt a flexible approach to negative interest rates like the ECB has. In the event, the BoJ decided not to move —at the risk of sowing even more confusion over its response mechanisms and sparking a bigger and more destabilising ascent in the yen. BoJ governor Haruhiko Kuroda justified inaction by arguing that it will take time for the combined effects of quantitative easing and negative interest rates to “sink in”. Unfortunately, the market has responded by increasing the risk premium on Japanese assets, while continued currency appreciation is putting yet more pressure on the BoJ to act at a later stage.

The People’s Bank of China (PBoC) has also come under significant strain. In the aftermath of the 2008 financial crisis, it intervened heavily in foreign-exchange markets to keep the yuan low, accumulating USD 4trn in reserves in the process. But its handling of the renminbi has proved more uncertain lately, with the value of the currency wobbling. As a consequence, we have seen significant capital outflows and the PBoC has again had to deploy part of its reserves to defend the currency. This explains the tumultuous markets we saw at the start of this year. The situation may have stabilised for now, thanks to stronger capital controls, but confidence needs to be fully restored in Chinese policy making.

So, central bank policies will continue to be crucial for the stability of markets. The potential loss of these policies’ credibility is the biggest risk markets currently face.

We believe central banks will keep trying to lift growth and inflation. To do this, they will have to proceed by trial and error, using unconventional measures as they now have little (if any) room to reduce interest rates without causing unintended consequences. This is why central banks have started to insist increasingly on the need for action on the fiscal front too—whether by postponing a planned hike in the sales tax rate in Japan, or lowering taxes and boosting infrastructure spending in Europe. Some policy makers have even dared evoke ‘helicopter money’—a further experiment that could see central banks printing money to fund government spending instead of buying bonds in the open market as the various quantitative easing schemes of recent years have done. Unlike interest rates, helicopter money would hold out the advantage of not relying of increased borrowing to work. This would be easier to implement in Japan where coupons have already been used in the past in a “use it or lose it” campaign. A similar scheme would be much more difficult to implement in Europe, as Mario Draghi recently flagged. But whatever happens, we can count on central banks continuing to implement supportive policies; we just need markets not to lose patience with them.

César Pérez Ruiz, Chief Investment Officer, Pictet Wealth Management